Does Weibo’s 14.4% Drop Signal a Value Opportunity After Recent Tech Sector Buzz?

- Wondering if Weibo stock is a hidden bargain or a value trap? Let’s quickly unpack what’s been happening and where it might go from here.

- Weibo’s share price moved up 0.9% over the last week, but it’s still down 14.4% over the past month, keeping investors alert to both growth potential and risks.

- Recent headlines have spotlighted renewed interest in Chinese tech stocks amid regulatory shifts and fresh partnership announcements from industry players. This backdrop of evolving sentiment is adding extra fuel to both optimism and caution in the market.

- Weibo earns a 5 out of 6 score when we run it through our valuation checks, which is impressive but not quite perfect. Next, we’ll explore classic valuation frameworks, and at the end of the article you’ll find a more insightful twist on valuing the business.

Find out why Weibo's 16.1% return over the last year is lagging behind its peers.

Approach 1: Weibo Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to their present value. This method helps investors judge whether a stock’s current price represents a genuine bargain or is still too expensive despite falling in value.

For Weibo, the current Free Cash Flow stands at $541 million. Analysts have provided cash flow projections for the next several years, with estimates reaching $494 million by the end of 2028. After that, projections are extrapolated based on typical industry trends. In total, the next ten years are expected to see steady growth in cash flows, though each year’s value is discounted to reflect its worth in today’s dollars.

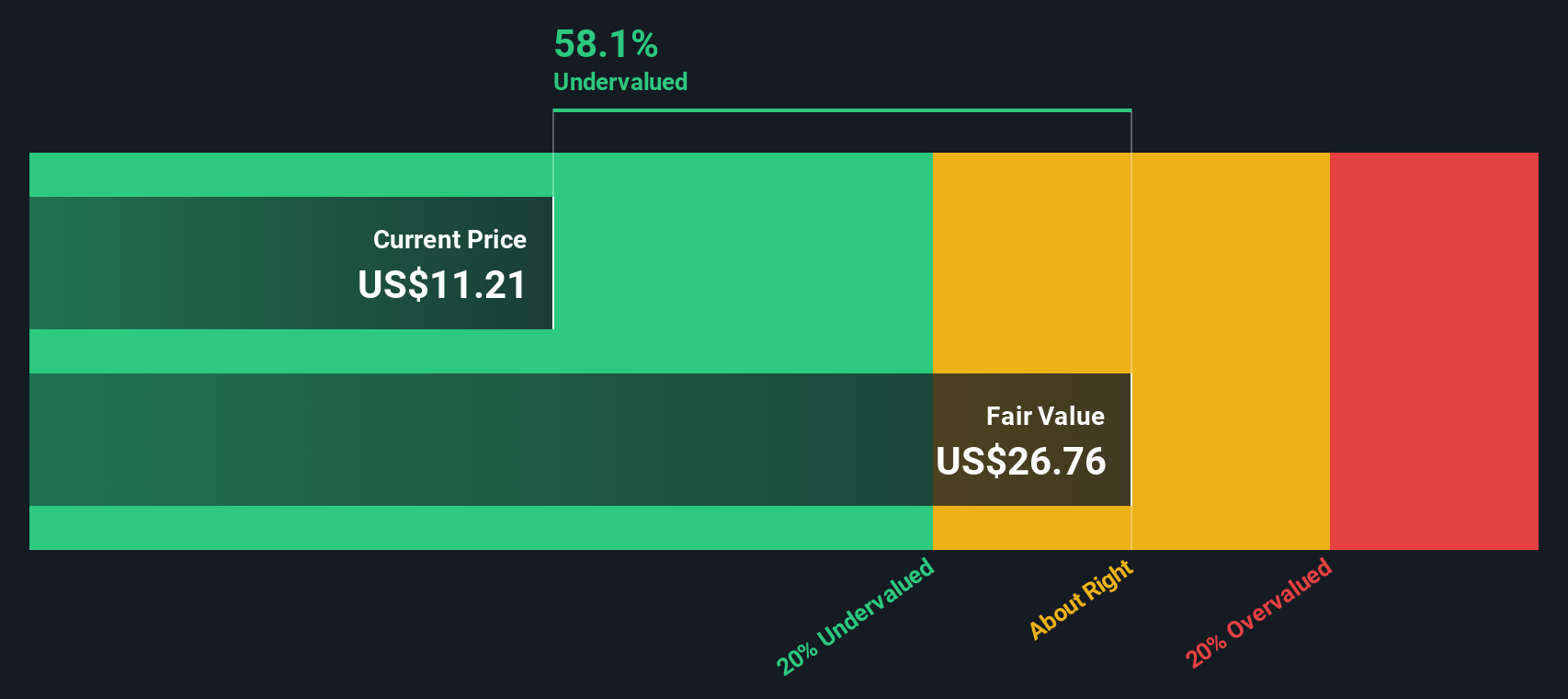

Bringing all these estimates together, the DCF model calculates Weibo’s fair value at $23.01 per share. Compared to today’s share price, this suggests the stock is trading at a 57.2% discount to its intrinsic value. In other words, the market is currently pricing Weibo shares far beneath what its future cash flows might justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Weibo is undervalued by 57.2%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Weibo Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular tool for valuing companies that are solidly profitable, as it allows investors to compare a company’s share price relative to its earnings per share. It works best for firms like Weibo that consistently generate positive earnings, providing an intuitive way to gauge what investors are willing to pay for each dollar of profit.

