Is PPL’s Recent Grid Modernization Enough to Justify Its Current Share Price?

- Is PPL stock truly a bargain waiting to be uncovered? If you have ever wondered whether now is the right moment to buy in, you are not alone.

- The share price has dipped slightly by 0.9% over the past week and is down 2.3% for the month. PPL is still up an impressive 13.4% since the start of the year.

- Recent headlines have focused mainly on strategic moves within the U.S. utilities sector. PPL has drawn attention for its grid modernization efforts and progress on renewable energy initiatives. These developments offer important context for understanding the current investor mood and the stock’s momentum.

- PPL scores just 1 out of 6 on our valuation checks, suggesting there may be limited signs of undervaluation for now. We will dive into these methods shortly, and at the end, share an even smarter way to approach the question of value.

PPL scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: PPL Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to reflect today's dollars. This process tries to answer the question: If all expected future cash generation were received today, what would PPL be worth?

PPL's latest reported Free Cash Flow (FCF) is negative, at -$433 Million, mainly due to near-term spending and investments. However, cash flow is anticipated to improve sharply. Forecasts for 2027 show FCF rising to about $2.24 Billion, with similar results projected through 2035, based partly on analyst estimates and then extended by third-party modeling. Over the next decade, FCF is estimated to remain well above $1 Billion each year, according to these projections.

