Why Green Brick Partners (GRBK) Is Up 10.1% After Analysts Lift Earnings Forecasts and Zacks Rank

- Green Brick Partners recently received a Zacks Rank of #2 (Buy) as analysts raised full-year earnings forecasts by 8%, reflecting improved optimism in the company's outlook.

- This positive shift in analyst sentiment aligns with growing confidence in Green Brick Partners' ability to outperform sector trends despite broader construction market challenges.

- Now, let’s explore how these upward earnings estimate revisions could influence Green Brick Partners’ overall investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Green Brick Partners Investment Narrative Recap

To feel comfortable owning Green Brick Partners, investors generally need to believe that the company can maintain strong operational execution, manage rising incentive costs, and leverage Texas and Atlanta market strengths to offset housing affordability and demand risks. The recent uptick in analyst earnings estimates is a positive sentiment shift, but given persistent affordability pressures and a year-over-year dip in quarterly profits, it does not, on its own, significantly change the near-term outlook on profit margin compression or demand moderation risks.

One relevant recent announcement is Green Brick's launch of their first Houston-area community, Riviera Pines, set to open model homes in November 2025. This expansion aligns with a key short-term catalyst: broadening geographic reach and potentially diversifying revenue streams, which may help the company counterbalance slowing backlog growth and localized risks in existing markets.

However, it’s important to weigh this optimism against the potential impact of prolonged margin pressure if affordability issues persist or consumer credit weakens...

Read the full narrative on Green Brick Partners (it's free!)

Green Brick Partners' narrative projects $2.0 billion in revenue and $252.1 million in earnings by 2028. This reflects a -2.1% yearly revenue decline and a $95 million decrease in earnings from the current $347.1 million.

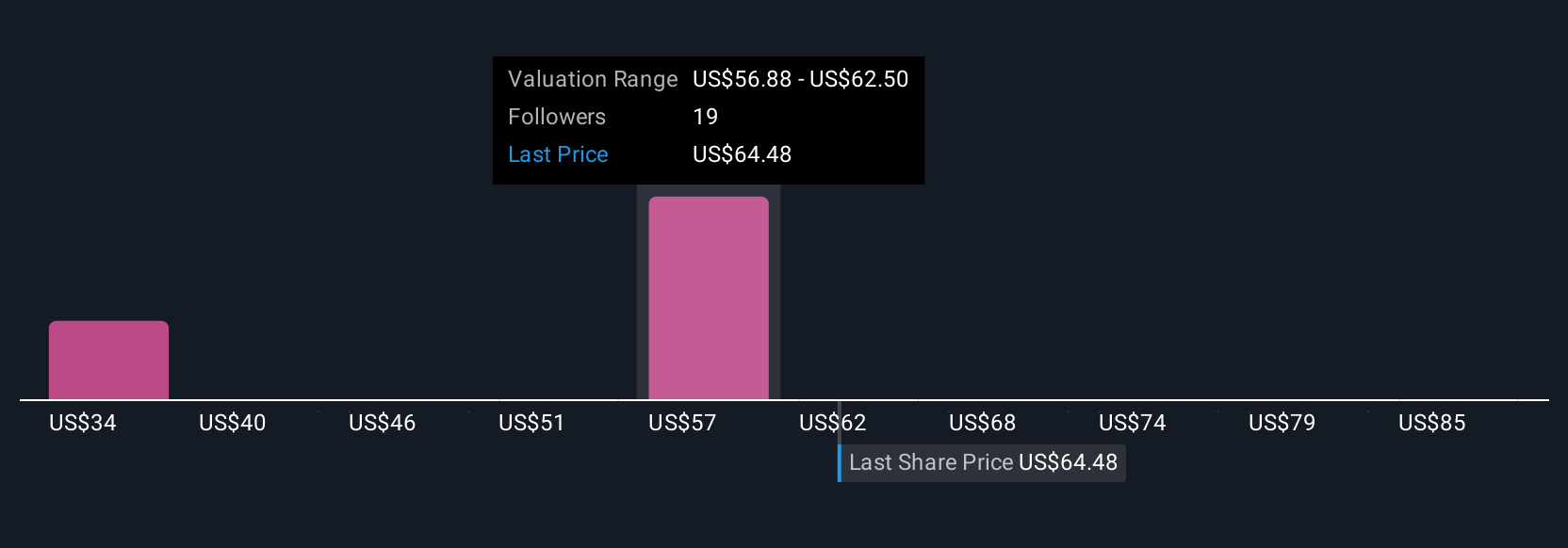

Uncover how Green Brick Partners' forecasts yield a $62.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Seven recent Simply Wall St Community fair value estimates for Green Brick Partners range from US$25.54 to US$90.58 per share, showing wide variation in views. While many see opportunity, uncertainty around homebuilding margins and affordability trends prompts investors to compare diverse expectations for the company's future.

Explore 7 other fair value estimates on Green Brick Partners - why the stock might be worth as much as 33% more than the current price!

Build Your Own Green Brick Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Green Brick Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Green Brick Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Green Brick Partners' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com