Leadership Shakeup and Steady Guidance Could Be a Game Changer for Ball (BALL)

- On November 10, 2025, Ball Corporation announced a major leadership transition, appointing Ronald J. Lewis as CEO and Daniel Rabbitt as CFO, while naming Stuart A. Taylor II as Chairman and reaffirming its full-year earnings guidance.

- This combination of executive changes and maintained financial outlook points to the company's effort to reinforce stability and operational continuity during a period of management transition.

- We'll explore how the appointment of an experienced internal leader as CEO influences Ball's investment narrative and future prospects.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ball Investment Narrative Recap

Owning Ball shares requires confidence in the accelerating demand for recyclable aluminum packaging, continued earnings growth, and effective management of customer concentration risks and input costs. The recent leadership transition, appointing Ronald J. Lewis as CEO and Daniel Rabbitt as CFO, does not materially alter the primary catalyst of robust sustainability-driven demand, or the ongoing risk of customer concentration, which remains largely unchanged for now. Investors should pay close attention to how internal leadership experience translates into operational stability and execution.

Among several recent announcements, Ball’s reaffirmed full-year earnings guidance for 2025 stands out. Maintaining its 12%-15% EPS growth target, even through executive changes, suggests an intent to provide short-term earnings stability and visibility, which remains central to supporting near-term investor confidence and mitigating any uncertainty from management changes.

Yet, despite these positives, investors should not overlook the customer concentration risk in key markets such as South America, where...

Read the full narrative on Ball (it's free!)

Ball's outlook projects $14.2 billion in revenue and $1.1 billion in earnings by 2028. This requires 4.6% annual revenue growth and an increase in earnings of $519 million from the current $581 million.

Uncover how Ball's forecasts yield a $60.31 fair value, a 21% upside to its current price.

Exploring Other Perspectives

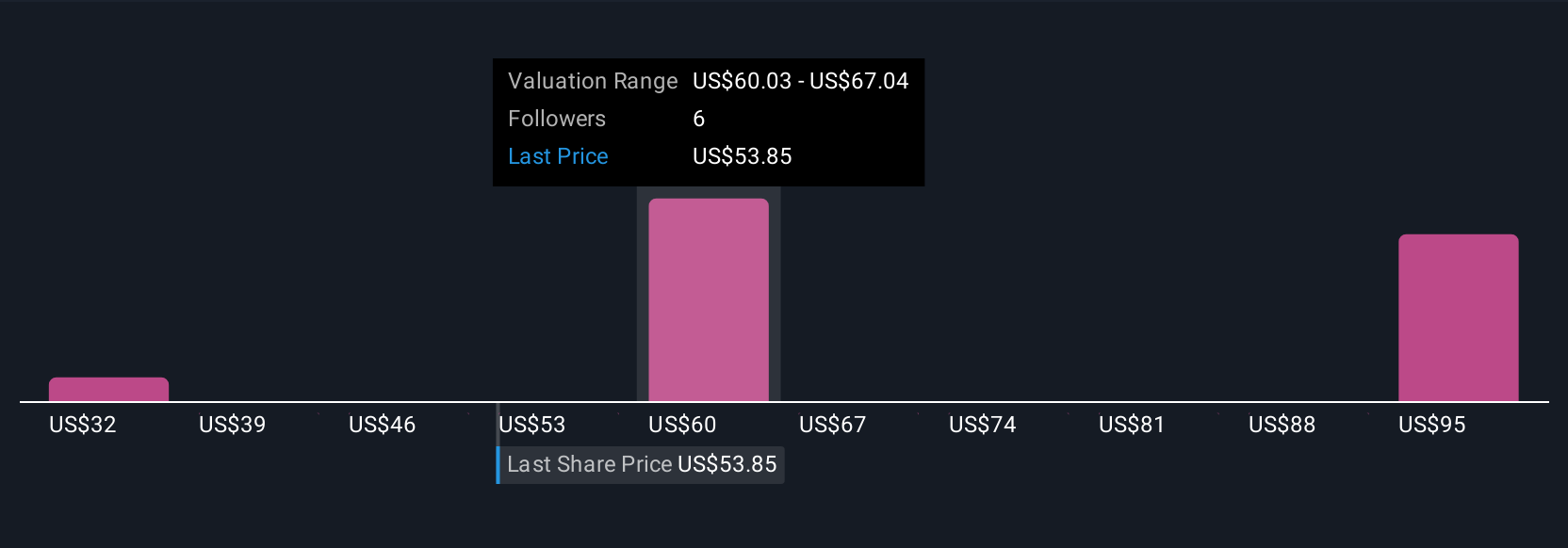

Five private investors in the Simply Wall St Community estimated Ball’s fair value between US$32 and US$86, highlighting wide valuation differences. Against this backdrop, sustained demand for aluminum packaging may support optimism, but further insights await from those tracking evolving risks to Ball’s performance.

Explore 5 other fair value estimates on Ball - why the stock might be worth 36% less than the current price!

Build Your Own Ball Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ball research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ball research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ball's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com