Pinnacle West Capital (PNW): Is There More Value Left for Investors After Recent Gains?

Pinnacle West Capital (PNW) shares have edged higher over the past week and month, reflecting a modest upward trend amid steady performance. Investors are watching how the Arizona-based utility navigates its regulated electric service business.

See our latest analysis for Pinnacle West Capital.

Over the past year, Pinnacle West Capital’s share price has shown slow but steady progress, capped by a 7.45% gain year-to-date. Its total shareholder return over three and five years remains robust at 32.1% and 37.2% respectively. This momentum suggests investors continue to see long-term value as the company delivers on its regulated utility model and navigates sector challenges.

If you’re looking for the next opportunity, now’s your chance to discover fast growing stocks with high insider ownership.

With shares still trading at a modest discount to analyst targets and the company posting healthy profit and revenue growth, the real question for investors is whether Pinnacle West Capital remains undervalued or if the market has already factored in future gains.

Most Popular Narrative: 5.6% Undervalued

Pinnacle West Capital’s most widely followed valuation places fair value at $95.93 per share, which is about 5.6% above the last close of $90.59. Analysts suggest that current levels leave room for upside, but the gap to target has narrowed, reflecting a tempered optimism among experts tracking the company’s fundamentals.

The company's progress on regulatory modernization, including proposals for formula rate mechanisms and rate design adjustments to ensure large customers pay their full share, is expected to improve cost recovery, reduce regulatory lag, and stabilize net margins as future capital investments come online.

Curious which numbers powered this fair value estimate? The core of this outlook is based on projections for future margins and a premium profit multiple. Explore further to uncover the formula analysts are using to support Pinnacle West Capital’s valuation.

Result: Fair Value of $95.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainties and delays in renewable adoption could constrain Pinnacle West Capital's growth and challenge the current valuation outlook.

Find out about the key risks to this Pinnacle West Capital narrative.

Another View: Fair Value Depends on the Numbers You Trust

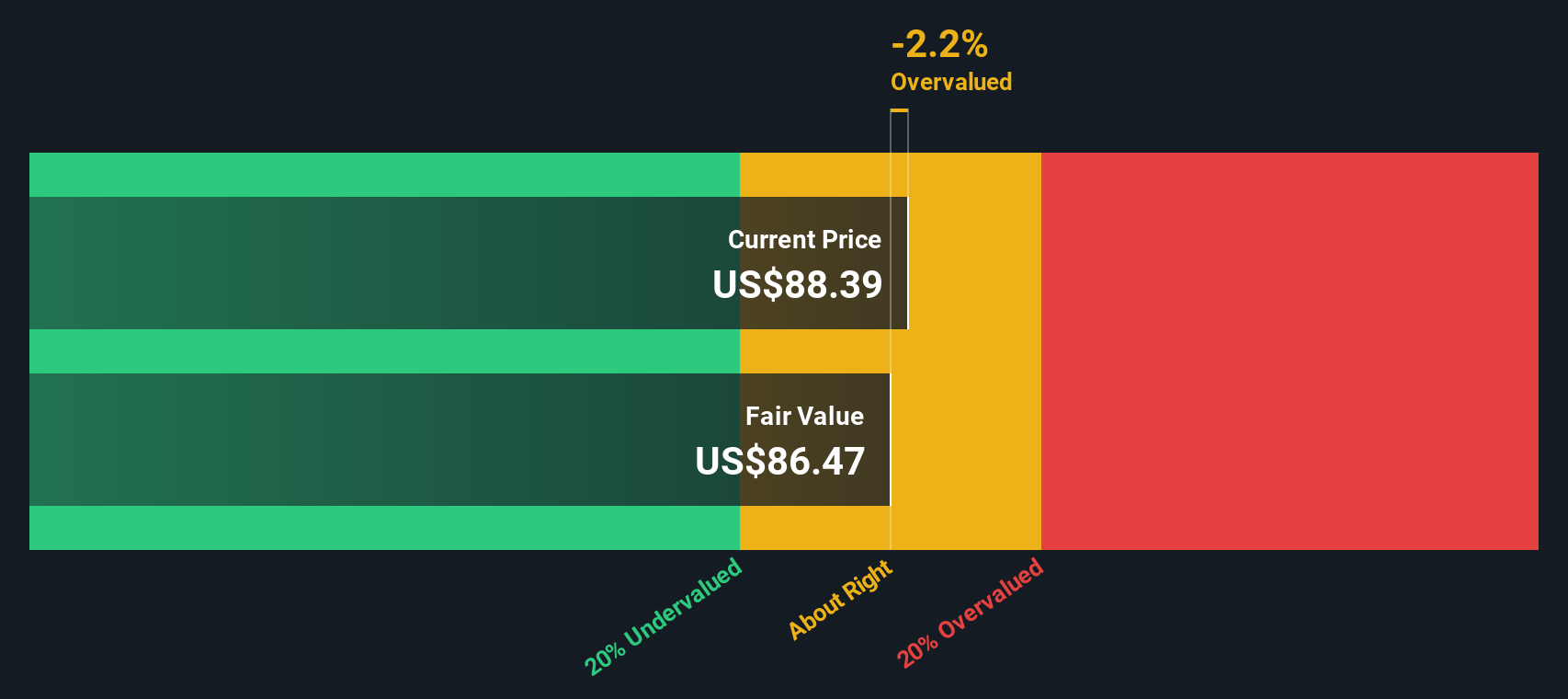

Looking at valuation from a different angle, our DCF model suggests Pinnacle West Capital is trading slightly above its estimated fair value, with shares at $90.59 compared to a DCF-based fair value of $86.32. This contrasts with the higher analyst consensus and raises a critical question: could expectations for future growth be a little too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pinnacle West Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pinnacle West Capital Narrative

Feel free to dig deep into the numbers yourself and shape your own perspective. Building a fresh valuation narrative takes just a few minutes. Do it your way

A great starting point for your Pinnacle West Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t wait on the sidelines. Some of the most promising stocks are getting snapped up by savvy investors right now. Give yourself a real edge with these handpicked ideas:

- Capture future growth by targeting these 25 AI penny stocks at the forefront of the artificial intelligence revolution, driving innovation across sectors you care about most.

- Boost your returns and protect your portfolio by checking out these 15 dividend stocks with yields > 3% with strong, consistent yields above 3 percent, perfect for steady income seekers.

- Capitalize on rapid breakthroughs and market momentum by reviewing these 82 cryptocurrency and blockchain stocks setting the pace in crypto and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com