A Look at EPAM Systems's Valuation After Strong Earnings and Raised Guidance on AI and Cloud Demand

EPAM Systems (EPAM) saw shares climb after its latest earnings report came in above expectations, with management also raising its outlook for the year. The company pointed to strong demand in AI, cloud, automation, and modernization services.

See our latest analysis for EPAM Systems.

EPAM’s upbeat quarterly results and raised outlook sparked a sharp rally, with the stock jumping 17% over the past month. Even with this momentum, EPAM’s year-to-date share price return remains negative. Its one-year total shareholder return stands at -25%, underscoring a challenging stretch despite fresh optimism from management’s outlook and the ongoing tech services boom.

If you’re interested in what’s performing in the broader software and AI sector, there’s a lot more to discover with our See the full list for free.

With the latest rally, is EPAM’s recent momentum just the start of a turnaround? Or has the market already factored in all of the company’s future potential growth?

Most Popular Narrative: 10.4% Undervalued

EPAM's fair value is set higher than its latest closing price, sparking speculation about how much potential upside remains according to analyst consensus. Here’s what is driving this view.

The accelerating enterprise adoption of AI is driving a surge in demand for advanced data engineering, cloud migration, and platform modernization projects. These are areas where EPAM holds deep technical expertise, leading to increased revenue from larger and more complex client engagements. EPAM's strategic investments in AI-native services, proprietary platforms (such as DIAL and AI/RUN), and upskilling of over 80% of its workforce have positioned it as a transformation partner for clients moving beyond pilot AI programs to large-scale deployments. This supports sustainable revenue growth and the potential for improved net margins as EPAM moves up the value chain.

Want to know what’s powering that premium? The narrative links ambitious top-line growth with margins not seen in years, all built on future-focused transformations. Wonder how those bold predictions stack up? There’s a crucial detail hidden in the consensus that could change how investors see fair value. Dig into the full story behind this price.

Result: Fair Value of $207 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing AI-powered automation and persistent margin pressures could still derail EPAM’s recovery if client demand shifts or operating costs increase further.

Find out about the key risks to this EPAM Systems narrative.

Another View: Multiples Suggest a Different Story

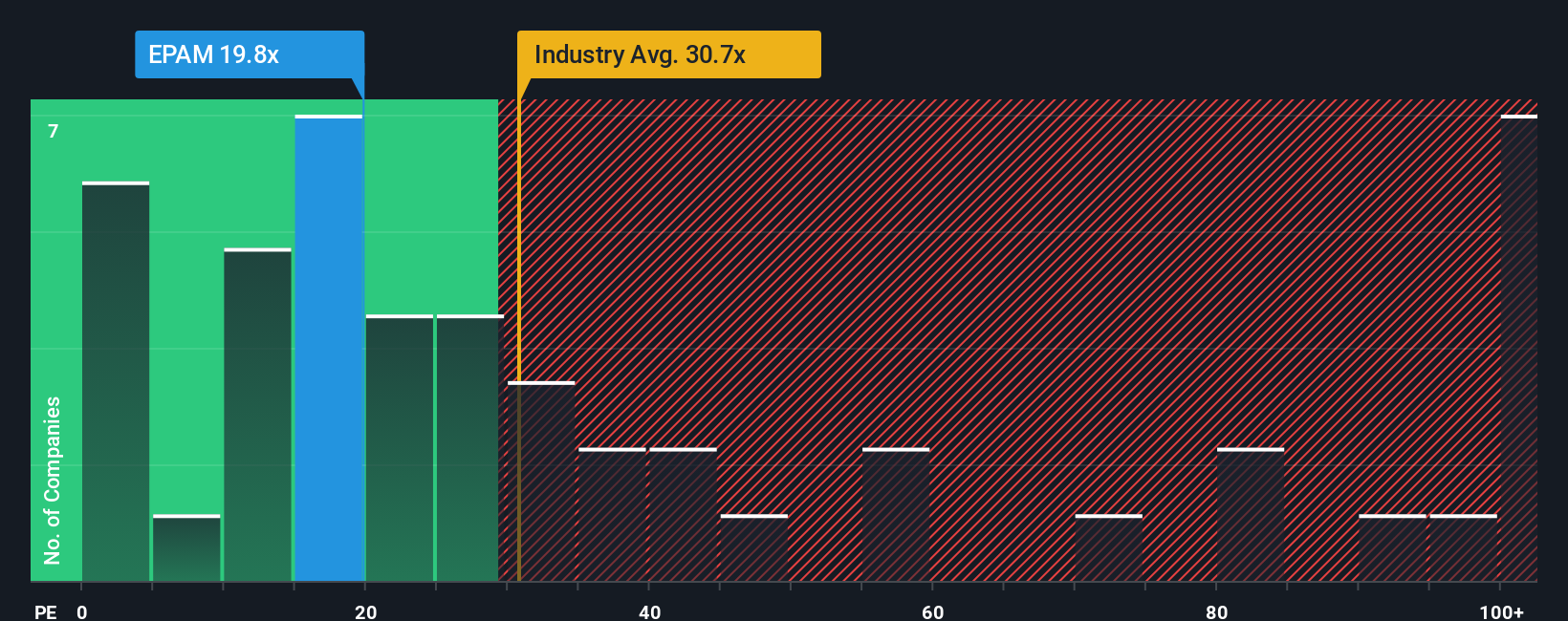

While the fair value estimate from analysts paints EPAM as undervalued, its current price-to-earnings ratio of 27.6x is actually a bit higher than the industry average of 27.2x and much higher than peers at 16.4x. However, this is still below the fair ratio of 33.1x that the market could potentially price in if confidence returns. Is this gap signaling hidden opportunity, or a risk of disappointment for those hoping for a re-rating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EPAM Systems Narrative

If you see the numbers differently or want to take a hands-on approach, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your EPAM Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for yesterday’s winners when you could be finding tomorrow’s game changers. The market never waits. Take action now to spot fresh opportunities that others might miss.

- Generate real income potential and target resilient returns with these 14 dividend stocks with yields > 3% offering attractive yields above 3%.

- Catalyze your search for high-growth by zeroing in on innovation with these 26 AI penny stocks fueling breakthroughs across industries.

- Seize value where others overlook by tapping into these 924 undervalued stocks based on cash flows primed for gains based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com