Should You Rethink Knight-Swift After 13% Drop and Industry Freight Demand Challenges?

- Wondering whether Knight-Swift Transportation Holdings is a bargain right now? If you have ever debated whether to buy, hold, or avoid the stock, you are not alone.

- Shares have ticked up 3.7% over the past week and 2.9% in the last month, but they are down 13.1% year-to-date and 21.7% over the past 12 months. This hints at shifting market sentiment and changing risk perceptions.

- Recent headlines have focused on industry-wide freight demand challenges and regulatory shifts. These factors provide important context behind Knight-Swift’s share price swings. The company’s expansion moves and sector consolidation chatter have also kept investors watching for the next catalyst.

- On Simply Wall St’s valuation checks, Knight-Swift scores 0 out of 6 for undervaluation. Here is what that means, how different valuation methods compare, and a smarter way to get the full picture by the end of this article.

Knight-Swift Transportation Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Knight-Swift Transportation Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by extrapolating its future free cash flows and discounting them back to their value in today’s dollars. This approach aims to capture how much cash Knight-Swift Transportation Holdings is expected to generate in the coming years, making adjustments for forecast uncertainty over the long term.

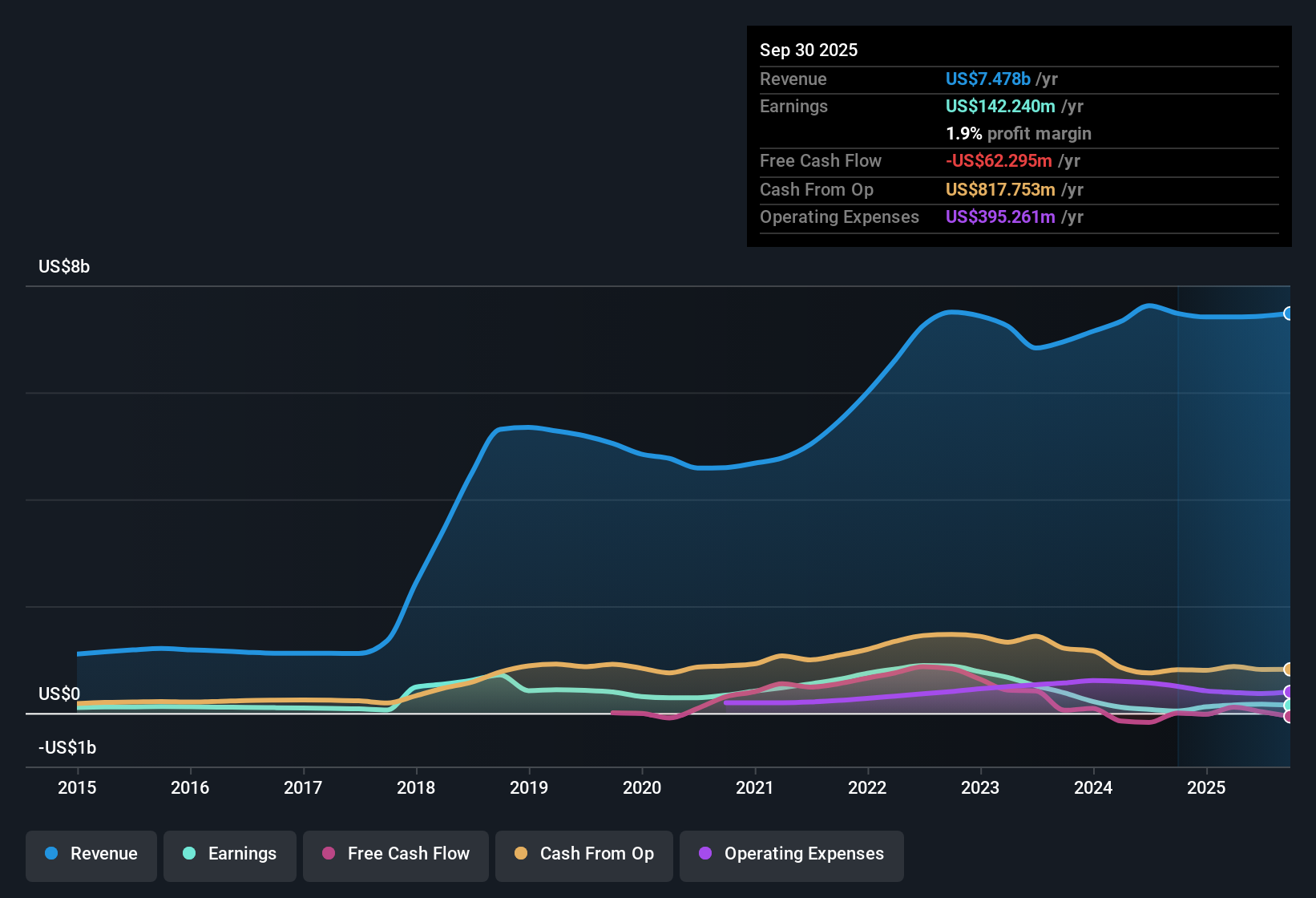

Currently, Knight-Swift’s Free Cash Flow (FCF) stands at -$154.7 million, which reflects industry headwinds weighing on recent performance. Looking ahead, analysts project FCF to recover and reach $493.3 million in 2026, with a gradual decline to $158.2 million by 2035. The estimates through 2027 are from analysts, and projections beyond that rely on Simply Wall St’s extrapolation method. All values are reported in US dollars.

