What Crown Holdings (CCK)'s Debt Redemption and New Notes Mean for Financial Flexibility

- In November 2025, Crown Holdings, Inc. announced the full redemption of its 7.375% debentures due 2026, covering US$350 million in principal, and initiated a fixed-income exchange offer involving US$700 million in new senior unsecured notes due 2033.

- These actions reduce near-term debt obligations while signaling a shift in Crown Holdings’ capital structure, following a quarter of robust financial performance.

- We'll explore how Crown's recent debt reduction initiatives impact its investment narrative and outlook on financial flexibility and capital returns.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Crown Holdings Investment Narrative Recap

Being a shareholder in Crown Holdings means believing in the continued global shift toward sustainable packaging, with growth fueled by strong demand for metal cans and ongoing capacity expansion in high-growth markets. The recent redemption of US$350 million in 7.375% debentures and new US$700 million fixed-income offering is unlikely to materially change the near-term catalysts, which remain tied to sustained can volume growth, but it could modestly reduce short-term interest expense. The greatest current risk is that geographic and commodity price pressures persist, particularly prolonged weakness in Asian and Mexican markets or rising input cost inflation, dampening revenue and margin expansion. A key development relevant to the company’s outlook is the tender and redemption of its 7.375% Debentures due 2026, announced shortly after a robust earnings report for Q3. While these actions enhance Crown’s financial flexibility and signal ongoing balance sheet optimization, the ability to convert this improved position into accelerated capital returns or margin expansion still hinges on end-market demand trends, especially in North America and Europe. By contrast, investors should also be aware that input cost inflation, especially if aluminum prices remain elevated, could limit...

Read the full narrative on Crown Holdings (it's free!)

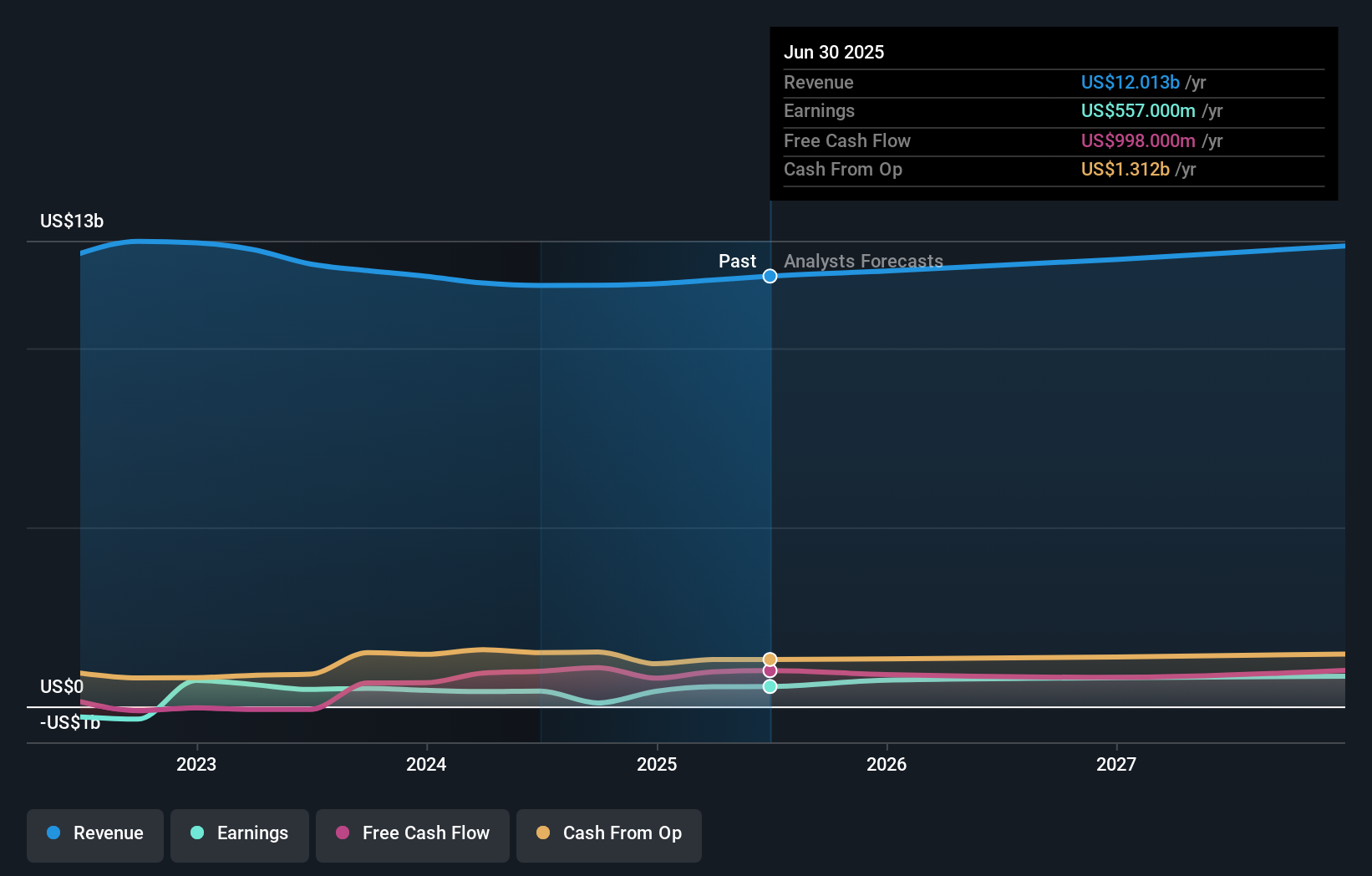

Crown Holdings' outlook anticipates $13.3 billion in revenue and $886.4 million in earnings by 2028. Achieving this will require 3.3% annual revenue growth and a $329.4 million increase in earnings from the current $557.0 million.

Uncover how Crown Holdings' forecasts yield a $121.50 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two fair value estimates, ranging from US$121.50 to US$206.39. While many focus on valuation potential, ongoing margin risk from elevated aluminum prices remains a key theme for future performance.

Explore 2 other fair value estimates on Crown Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Crown Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crown Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Crown Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crown Holdings' overall financial health at a glance.

No Opportunity In Crown Holdings?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com