Expanded Credit Lines Could Reshape CMS Energy’s (CMS) Ability to Fund Grid and Renewable Investments

- Earlier this month, CMS Energy amended and expanded its revolving credit facilities with a group of leading banks, increasing its CMS Facility to US$750 million and Consumers Energy’s facility to US$1.1 billion, while also adding a new secured US$300 million facility, all with extended maturities and updated terms.

- This rollout of larger, longer-term credit facilities is significant as it enhances CMS Energy’s financial flexibility and working capital options, which can support ongoing operational and investment needs.

- We'll explore how this expanded access to credit may influence CMS Energy's ability to fund its major grid and renewable investments.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

CMS Energy Investment Narrative Recap

To invest in CMS Energy, you need to believe in the long-term increase in electricity demand, driven by large customers and Michigan’s positive regulatory backdrop, as well as the company’s ability to execute its expansive infrastructure plan. The recent credit facility expansions increase CMS’s financial flexibility, which could help fund grid and renewable investments; however, this does not significantly alter the most critical short-term catalyst (advancing major projects) or reduce the key risk of elevated debt and potential pressure on margins.

The November 14 preferred dividend announcement is most relevant here, as it signals stable capital return even as the company takes on new credit lines. While the expanded facilities may help CMS manage its capital expenditure needs in the near term, ongoing dividend commitments remind investors of the balancing act between funding growth and maintaining payout levels.

But on the other hand, investors should be aware that increased reliance on external financing could also lead to...

Read the full narrative on CMS Energy (it's free!)

CMS Energy is projected to achieve $9.2 billion in revenue and $1.4 billion in earnings by 2028. This outlook relies on an annual revenue growth rate of 4.6% and a $0.4 billion increase in earnings from the current $1.0 billion.

Uncover how CMS Energy's forecasts yield a $78.31 fair value, a 4% upside to its current price.

Exploring Other Perspectives

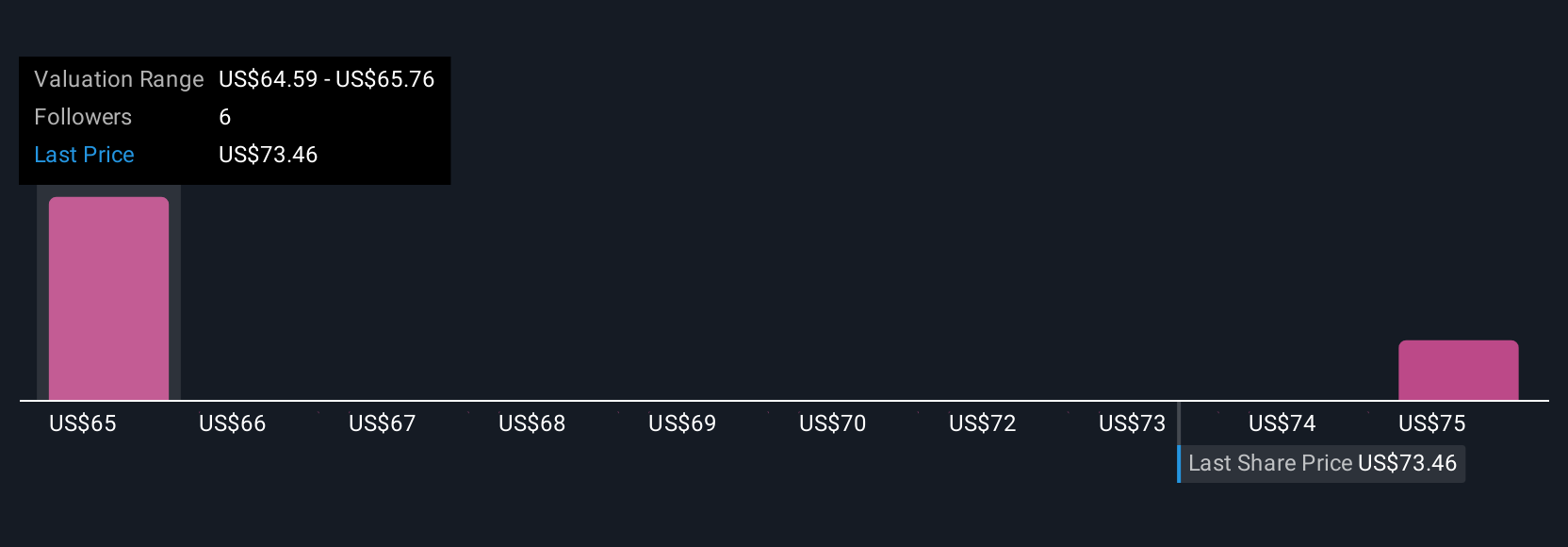

Simply Wall St Community members offer two fair value estimates for CMS, ranging from US$64.40 to US$78.31. Many are watching whether higher external funding will put extra pressure on the company’s net debt and earnings, which could shape future valuations and operating flexibility.

Explore 2 other fair value estimates on CMS Energy - why the stock might be worth as much as $78.31!

Build Your Own CMS Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CMS Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free CMS Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CMS Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com