Atour (NasdaqGS:ATAT) Net Margin Decline Challenges Bullish Growth Narrative Despite 20% Revenue Increase

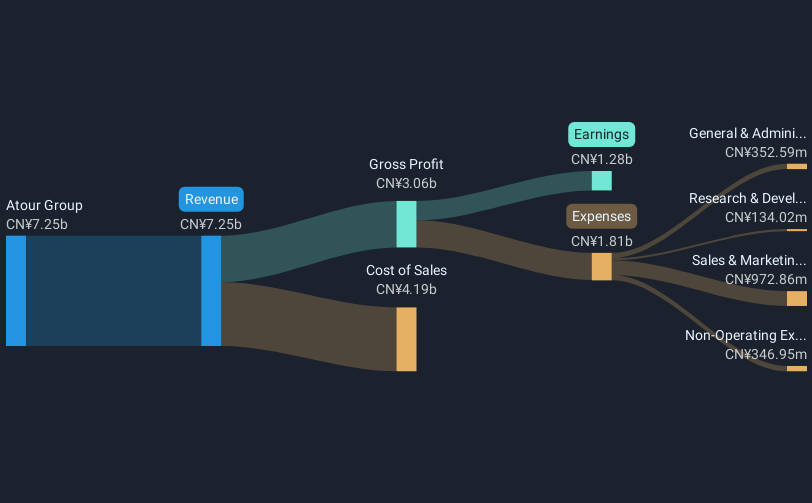

Atour Lifestyle Holdings (NasdaqGS:ATAT) just released its Q3 2025 results, reporting revenue of ¥2.6 billion and basic EPS of ¥3.41. Over the past year, the company has seen revenue climb from ¥6.1 billion to ¥9.1 billion, up 20.4%, while EPS increased from ¥7.57 to ¥10.62, a 26.2% gain. Although net profit margins narrowed slightly compared to last year, the topline and EPS growth indicate the business is still delivering for shareholders.

See our full analysis for Atour Lifestyle Holdings.Next, the headline numbers are compared with the most common market narratives to evaluate which stories align and which ones may need reassessment.

See what the community is saying about Atour Lifestyle Holdings

Profit Margin Narrows to 16.2%

- Net profit margin over the past twelve months was 16.2%, down from 17.5% a year ago, with total net income (excluding extra items) reaching ¥1.47 billion ($1.5 billion).

- Consensus narrative highlights Atour's strategy of pursuing scalable growth and franchise expansion in Tier 2 and 3 Chinese cities, using an asset-light model. It also notes that operational risks, such as maintaining quality across a growing franchise network and a shift toward lower-margin retail sales, could further pressure margins if not managed closely.

- This tension appears in the margin decline, yet the company’s earnings quality remains high and membership program growth is strengthening customer lifetime value.

- Despite lower margins, analysts expect profit margins to increase again to 18.1% over the next three years, which would directly support future earnings growth, provided operational risks are contained.

- For a balanced perspective on how Atour's financials interact with its growth strategy, check the detailed consensus narrative. 📊 Read the full Atour Lifestyle Holdings Consensus Narrative.

Trading 37.7% Below DCF Fair Value

- Atour shares trade at $37.76, which is 37.7% below the estimated DCF fair value of $60.59, and are valued at a forward P/E of 25x. This is less than direct peers at 31.9x but higher than the US hospitality sector average of 21.4x.

- Consensus narrative underscores that, while the discounted share price versus fair value is appealing and the company is delivering strong historical growth (5-year EPS CAGR of 58.8%), the pace has slowed recently, and the stock now appears fairly priced relative to the analyst consensus price target, with a projected upside of just 7.1%.

- Analysts expect annual earnings growth of 24.5% for the coming years, which, if hit, could help close Atour's valuation gap against its sector.

- However, the lower pace of profit growth in the most recent year signals that meeting or beating these targets is essential for the valuation thesis to play out.

Membership Base Jumps 34.7% Year Over Year

- Atour’s proprietary membership system grew past 102 million, a 34.7% year-over-year increase, supporting higher customer engagement and repeat business.

- Consensus narrative indicates the booming membership program and a 79.8% YoY growth in retail revenues are driving Atour’s premium brand positioning. It also warns that this domestic focus adds risk from exposure to shifts in China’s macro environment and demographics.

- The brand’s heavy concentration in China means that external risks, such as regulatory changes or demographic trends, could have a disproportionate effect on long-term revenue and occupancy rates.

- Even so, increased member loyalty and retail expansion are seen as major contributors to revenue stability and margin improvement opportunities in the future.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Atour Lifestyle Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your view and shape your own narrative in just a few minutes with ease. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Atour Lifestyle Holdings.

See What Else Is Out There

While Atour Lifestyle Holdings boasts robust growth and membership gains, its narrowing profit margins and slowing earnings momentum raise questions about future consistency.

If you’re looking for companies demonstrating reliable revenue and earnings trends through all market cycles, uncover more resilient options in our stable growth stocks screener (2073 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com