Is Now the Right Time to Revisit LPL Financial After Its Advisor Network Expansion?

- Curious whether LPL Financial Holdings is still a solid value play, or if its impressive run has left it looking expensive? You are not alone in wondering if now is the right time to take a closer look.

- The stock has continued its steady climb, returning 2.8% in the past week, 2.9% over the last month, and gaining a notable 7.8% since the start of the year.

- In recent news, LPL Financial has been expanding its advisor network and investing in technology solutions, both moves drawing positive attention from the industry. These strategic developments have fueled optimism and likely contributed to the latest uptick in the share price.

- When it comes to valuation, LPL Financial Holdings clocks in at a 2 out of 6 on our value score, suggesting there is more to the story than meets the eye. Let us explore how different valuation approaches stack up. Stay tuned for a perspective that can cut through the noise at the end of this article.

LPL Financial Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: LPL Financial Holdings Excess Returns Analysis

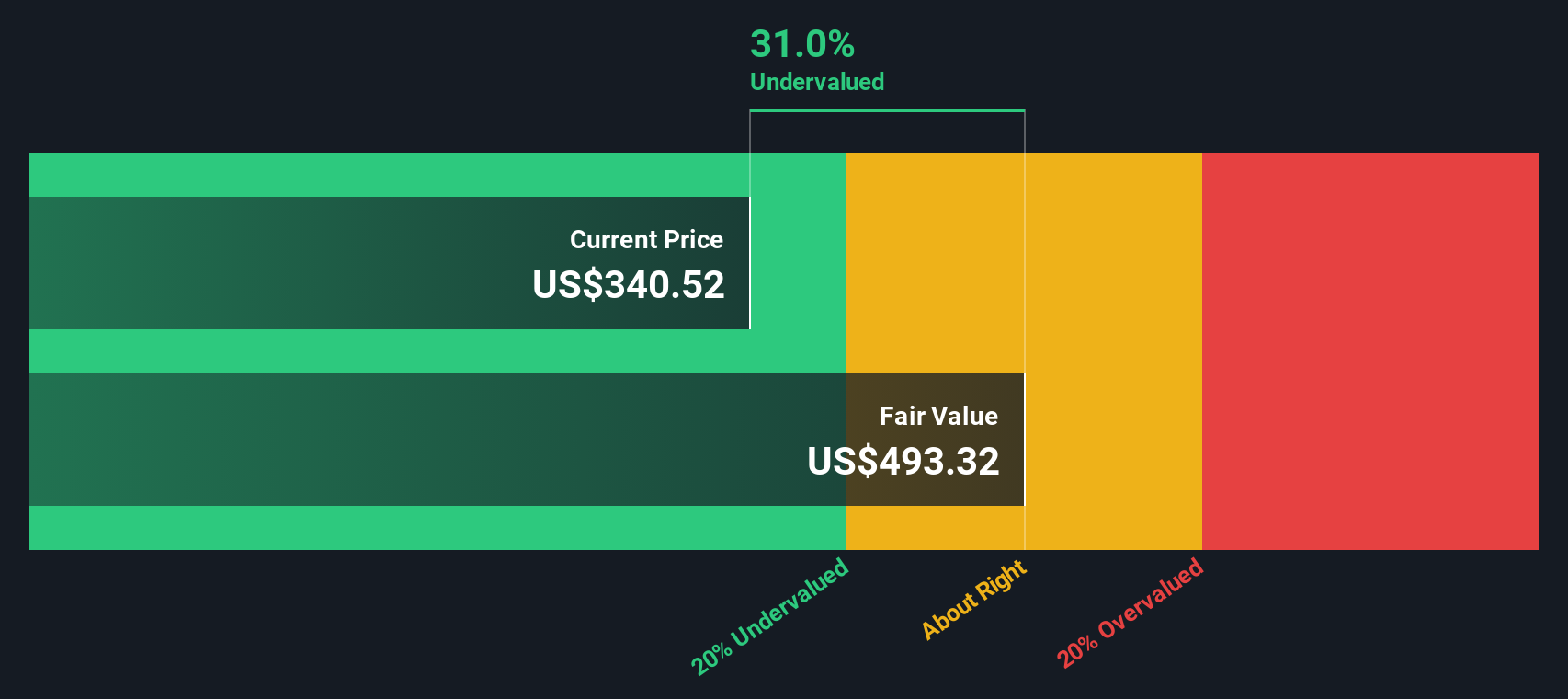

The Excess Returns valuation model provides insight into whether LPL Financial Holdings is generating returns on invested capital above its cost of equity. This method emphasizes how much value a company adds over and above what shareholders would expect for taking on investment risk, focusing on book value, return on equity, and projected growth.

