Could JPMorgan’s Move Shape Perceptions of Armstrong World’s (AWI) Long-Term Growth Trajectory?

- In the past week, JPMorgan removed Armstrong World Industries from its Analyst Focus List, citing a shift towards other companies with greater perceived growth potential in the industrial sector.

- Despite this change, analyst consensus remains positive on Armstrong’s financial trajectory, with recent upward earnings estimate revisions and growth forecasts underscoring continued confidence in the company’s fundamentals.

- We’ll explore how JPMorgan’s reduced focus on Armstrong impacts the overall investment narrative and outlook for the company.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Armstrong World Industries Investment Narrative Recap

To be a shareholder in Armstrong World Industries, you need to believe in sustained commercial construction growth, margin resilience, and innovation in energy-efficient building solutions. JPMorgan's removal of AWI from its Analyst Focus List does not materially shift the most important near-term catalyst, upward earnings revisions and healthy sales momentum, nor does it increase the risk tied to commercial construction softness, which remains the key challenge for the business.

Among recent announcements, the October earnings report stands out, showing quarterly and year-to-date growth in both revenue and profits, while management raised full-year guidance. This reinforces the upbeat analyst outlook underpinning AWI’s pricing and supports ongoing confidence in the company’s fundamental strengths in the face of shifting analyst attention elsewhere.

Yet, in contrast to these positive signals, investors should be aware of market risks if commercial construction activity remains...

Read the full narrative on Armstrong World Industries (it's free!)

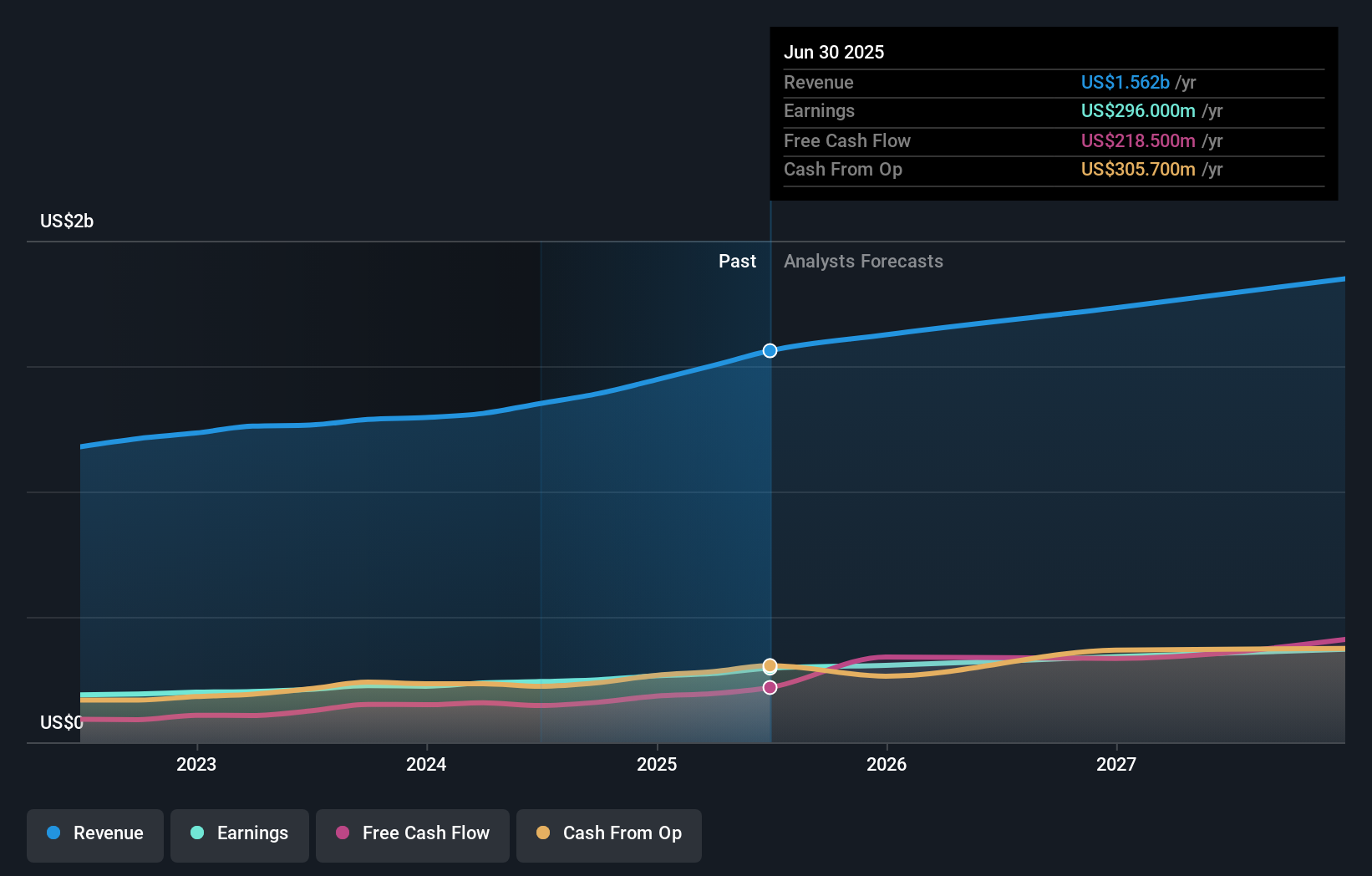

Armstrong World Industries' narrative projects $1.9 billion revenue and $389.4 million earnings by 2028. This requires 6.9% yearly revenue growth and a $93.4 million earnings increase from the current $296.0 million.

Uncover how Armstrong World Industries' forecasts yield a $207.10 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate AWI’s fair value between US$158.35 and US$223.37, offering a broad spectrum of opinions. Although analysts see robust innovation and margin expansion as catalysts, you could consider how differing views highlight the importance of exploring multiple approaches to evaluating the company’s future.

Explore 3 other fair value estimates on Armstrong World Industries - why the stock might be worth as much as 21% more than the current price!

Build Your Own Armstrong World Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Armstrong World Industries research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Armstrong World Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Armstrong World Industries' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com