LexinFintech (LX) Is Down 13.6% After Profit Growth and Higher Dividend—Has the Bull Case Changed?

- LexinFintech Holdings Ltd. recently reported a net profit of RMB521 million for Q3 2025, achieving year-over-year profit growth, implementing a business model shift to comply with new lending regulations, and completing a US$25 million share buyback covering 2.35% of its shares.

- The company also raised its dividend payout ratio to 30%, reinforced risk management through enhanced AI capabilities, and reaffirmed its full-year guidance for significant net income growth.

- We’ll explore how LexinFintech’s profit growth and commitment to capital returns influence its investment narrative and future prospects.

Find companies with promising cash flow potential yet trading below their fair value.

LexinFintech Holdings Investment Narrative Recap

To be a LexinFintech shareholder, you have to believe that the company’s ability to adapt to regulatory changes and drive sustained profit growth will support long-term value, despite a competitive industry and ongoing government scrutiny. The recent earnings announcement does little to alter the current short-term catalyst, which is the potential for further profit expansion through improved risk management and compliance, but it does little to mitigate the largest risk: further regulatory tightening that could compress margins or restrict business lines.

Of the recent announcements, the confirmation of the completed US$25 million share buyback, representing 2.35% of outstanding shares, stands out as most relevant for framing current shareholder returns. By following through on share repurchases while maintaining its dividend payout hike, LexinFintech is clearly signaling its willingness to distribute capital even during periods of business model transition and regulatory adaptation, which remains closely tied to the company's performance catalysts.

However, investors should be aware that, in contrast, the potential for additional regulatory action could still...

Read the full narrative on LexinFintech Holdings (it's free!)

LexinFintech Holdings' outlook estimates CN¥20.8 billion in revenue and CN¥4.5 billion in earnings by 2028. This projection reflects a 14.1% annual revenue growth rate and a CN¥2.9 billion increase in earnings from the current level of CN¥1.6 billion.

Uncover how LexinFintech Holdings' forecasts yield a $8.88 fair value, a 160% upside to its current price.

Exploring Other Perspectives

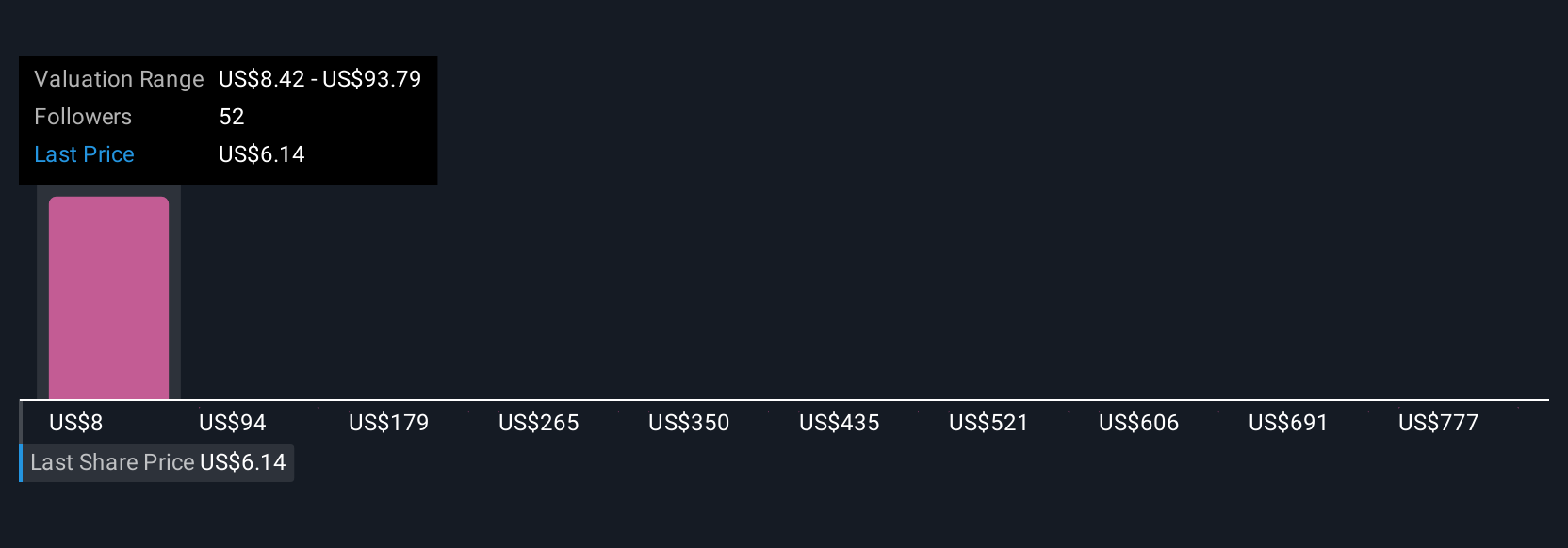

The Simply Wall St Community currently posts 9 different fair value estimates ranging from US$4.79 to US$24.60 per share. Given this diversity, you can see how ongoing regulatory scrutiny continues to shape wide-ranging opinions on LexinFintech’s future, and there are many viewpoints here worth considering.

Explore 9 other fair value estimates on LexinFintech Holdings - why the stock might be worth over 7x more than the current price!

Build Your Own LexinFintech Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LexinFintech Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free LexinFintech Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LexinFintech Holdings' overall financial health at a glance.

No Opportunity In LexinFintech Holdings?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com