Avery Dennison (AVY): Assessing Valuation After Q3 Earnings Beat and Enhanced Shareholder Payouts

Avery Dennison (AVY) posted third-quarter results that surprised to the upside, outperforming adjusted earnings forecasts due to productivity improvements. The company also highlighted its commitment to shareholders through significant buybacks and dividends this year.

See our latest analysis for Avery Dennison.

Avery Dennison stock jumped 2.7% following its upbeat quarterly report, but that momentum has been tough to sustain. The share price is still down about 7% this year and has delivered a -14.2% total shareholder return over the past twelve months. Longer-term investors are still in the black, however, with a 23% total return over five years.

If today’s shift has you thinking about other companies with strong shareholder engagement, consider broadening your horizons and discover fast growing stocks with high insider ownership

With analysts projecting modest near-term growth and shares trading at a noticeable discount to both price targets and intrinsic value, the question remains: Is Avery Dennison stock undervalued at current levels, or is the market already pricing in future gains?

Most Popular Narrative: 15.8% Undervalued

With Avery Dennison closing at $170.46 and the most popular narrative calling fair value at $202.36, today's price is notably below that benchmark. The bull case hinges on future-focused strategies that go beyond the current market mood.

The accelerating global adoption of smart labels, RFID, and traceable technologies, seen in robust growth in food and logistics (mid-teens growth) and ongoing program rollouts (e.g., Kroger and new pilots), positions Avery Dennison for sustained revenue expansion as more end-markets digitize their supply chains and inventory management. Rising consumer brand focus on sustainability and regulatory pressures is driving strong adoption of Avery Dennison's eco-friendly and recyclable labels (e.g., APR-recyclable tag launch), supporting both higher-margin product growth and protecting net margins as next-generation sustainable solutions command premium pricing.

What kind of growth assumptions drive this bold upside? Hint: future profit margins and a valuation multiple fit for innovative industry leaders are at the heart of this calculation. Discover the key projections shaping this “undervalued” call. See how analysts reach their confidence verdict.

Result: Fair Value of $202.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade policy uncertainty and sales declines in key apparel categories could quickly challenge the current growth outlook for Avery Dennison.

Find out about the key risks to this Avery Dennison narrative.

Another View: What Do Multiples Say?

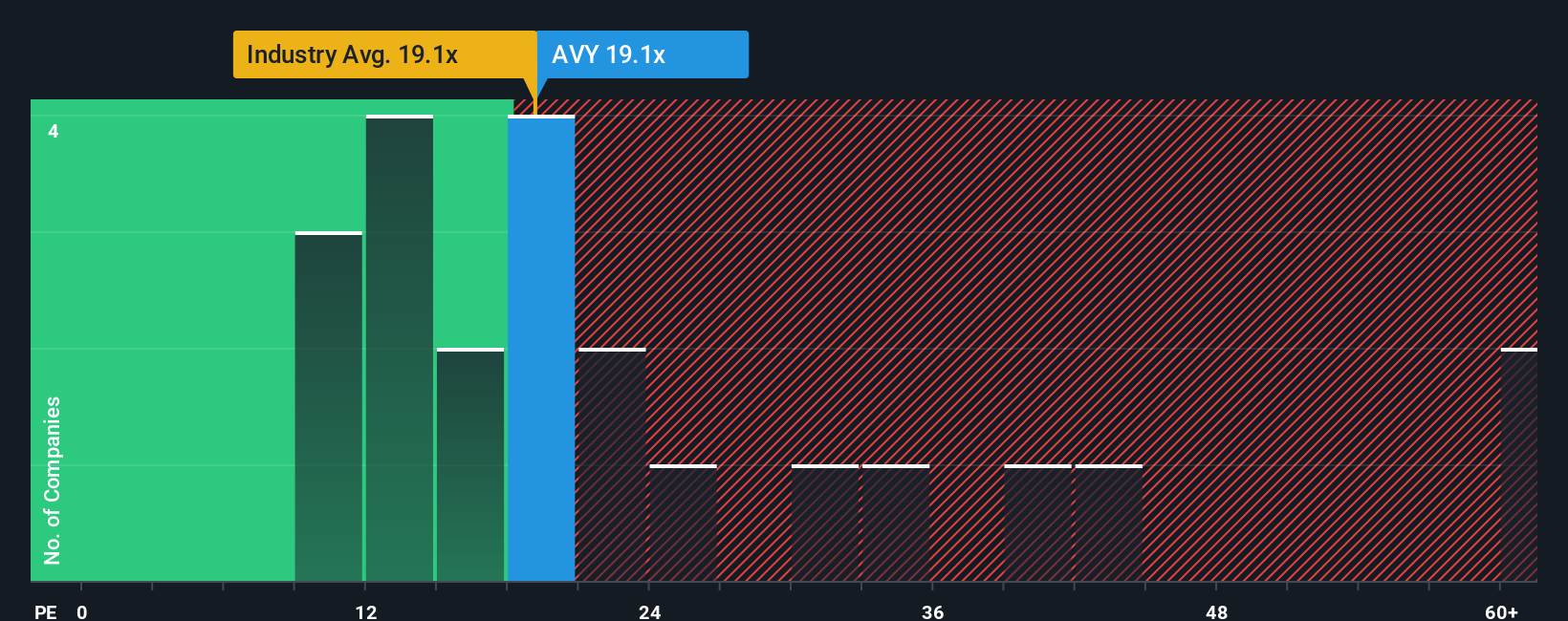

Looking at Avery Dennison’s valuation through the lens of its price-to-earnings ratio, the story shifts. The company trades at 18.9x earnings, making it a bit pricier than the North American Packaging industry average of 18.5x but cheaper than its peer average of 23.2x. The fair ratio signals room for a higher valuation, currently 19.9x, suggesting the market might catch up. But does this gap signal value or risk for investors who buy now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Avery Dennison Narrative

If you have your own perspective or want to dive into the numbers firsthand, crafting a personal narrative takes just a few minutes. Do it your way

A great starting point for your Avery Dennison research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Investment Ideas?

Seize the chance to get ahead. Great opportunities are not waiting around. Use the Simply Wall Street Screener to unlock stocks that match your investing goals today.

- Boost your passive income with these 17 dividend stocks with yields > 3% featuring high-yield options that consistently reward shareholders.

- Stay on the forefront of artificial intelligence innovation by checking out these 25 AI penny stocks powering tomorrow’s biggest breakthroughs.

- Capitalize on mispriced assets by targeting these 919 undervalued stocks based on cash flows primed for potential outperformance based on strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com