Ameren (AEE) Valuation: Is There More Upside After Recent Share Price Gains?

Ameren (AEE) has caught the interest of investors following steady gains in recent weeks, as the stock notched a 6% rise over the past month. The company’s performance has many observers considering its long-term value profile.

See our latest analysis for Ameren.

Ameren’s momentum has picked up in recent months, with a 19.14% share price gain year-to-date and a 15.64% total return over the past year. This suggests renewed confidence from investors. This positive trend comes as stable utility demand and a strong earnings track record continue to shape the outlook for the stock.

If you’re interested in what else is drawing investor attention right now, it could be a good time to broaden your perspective and discover fast growing stocks with high insider ownership

The question now is whether Ameren’s recent run-up has left it fully valued, or if the stock’s fundamentals suggest there is still an attractive buying opportunity for investors who anticipate further growth.

Most Popular Narrative: 5.8% Undervalued

Ameren’s last close price is noticeably below the fair value determined by the most widely followed narrative, suggesting the stock may hold some potential upside. This perspective highlights bullish drivers, such as robust infrastructure investment, alongside underlying sector trends, creating a compelling outlook.

Ongoing and future investments in grid modernization and resilience (for example, smart substations, composite poles, automation), as well as clean energy resources like wind, solar, and batteries, are expected to expand Ameren's regulated rate base at a forecasted 9.2% CAGR. This expansion could enable higher allowed returns and improved net margins. Supportive and constructive regulatory relationships, along with approval of new rate structures (such as the proposed large-load rate for data centers), help provide cost-recovery certainty, minimize earnings volatility, and support predictable long-term earnings and dividend growth.

How do large-scale capital deployments, ambitious grid upgrades, and regulatory support come together to shape Ameren’s potential? The most followed narrative takes into account a wave of revenue and margin expectations, based on complex growth forecasts and justified premiums. Want to know what’s really behind that fair value?

Result: Fair Value of $112.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory changes and uncertain data center demand could pose challenges for Ameren’s growth outlook. These factors may potentially impact future earnings and investor sentiment.

Find out about the key risks to this Ameren narrative.

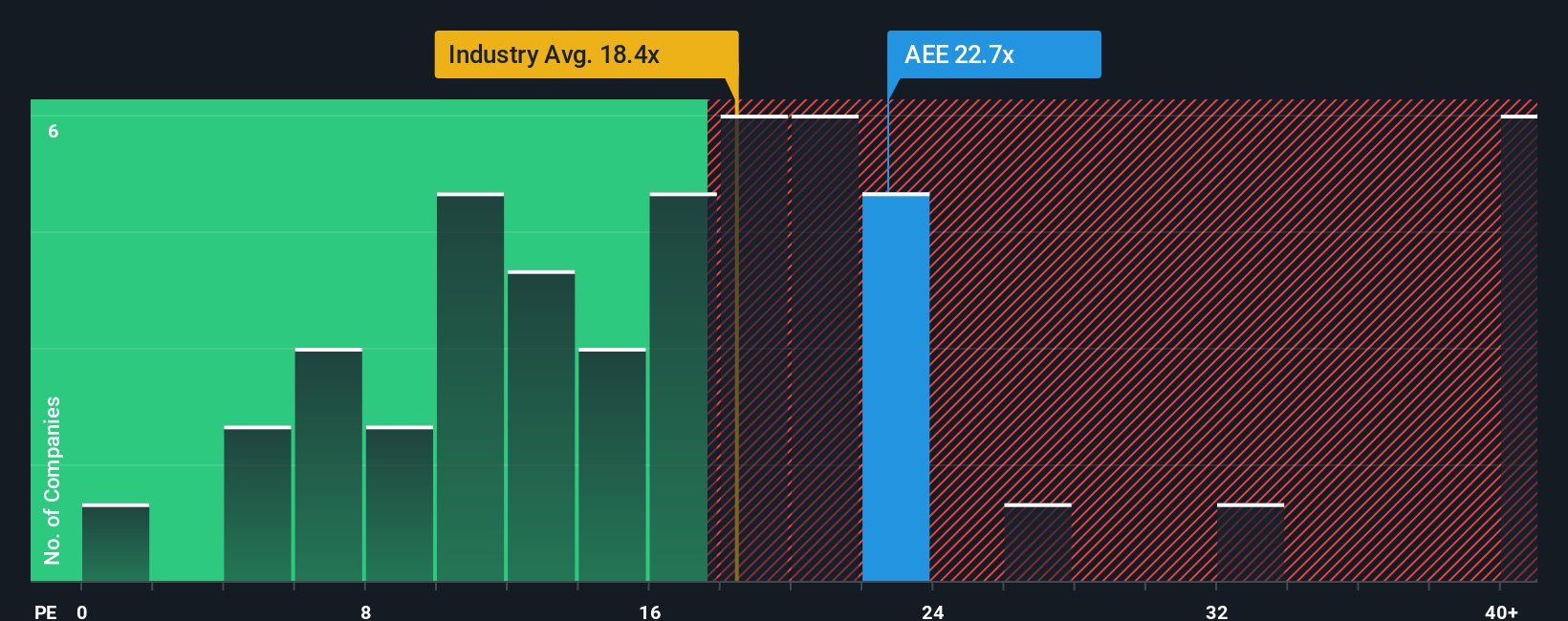

Another View: Price-to-Earnings Tells a Different Story

While some see Ameren as undervalued, its price-to-earnings ratio of 20.3x sits just below the US Integrated Utilities industry average of 20.5x and well below peers at 21.6x. Interestingly, it is also below the market's fair ratio of 20.7x, suggesting reasonable value but little obvious bargain.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameren Narrative

If you have your own interpretation of the numbers or want to dig deeper into Ameren's fundamentals, take a few moments to form your own view. Do it your way.

A great starting point for your Ameren research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let Ameren be your only opportunity. Open the door to new markets and breakthrough sectors with these powerful investing shortcuts from Simply Wall Street.

- Capitalize on underpriced opportunities by jumping straight into these 926 undervalued stocks based on cash flows that top analysts believe offer strong future cash flows.

- Boost your portfolio’s income potential when you check out these 15 dividend stocks with yields > 3% consistently delivering yields above 3%, ideal for steady returns.

- Stay ahead of technological shifts by positioning yourself early in the growth of healthcare innovation with these 30 healthcare AI stocks that are pushing boundaries in medicine and AI.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com