Will AXIS Capital’s (AXS) $238 Million Buyback Boost Confidence in Its Long-Term Value?

- AXIS Capital Holdings recently executed a repurchase of approximately 2.4 million of its shares from a Stone Point Capital-managed vehicle for US$238 million, under its approved US$400 million buyback program; Stone Point-managed funds now no longer hold AXIS shares.

- This move coincided with a wave of positive analyst ratings and upgrades, emphasizing growing confidence in AXIS’s business outlook and capital strength.

- Next, we’ll examine how the significant share repurchase signals management’s faith in future value and impacts AXIS’s investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

AXIS Capital Holdings Investment Narrative Recap

To believe in AXIS Capital Holdings as a shareholder, you need conviction in the ongoing global demand for specialty insurance solutions, the company's disciplined focus on profitable lines, and management's ability to adapt to fast-changing risks. The recent share repurchase removes an overhang from Stone Point Capital's stake and suggests management confidence, but it does not materially alter near-term catalysts or address the sharpest risks such as intensifying cyber exposures or price competition in key business lines. Of particular relevance to this buyback news is the wave of analyst rating upgrades, with several firms, including RBC Capital and KBW, expressing increased confidence in AXIS’s business performance and capital strength following the transaction. This aligns with the prevailing catalyst: accelerating demand for specialty insurance lines and strong premium growth supporting the company’s revenue and earnings outlook. However, investors should also consider that, by contrast, one major risk remains the impact of rising cyber and ransomware losses, especially if...

Read the full narrative on AXIS Capital Holdings (it's free!)

AXIS Capital Holdings is projected to reach $7.0 billion in revenue and $1.1 billion in earnings by 2028. This outlook is based on a 3.9% annual revenue growth rate and a $238 million increase in earnings from the current earnings of $861.5 million.

Uncover how AXIS Capital Holdings' forecasts yield a $115.78 fair value, a 16% upside to its current price.

Exploring Other Perspectives

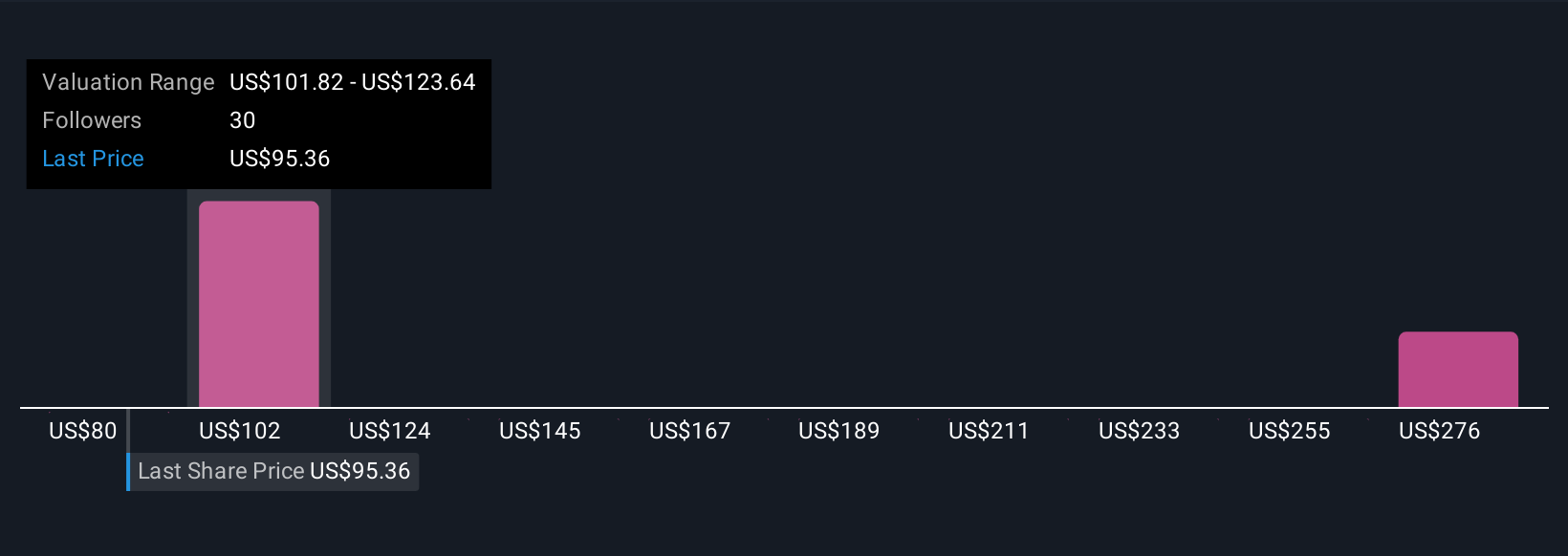

Three members of the Simply Wall St Community currently estimate AXIS Capital’s fair value from US$115.78 up to US$318.87. While market catalysts focus on specialty line growth and margin improvement, differences in assumptions show just how widely you and others may interpret AXIS’s future prospects.

Explore 3 other fair value estimates on AXIS Capital Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own AXIS Capital Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AXIS Capital Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AXIS Capital Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AXIS Capital Holdings' overall financial health at a glance.

No Opportunity In AXIS Capital Holdings?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com