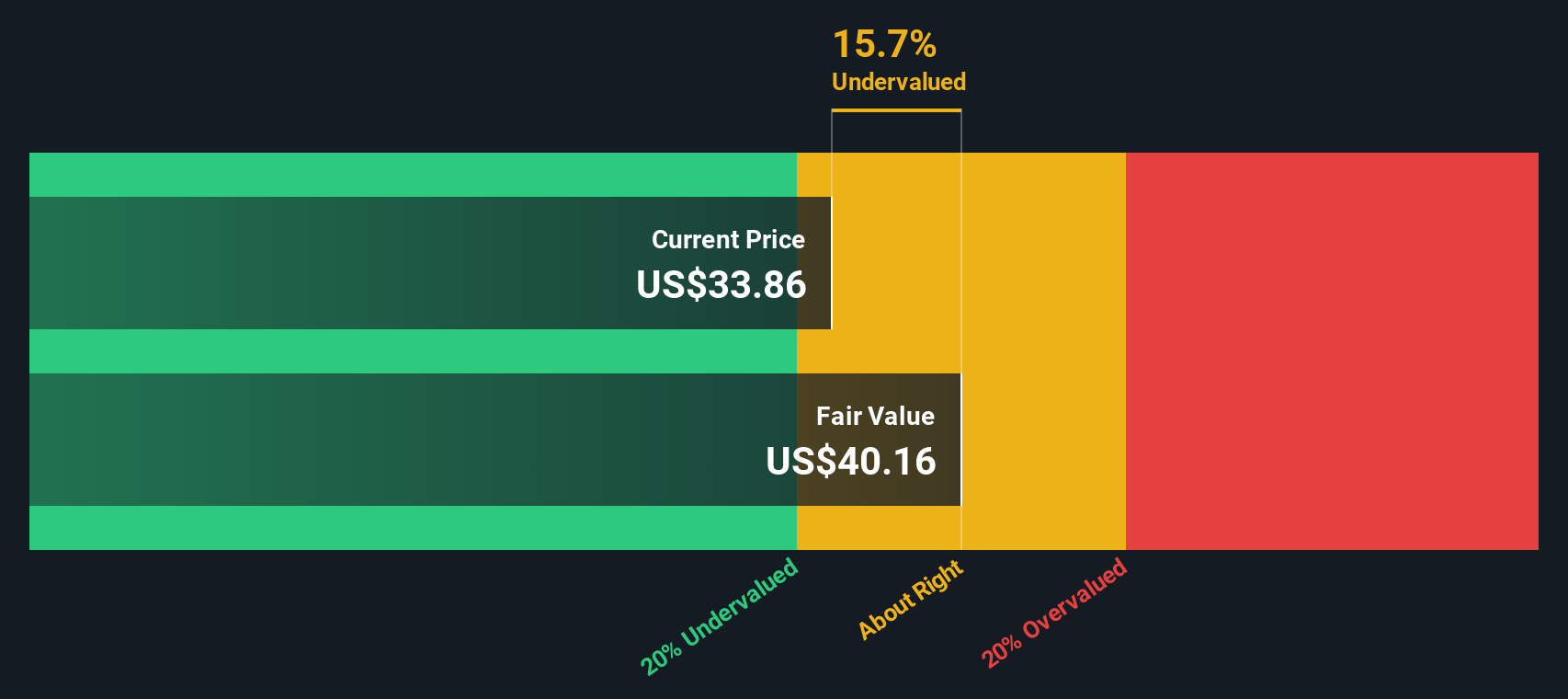

Using these figures, the DCF model estimates PPL's intrinsic value at $41.04 per share. With the current share price about 11.1% below this fair value, the result suggests the stock is undervalued according to this analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PPL is undervalued by 11.1%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: PPL Price vs Earnings

For profitable companies like PPL, the Price-to-Earnings (PE) ratio is a popular way to check if the stock price seems fair. This ratio reflects how much investors are willing to pay for $1 of the company’s reported earnings, making it a straightforward benchmark for valuation. However, it is important to remember that growth expectations and risk both play a role in what counts as a “normal” or “fair” PE ratio. Companies with higher earnings growth or lower risks typically deserve a higher PE ratio, while slower growth or added risks tend to lower it.

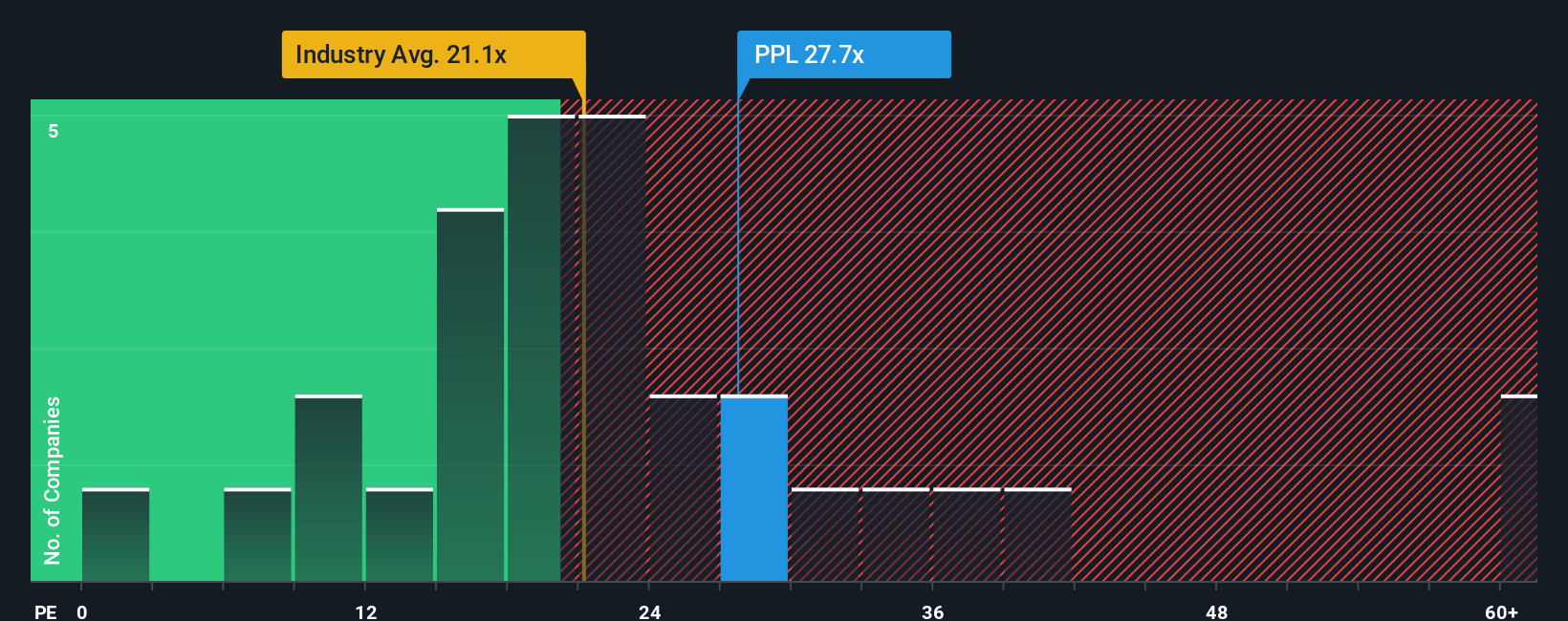

PPL currently trades at a PE ratio of 24.8x, which is noticeably higher than the Electric Utilities industry average of 20.6x and higher than the peer average of 15.0x. At first glance, this premium might raise eyebrows. However, context matters, particularly around how much earnings growth, stability, and potential risk investors expect from PPL compared to its sector.

