Can Hub Group’s (HUBG) Dividend and Intermodal Gains Redefine Its Capital Allocation Strategy?

- Hub Group's Board of Directors recently declared a quarterly cash dividend of US$0.125 per share for both Class A and Class B stock, payable on December 17, 2025, to shareholders of record as of December 5, 2025, as part of its capital allocation plan.

- This announcement coincided with Hub Group reporting US$934.5 million in quarterly revenue, which, while showing a 5.3% year-on-year decline, exceeded analyst estimates and highlighted gains in intermodal profitability and the impact of the Marten Intermodal acquisition.

- We'll examine how the recent boost in intermodal performance and capital returns could reshape Hub Group's investment narrative and outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Hub Group Investment Narrative Recap

To be a Hub Group shareholder, one must see value in the company’s adaptability across shifting freight markets and ongoing investment in intermodal offerings, even amidst recent revenue softness. The latest dividend declaration reinforces management’s intent to return capital while focusing on growth initiatives, but does not materially change the immediate catalysts, such as ongoing intermodal margin gains, or address the persistent risk of revenue volatility tied to industry demand uncertainty.

Among recent developments, the Marten Intermodal acquisition stands out as highly relevant. This move supports Hub Group’s efforts to capitalize on modal shifts toward lower-emission rail solutions and bolsters its refrigerated intermodal business, directly linking to the improvement in profitability spotlighted in the latest quarterly results.

However, investors should also be aware that, in contrast to these positive signals, risks remain if demand visibility in logistics and brokerage segments does not...

Read the full narrative on Hub Group (it's free!)

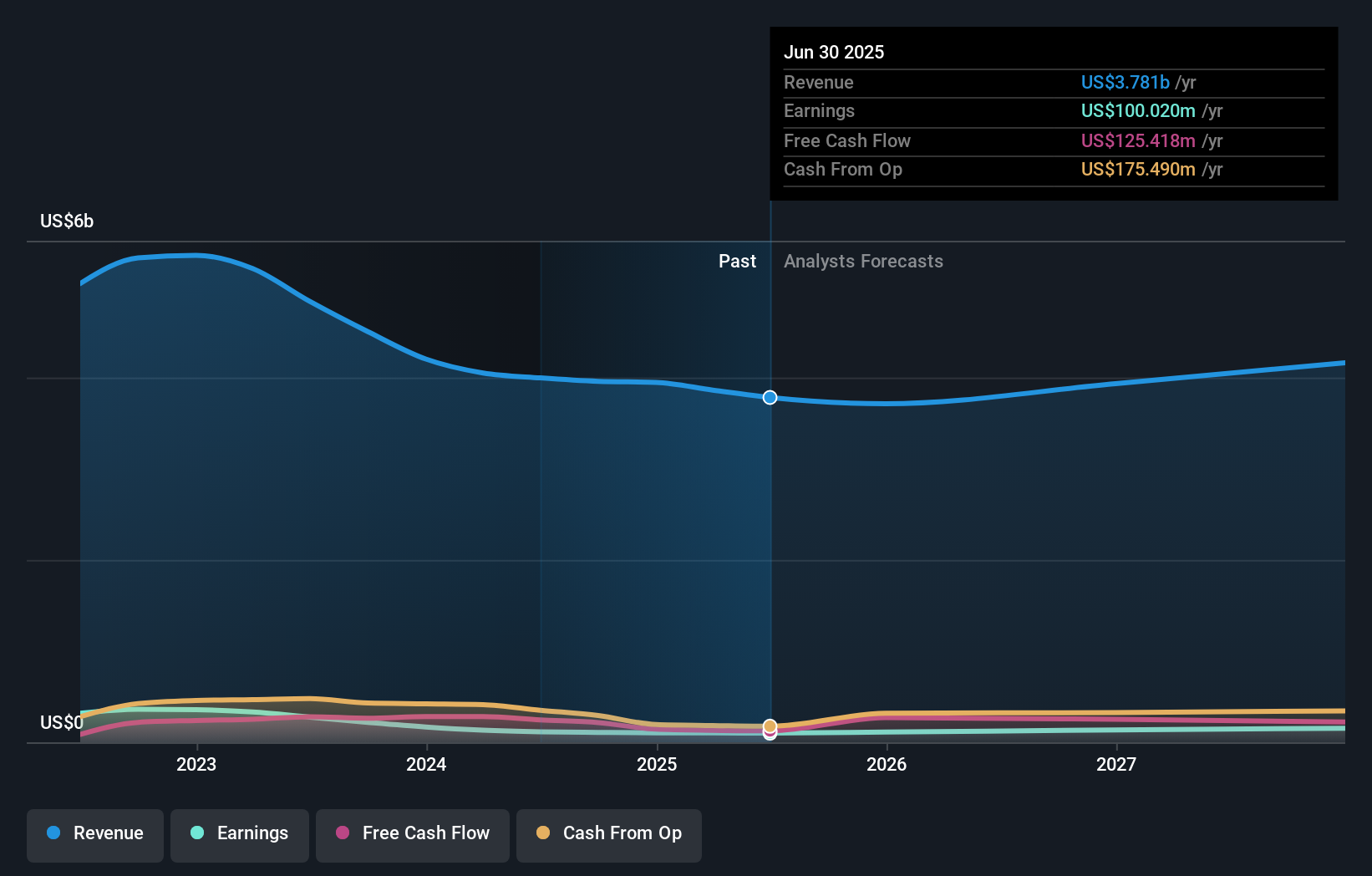

Hub Group's outlook projects $4.3 billion in revenue and $164.5 million in earnings by 2028. This scenario assumes a 4.3% annual revenue growth rate and a $64.5 million increase in earnings from the current $100.0 million.

Uncover how Hub Group's forecasts yield a $39.94 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Fair value estimates from three Simply Wall St Community members range from US$39.94 to US$66.07 per share. These varied viewpoints highlight ongoing concerns about revenue and earnings volatility in softer demand cycles, giving you the opportunity to compare different outlooks for Hub Group’s future.

Explore 3 other fair value estimates on Hub Group - why the stock might be worth as much as 79% more than the current price!

Build Your Own Hub Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hub Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hub Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hub Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com