Is NiSource (NI) Still Undervalued? A Fresh Look at the Utility’s Recent Performance and Valuation

See our latest analysis for NiSource.

With NiSource’s share price now at $43.76, the company has built steady positive momentum this year, posting a year-to-date price return over 20% as investor sentiment improves. Recent price movement reflects growing optimism about long-term value, supported by an impressive 18% total shareholder return over the past year and gains topping 75% across three years. This indicates that confidence in NiSource’s growth story has been building.

If you’re curious to see which other companies are demonstrating strong momentum, it’s a great time to broaden your investing search and discover fast growing stocks with high insider ownership

But with shares closing in on analyst targets and strong recent gains, the big question now is whether NiSource is still undervalued or if the market is already pricing in its future growth potential.

Most Popular Narrative: 4.5% Undervalued

NiSource's most followed narrative puts its fair value at $45.80, which comes in above the recent close of $43.76, hinting at a potential upside. This suggests analysts collectively still see room for growth after recent share gains.

Strong visibility into multi-year, rate-based capital expenditure ($19.4B base plan, plus $2B+ in upside and incremental projects) positions NiSource for 6 to 8% annual EPS growth and compound growth in regulated revenue. NiSource's proactive engagement with economic development (particularly data centers) and decarbonization investments is expanding its addressable market and enabling greater long-term reinvestment, further supporting durable top-line and EPS growth.

Want to see what really drives the price target? The heart of this narrative is how major investments, earnings growth, and a rising profit multiple set the stage for valuations usually reserved for sector leaders. What assumptions are hiding under the hood? The numbers behind the story might surprise you.

Result: Fair Value of $45.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing regulatory approvals or a faster shift to electrification and decarbonization could limit NiSource’s earnings growth and challenge this optimistic outlook.

Find out about the key risks to this NiSource narrative.

Another View: What Do Earnings Multiples Say?

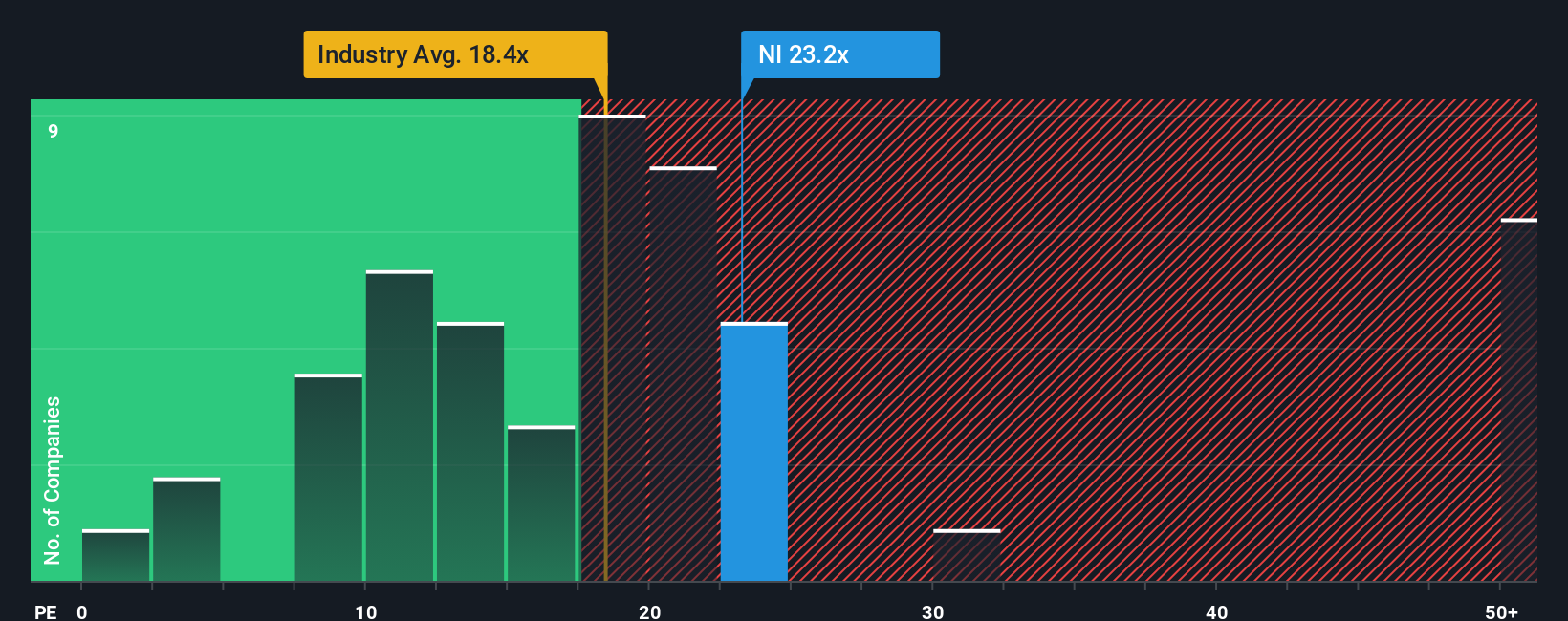

While narratives and analyst targets point to upside, the company’s price-to-earnings ratio of 23.4x actually runs higher than the global industry average of 18.6x and above the estimated fair ratio of 21.1x. This suggests investors may be paying a premium, which could indicate that expectations are running ahead of value.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NiSource Narrative

If you see things differently or want to dig into the numbers on your own, you can easily craft a personalized view in just a few minutes. Do it your way

A great starting point for your NiSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your portfolio to just one opportunity when there are smarter choices within reach. Act now and tap into the power of unique stock groups fueling breakthrough trends and long-term potential.

- Accelerate your growth strategy and tap into breakout momentum with these 3577 penny stocks with strong financials, which are ready to shake up the market this year.

- Unlock reliable income opportunities by checking out these 15 dividend stocks with yields > 3% offering yields above 3% for steady cash flow.

- Take advantage of technological advancement by evaluating these 25 AI penny stocks making waves in artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com