Does Avery Dennison’s (AVY) Productivity-Fueled EPS Beat Signal a Shift in Its Investment Outlook?

- Avery Dennison reported third-quarter 2025 adjusted earnings per share of US$2.37, surpassing estimates due to productivity gains and returned US$670 million to shareholders over the first nine months of the year through buybacks and dividends.

- An interesting takeaway is the company's fourth-quarter adjusted EPS guidance between US$2.35 and US$2.45, offering a transparent outlook despite a broader trend of downward estimates prior to this report.

- As Avery Dennison's productivity-driven earnings beat expectations, we'll explore what this means for its ongoing investment narrative and outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Avery Dennison Investment Narrative Recap

To be a shareholder in Avery Dennison, one needs to believe in sustained demand for smart label technology and the company’s ability to broaden its reach beyond traditional apparel and retail into faster-growing end-markets. The recent third-quarter earnings surprise, driven by productivity gains, adds confidence in management’s ability to execute, but does not materially change the biggest near-term catalyst: faster adoption of RFID and intelligent labels beyond core retail; nor does it offset the ongoing risk from structural declines in core apparel and retail categories.

Among recent announcements, the introduction of innovative RFID technology for fresh products in partnership with Walmart stands out. This ties directly to the company’s key growth catalyst of expanding its Intelligent Labels platform into food and logistics, sectors showing more robust demand trends and offering some insulation from sluggish apparel markets.

However, despite positive momentum, investors should not lose sight of continuing exposure to weak end-markets and the potential for prolonged softness in apparel and retail, particularly if secular trends shift further away from...

Read the full narrative on Avery Dennison (it's free!)

Avery Dennison's outlook anticipates $9.8 billion in revenue and $909.0 million in earnings by 2028. This scenario assumes a 4.0% annual revenue growth rate and an increase in earnings of $198.0 million from the current $711.0 million level.

Uncover how Avery Dennison's forecasts yield a $202.36 fair value, a 19% upside to its current price.

Exploring Other Perspectives

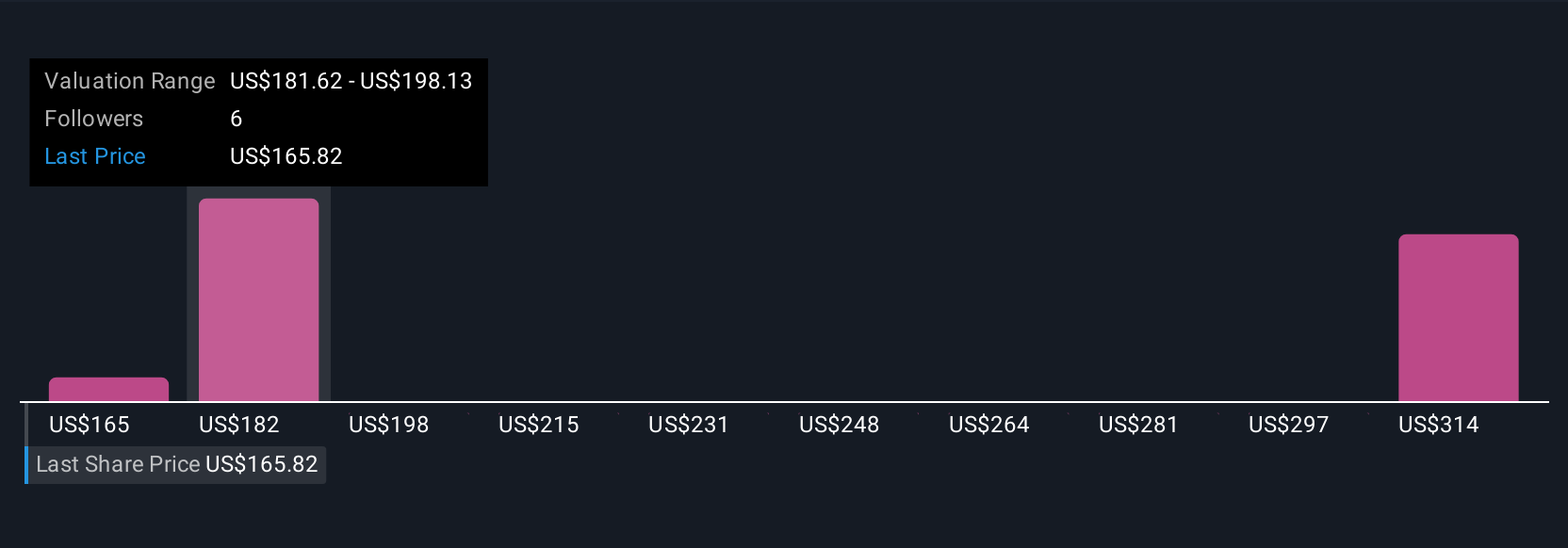

Fair value estimates from three Simply Wall St Community members range widely from US$165 to over US$319 per share. With varied outlooks, some expect further growth from the RFID and food segment, while others see risks tied to apparel and broader retail market uncertainty, be sure to compare these differing viewpoints for a fuller picture.

Explore 3 other fair value estimates on Avery Dennison - why the stock might be worth just $165.12!

Build Your Own Avery Dennison Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avery Dennison research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Avery Dennison research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avery Dennison's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com