A Look at BBB Foods (NYSE:TBBB) Valuation After Strong Revenue Growth and Net Loss in Latest Results

BBB Foods (NYSE:TBBB) has just released its third-quarter earnings, showing strong revenue and same-store sales growth, but reporting a net loss driven by increased share-based compensation expenses. Investors are watching how this mix affects the company’s outlook.

See our latest analysis for BBB Foods.

BBB Foods’ latest results come after a period of strong momentum, with the company’s share price climbing nearly 21% over the past 90 days and delivering a 13.2% total shareholder return over the last year. The robust operational updates and continued sales growth appear to be fueling investor interest, even as the company addresses short-term earnings pressure.

If this kind of momentum has you rethinking your investing approach, consider broadening your search and discover fast growing stocks with high insider ownership

With the stock recently climbing and quarterly results revealing impressive revenue growth, but also a widening net loss, the question for investors is whether BBB Foods is still undervalued or if the market has already priced in its future potential.

Most Popular Narrative: 4.5% Undervalued

Analysts see BBB Foods’ fair value at $33.47, which is just above the last close of $31.95, suggesting a modest upside. To understand this narrative, let’s look at the forces shaping these expectations.

Ongoing aggressive store expansion, particularly into four new regions with adjacent, already familiar markets, is fueling rapid top-line revenue growth and accelerating market penetration. As these new stores mature, operating leverage is expected to improve EBITDA margins and earnings.

There is an ambitious expansion strategy at play and a crucial bet on margins improving as scale kicks in. Ever wondered which blockbuster revenue projections or margin assumptions justify this premium? Unpack the pivotal drivers and financial leaps behind the price tag inside the narrative.

Result: Fair Value of $33.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Overzealous store expansion or heavy geographic concentration in Mexico could pressure margins and expose BBB Foods to unexpected volatility.

Find out about the key risks to this BBB Foods narrative.

Another View: Multiples Tell a Different Story

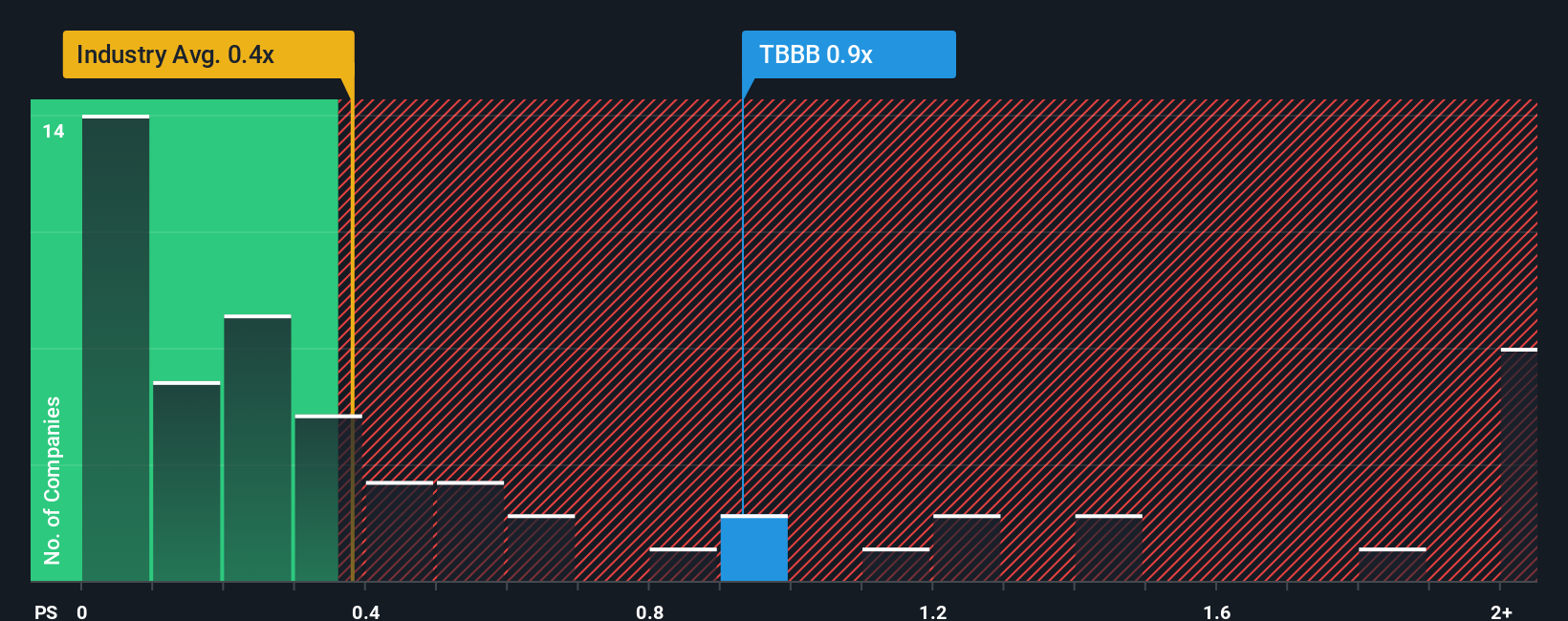

Looking at valuation through market ratios, BBB Foods is trading at a price-to-sales ratio of 0.9x compared to the industry average of 0.4x and a fair ratio of 1.1x. This means the stock is valued higher than most peers, but below what the market could eventually assign. This suggests both risk and potential opportunity.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BBB Foods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BBB Foods Narrative

Of course, if you'd rather dive into the numbers and challenge these assumptions yourself, you can craft your own take in under three minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding BBB Foods.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Make sure you’re ahead of the curve by checking out investments that stand out for their growth, innovation, or steady returns. There is a world of potential waiting beyond BBB Foods.

- Unlock emerging tech gains as you scan these 25 AI penny stocks shaping every facet of our digital future, from automation to intelligent platforms.

- Tap into income stability and let your portfolio benefit from these 15 dividend stocks with yields > 3% offering attractive yields above 3% for reliable returns.

- Catch the wave of market mispricing by sizing up these 932 undervalued stocks based on cash flows positioned to bounce back based on their solid cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com