What constitutes a “normal” or “fair” PE ratio depends on expectations for future growth and the perceived risks of the business. Companies with strong growth prospects or stable profit margins often trade at higher multiples, while those facing uncertainty or slower growth command lower ratios. Risk factors such as regulatory changes or industry disruption can also suppress valuations.

Currently, Weibo trades at a PE ratio of 5.2x. This compares to the Interactive Media and Services industry average of 19.5x and its peer average of 14.1x. Even with conservative assumptions, this represents a notable discount, but context is crucial.

Simply Wall St’s proprietary “Fair Ratio” provides additional perspective. The Fair Ratio is a tailored benchmark that considers a company’s earnings growth, profit margins, market cap, risk factors, and industry trends to provide a more individualized target multiple. Unlike simple industry or peer comparisons, it adjusts for company-specific strengths or weaknesses.

For Weibo, the Fair Ratio is estimated at 12.6x. Since the current PE of 5.2x is significantly below this benchmark, it suggests that the stock is undervalued from a multiple perspective after factoring in sector and business-specific risks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Weibo Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just a set of numbers; it's your personal story about a company, where you connect your expectations for things like Weibo's revenue growth and profit margins with your fair value estimate, all grounded in your perspective on their business and industry trends.

On Simply Wall St's popular Community page, Narratives let you quickly turn your unique view of Weibo’s future into a tangible forecast, backing your investment decision with both data and reasoning. Narratives make it easy for any investor to see how a company's story, financial assumptions, and fair value connect, and most importantly, how they compare to the current market price to guide your buy or sell decisions.

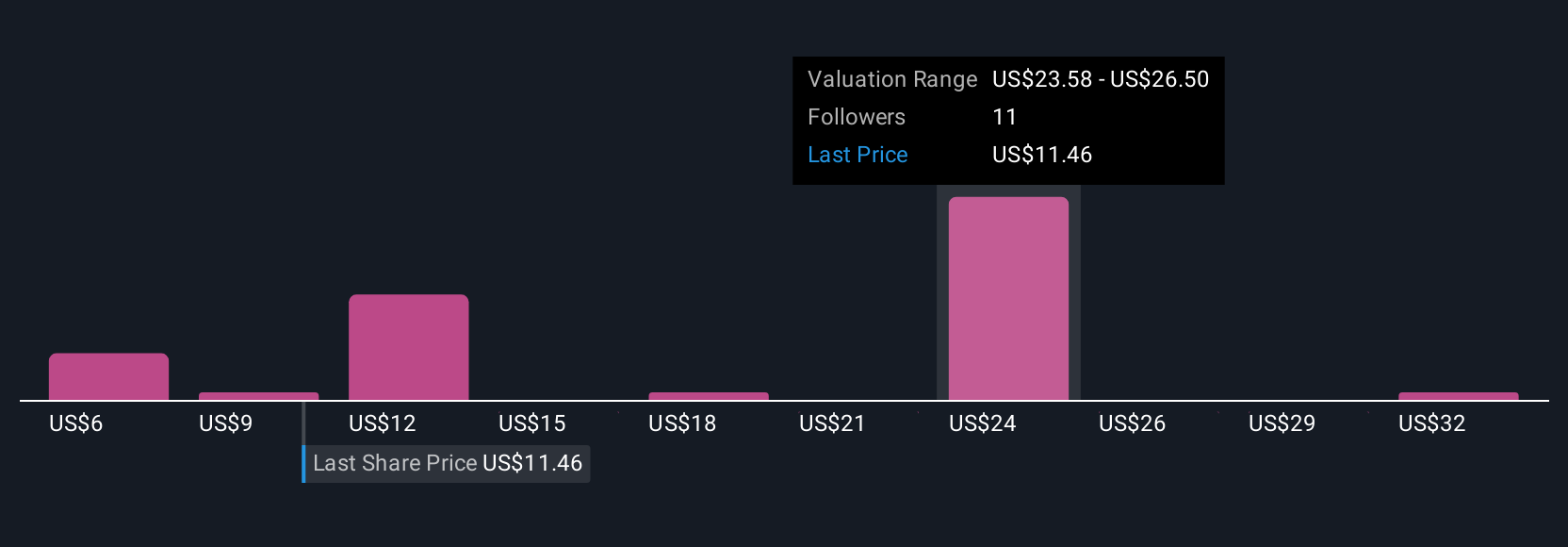

Narratives update automatically with the latest news and earnings, so your outlook is always in sync with new developments. For example, some investors view Weibo’s expanding AI-driven ad business and partnerships as a catalyst for a fair value as high as $18.31 per share, while others see regulatory and competitive risks holding fair value closer to $8.60. All these perspectives are reflected transparently, side by side, so you can decide which story and number best fit your own beliefs.

Do you think there's more to the story for Weibo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com