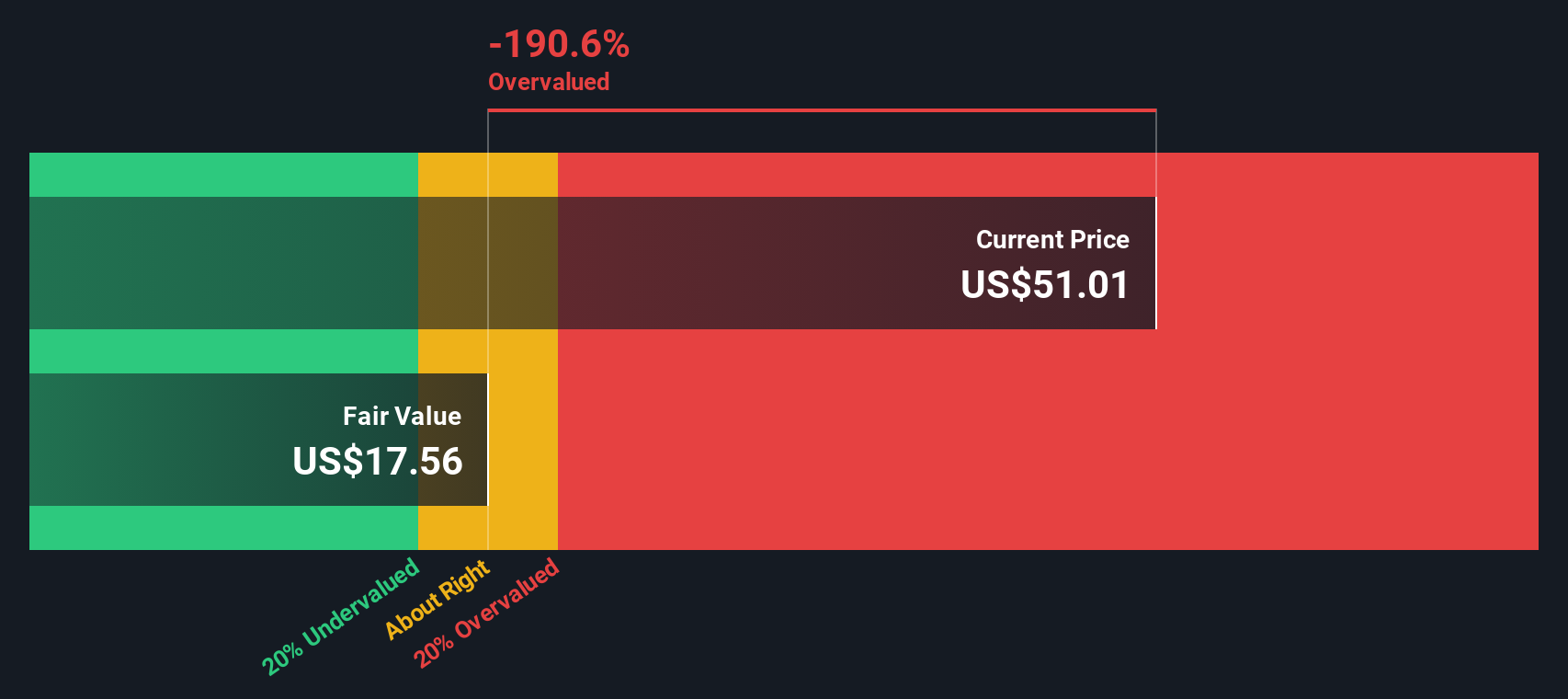

Based on these projections, the DCF model estimates Knight-Swift’s fair value at $17.38 per share. The share price is currently trading well above this level, and the model indicates that the stock is 163.6% overvalued using cash flow fundamentals. Long-term cash flow recovery is reflected in the projections, but the market price assumes much more optimistic growth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Knight-Swift Transportation Holdings may be overvalued by 163.6%. Discover 926 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Knight-Swift Transportation Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation multiple, especially for profitable companies. It measures how much investors are willing to pay for each dollar of a company's earnings, helping to gauge market expectations of growth and risk. In general, higher PE ratios can signal optimism about a company’s future prospects or reflect lower perceived risk. Lower PE ratios often indicate more modest growth expectations or elevated uncertainty.

Knight-Swift Transportation Holdings currently trades at a PE ratio of 52.3x. This is substantially higher than both the Transportation industry’s average of 26.7x and the peer group average of 29.7x. Such a premium suggests the market expects either robust growth or exceptional stability from Knight-Swift compared to its peers.

To refine this comparison, Simply Wall St calculates a “Fair Ratio.” This is a proprietary metric representing the PE multiple you would expect given Knight-Swift’s earnings growth, industry context, profit margin, market cap, and specific risks. Unlike the basic approach of comparing PE ratios with the peer or industry average, the Fair Ratio provides a more comprehensive and tailored benchmark because it incorporates company-specific fundamentals and future prospects.