For LPL Financial Holdings, the latest analysis yields the following figures:

- Book Value: $63.01 per share

- Stable EPS: $26.58 per share (based on future Return on Equity estimates from four analysts)

- Cost of Equity: $9.13 per share

- Excess Return: $17.44 per share

- Average Return on Equity: 28.49%

- Stable Book Value: $93.28 per share (from three analysts' projections)

Given these inputs, the Excess Returns model estimates that LPL Financial Holdings is trading at roughly a 1.8% discount to its intrinsic value. This narrow margin suggests the stock is neither notably undervalued nor overvalued relative to its fundamentals.

Result: ABOUT RIGHT

LPL Financial Holdings is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

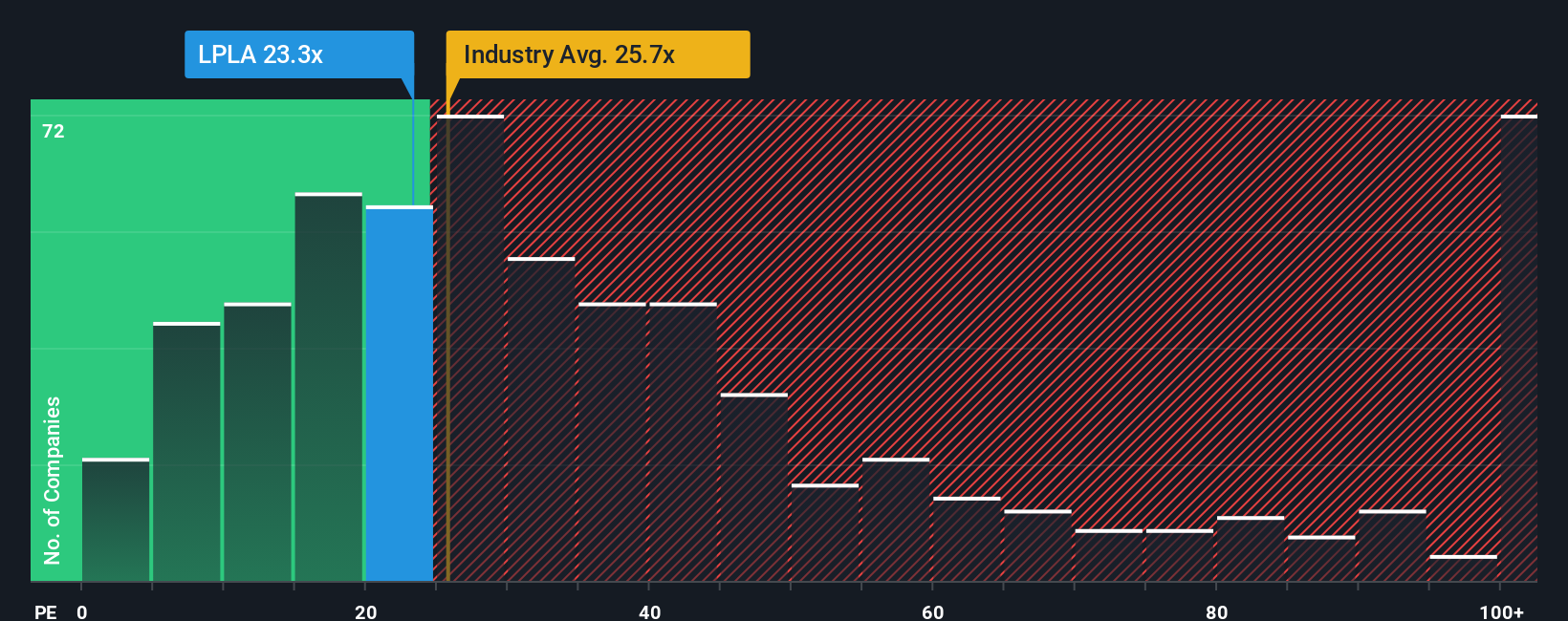

Approach 2: LPL Financial Holdings Price vs Earnings

The price-to-earnings (PE) ratio is widely regarded as the most relevant valuation metric for profitable companies like LPL Financial Holdings. It captures how much investors are currently willing to pay for each dollar of earnings, providing a straightforward way to compare valuation across both peers and the broader industry.

Growth expectations and risk play important roles in determining what a "normal" or "fair" PE ratio should be. Companies expected to deliver strong future earnings growth or that operate with lower risk typically justify higher PE multiples, while slower-growing or riskier companies command lower ones.

