Does Analyst Optimism on Holding Company Shift Signal a New Era for Portland General Electric (POR)?

- In recent days, Portland General Electric drew attention after multiple analysts revised their outlooks amid ongoing regulatory developments and the company’s proposed shift to a holding company structure. This series of analyst actions and regulatory updates reflects both optimism and caution about the company’s ability to unlock value and manage capital pressures.

- We’ll now examine how analyst optimism around the holding company proposal may reshape Portland General Electric’s investment narrative and future growth drivers.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Portland General Electric Investment Narrative Recap

To be a shareholder in Portland General Electric today, an investor needs to believe in the company’s ability to execute on clean energy growth and unlock greater capital flexibility, particularly through its proposed holding company structure. Recent analyst activity, including revised price targets and ratings, reflects mixed reactions, but does not materially impact the company’s most important near-term catalyst: pending regulatory approval for the holding company conversion. The biggest risk remains cost recovery challenges amid Oregon’s aggressive energy mandates and evolving customer demands.

Among recent announcements, Jefferies' decision to increase its price target cited the holding company proposal as a driver for possible EPS accretion and capital market risk mitigation. This is directly relevant to the current debate, as regulatory and equity overhang issues tie closely to the company’s ability to fund major grid and renewable investments. The outcome of the Oregon Public Utility Commission review will be closely watched for its implications on both risk and opportunity ahead.

However, investors should keep in mind that pressures to keep customer rates low may still squeeze margins if cost recovery falls short…

Read the full narrative on Portland General Electric (it's free!)

Portland General Electric's outlook anticipates $4.0 billion in revenue and $479 million in earnings by 2028. This is based on a forecast annual revenue growth rate of 4.7% and an increase in earnings of $185 million from the current $294 million.

Uncover how Portland General Electric's forecasts yield a $48.33 fair value, in line with its current price.

Exploring Other Perspectives

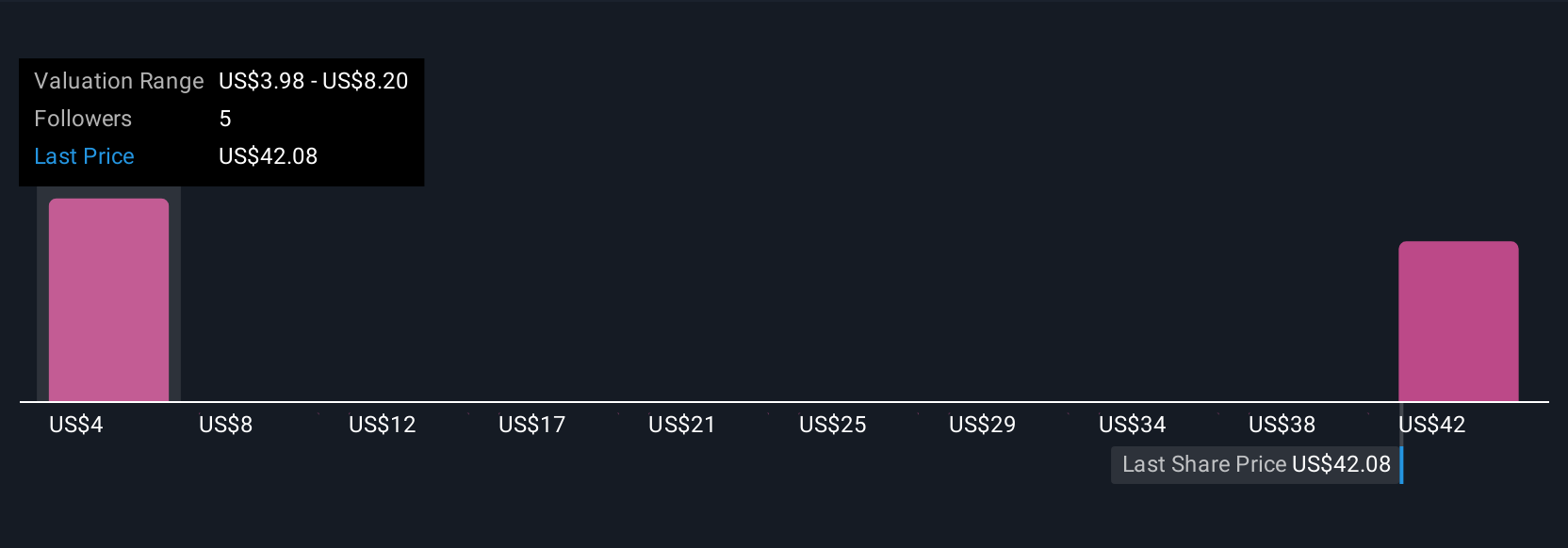

Three Simply Wall St Community fair value estimates for Portland General Electric range widely from US$3.92 to US$54.07 per share. While many see possible upside, the risk that cost recovery may not keep pace with investments can also weigh on future returns, reminding you to compare differing viewpoints.

Explore 3 other fair value estimates on Portland General Electric - why the stock might be worth less than half the current price!

Build Your Own Portland General Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Portland General Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Portland General Electric's overall financial health at a glance.

No Opportunity In Portland General Electric?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com