For Knight-Swift, the Fair Ratio is 24.2x. With the actual PE at 52.3x, the stock is trading far above this balanced benchmark, indicating investors may be overpaying relative to what the company’s fundamentals warrant.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Knight-Swift Transportation Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives.

A Narrative is a simple way for you, the investor, to capture the story you believe about a company, such as Knight-Swift, and link it directly to your financial forecasts and the fair value you estimate. Instead of focusing only on static numbers or ratios, Narratives let you express your own expectations for key drivers like revenue, future earnings, and margins. This approach weaves together the story behind the numbers and helps you shape your investment thesis in a format that is accessible to all types of investors, whether you are new to the markets or a seasoned professional.

Within the Simply Wall St Community page, millions of investors use Narratives to articulate their viewpoints. These Narratives are not just static forecasts. They update automatically when new information such as earnings reports, news, or industry developments emerge, keeping your perspective current. Narratives empower you to make smarter buy, sell, or hold decisions by comparing your fair value with the latest market price, letting you see if Knight-Swift is trading above or below your personal estimate.

For example, one investor expects robust freight recovery and targets a fair value of $68.00, while another, more cautious, sees operational risks limiting upside and values the stock closer to $43.00. Narratives bring these diverse viewpoints together, helping you understand not just what the market price is but also the different rationales behind why it might be justified or not.

Do you think there's more to the story for Knight-Swift Transportation Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com