LPL Financial Holdings currently trades on a PE ratio of 34x, notably above the Capital Markets industry average of 23.6x as well as the peer group average of 21.3x. At a glance, this might suggest the stock is expensive compared to its competitors. However, relying solely on industry and peer comparisons can be misleading because they do not fully account for LPL’s unique growth outlook or risk profile.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. The Fair Ratio for LPL Financial Holdings is estimated at 21.5x, reflecting a balanced perspective that incorporates the company’s projected earnings growth, profit margins, risks, and its position within the industry. Because this approach accounts for more context than simple peer or industry averages, it offers a more refined benchmark.

Comparing LPL’s current PE ratio of 34x to its Fair Ratio of 21.5x suggests the shares are trading above what would be considered reasonable based on the company’s fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

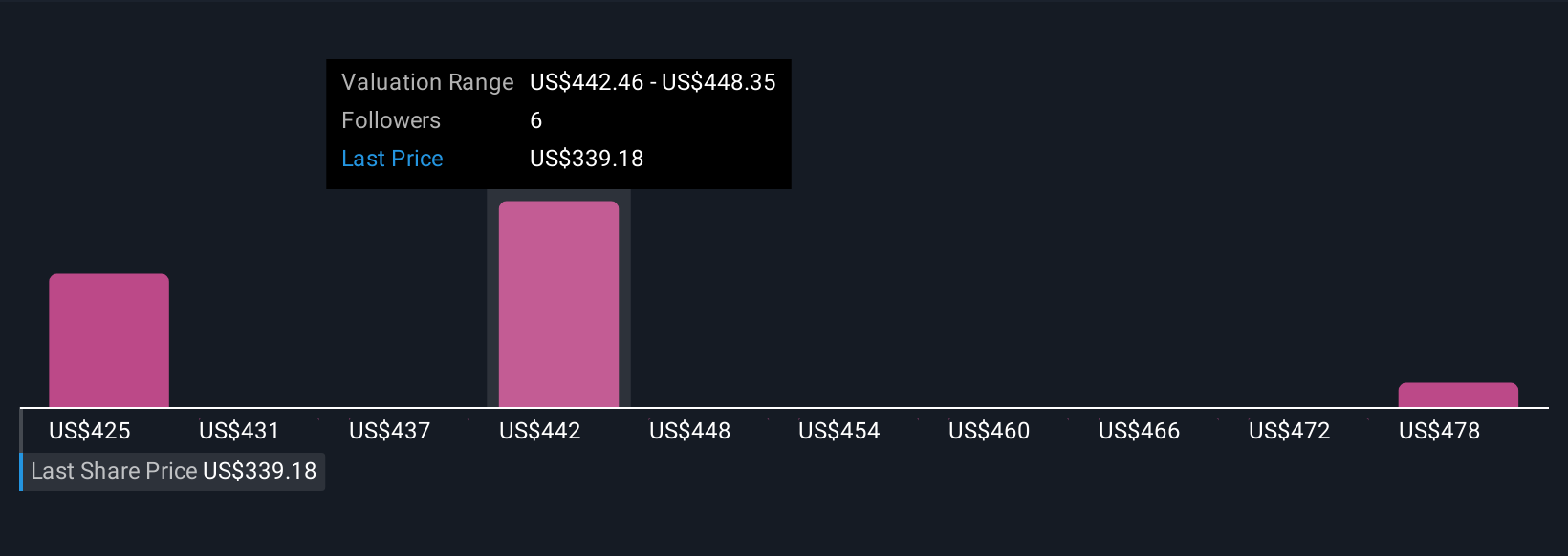

Upgrade Your Decision Making: Choose your LPL Financial Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story for a company— it connects your outlook for future revenue, earnings, and margins to a financial forecast and finally to a fair value. Rather than just focusing on numbers, Narratives allow you to add your perspective, whether optimistic or cautious, behind those forecasts. On Simply Wall St’s Community page, millions of investors use Narratives as a straightforward, accessible tool to record their investment case and see how their view stacks up against others.

What makes Narratives truly powerful is that they dynamically update with new information— like earnings, news, or company announcements— so your valuation always reflects the latest reality. Narratives also make it easier to decide when to buy or sell; by comparing your Fair Value with the current price, you can act with more confidence based on your own story, not just the crowd.

For example, when it comes to LPL Financial Holdings, one investor’s Narrative might expect rapid advisor recruitment, robust technology advances, and margin expansion, supporting a high fair value, while another may be cautious, seeing risks in interest rate swings or fee compression, and lands on a lower fair valuation. Narratives help you factor in both sides and make smarter, more personalized decisions.

Do you think there's more to the story for LPL Financial Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com