That is where Simply Wall St’s proprietary “Fair Ratio” becomes valuable. Unlike simple comparisons to industry or peer averages, the Fair Ratio weighs unique company-specific factors such as growth, profit margins, risks, its industry, and market capitalization. For PPL, the Fair Ratio is calculated at 23.2x. This means the current valuation is very close to what you would expect based on the company’s outlook and profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PPL Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your chance to connect the company’s story to the numbers by building your own view of PPL’s future, such as expected revenue, profit margins, and fair value, and updating it as new information comes to light. Narratives make investing accessible by putting you in the driver’s seat, helping you clearly explain why you think the stock should be worth more or less, and seeing how your forecast stacks up against millions of other investors on Simply Wall St’s Community page.

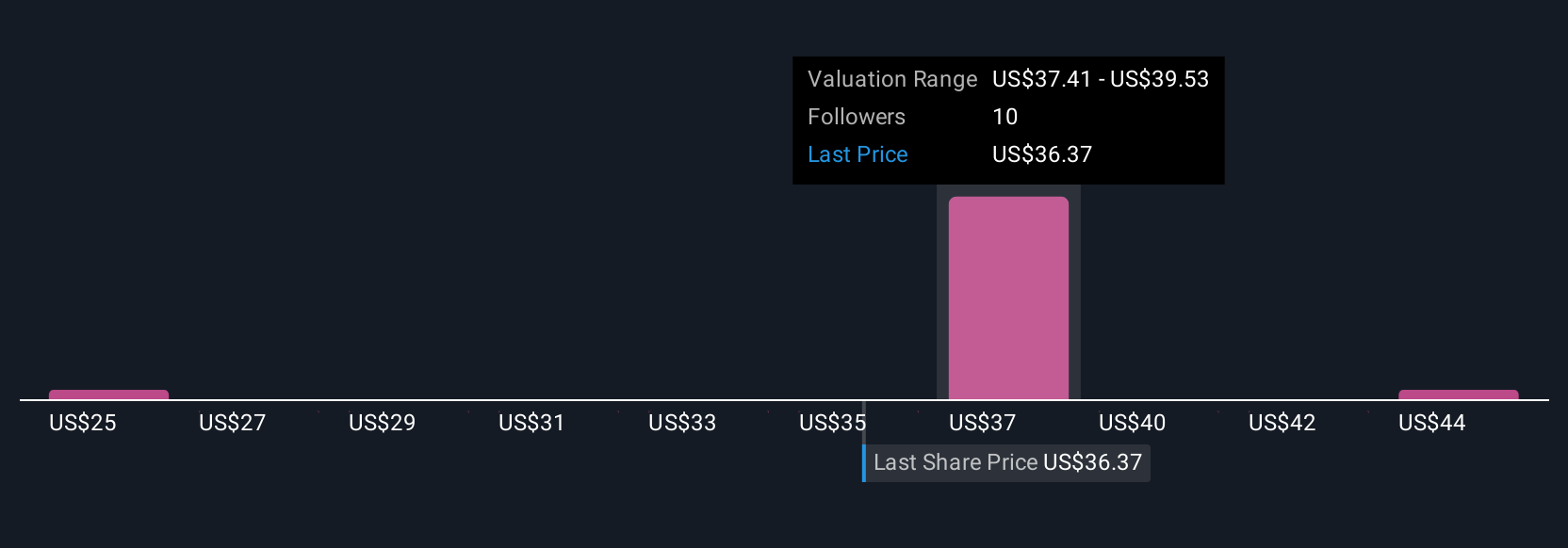

Every Narrative ties your perspective, whether you believe PPL will benefit from a data center boom or that regulatory headwinds will limit growth, directly to a fair value based on your estimates. As news or earnings reports come in, your Narrative stays current, dynamically updating key numbers and keeping your decision-making sharp. For PPL, this means some investors may see fair value as high as $42 if they are optimistic about long-term growth and rising margins, while more cautious investors may calculate a conservative fair value closer to $34, reflecting uncertainty around regulation or demand.

Do you think there's more to the story for PPL? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com