Can H World Group’s (HTHT) Resilient Earnings Reveal a New Strategic Focus for Investors?

- H World Group Limited recently announced its revenue guidance for the fourth quarter of 2025, projecting quarter-over-quarter growth between 2% and 6%, and also released earnings for the nine months ended September 30, 2025, showing revenue of ¥6.96 billion and net income of ¥1.47 billion.

- An interesting detail is that while sales from continuing operations fell year-over-year, the company still achieved growth in revenue, net income, and basic earnings per share, signaling shifts within its operations.

- We'll explore how H World Group's fourth-quarter revenue outlook and improved earnings results may influence its longer-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

H World Group Investment Narrative Recap

To be a shareholder in H World Group, you need to believe in its potential to expand its hotel network and leverage domestic travel growth despite ongoing RevPAR pressures and a tough macro backdrop. The latest guidance and earnings update do not materially change the short-term catalyst: whether expansion can offset softness in same-store performance; nor the biggest risk, which remains downward pressure on room yields from rising supply and muted consumer demand.

Of recent announcements, management's fourth-quarter revenue guidance of 2%–6% growth stands out. While this suggests solid momentum, it does not fully resolve concerns about the sustainability of growth in an environment where new hotel supply and cautious consumer behavior could weigh on future revenues and margins. Yet, the resilience in overall revenue and earnings gives some reassurance as the group continues to shift toward franchised and manachised operations.

However, against this improving topline, the persistent risk investors should watch is how rising hotel supply and lagging consumer spending…

Read the full narrative on H World Group (it's free!)

H World Group's narrative projects CN¥28.8 billion revenue and CN¥5.9 billion earnings by 2028. This requires 5.9% yearly revenue growth and a CN¥2.1 billion earnings increase from CN¥3.8 billion today.

Uncover how H World Group's forecasts yield a $49.47 fair value, a 6% upside to its current price.

Exploring Other Perspectives

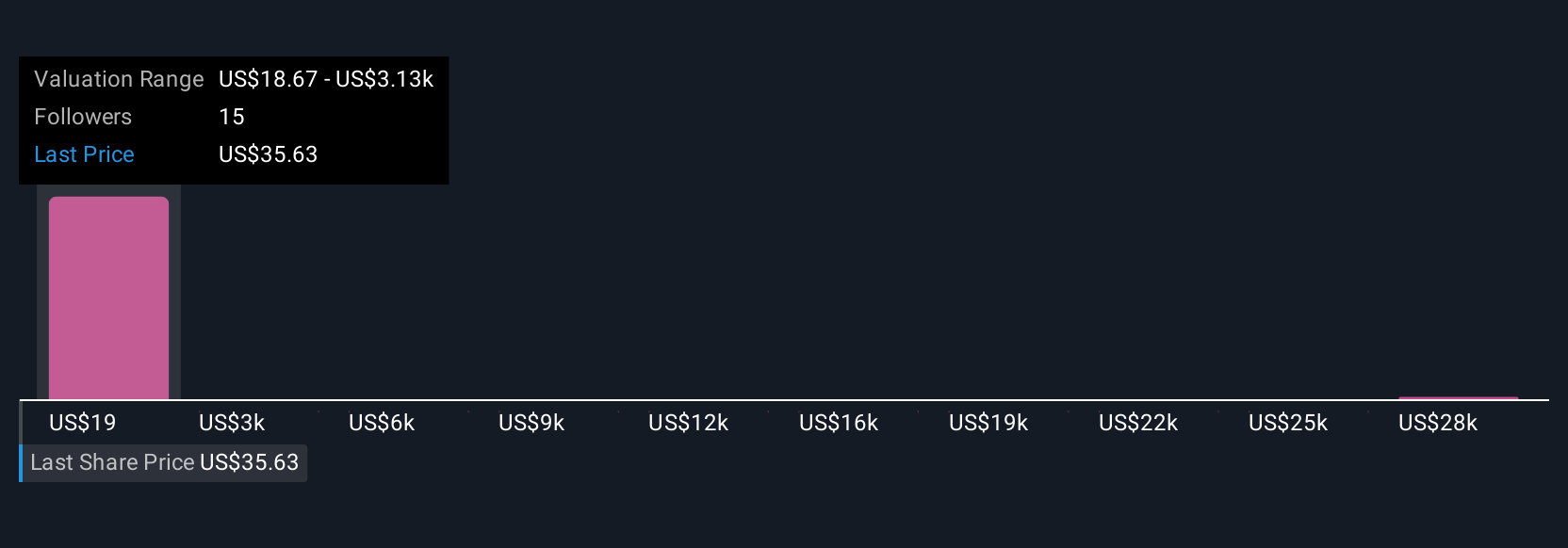

Four fair value estimates from the Simply Wall St Community range from ¥18.67 to ¥31,138.76, reflecting wide divergence. You will want to consider whether ongoing RevPAR pressure could influence profits and challenge even the higher forecasts.

Explore 4 other fair value estimates on H World Group - why the stock might be worth less than half the current price!

Build Your Own H World Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H World Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free H World Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H World Group's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com