Did Analyst Support and Strong Q3 Results Just Shift Capital One Financial’s (COF) Investment Narrative?

- Capital One Financial recently delivered Q3 results that exceeded analyst expectations for both revenue and earnings per share, bolstered by persistent support from major analysts like UBS and BTIG following its acquisition of Discover Financial Services.

- Despite operational outperformance and strong analyst confidence, some concerns remain surrounding the company’s future cash flow growth and the challenges involved in integrating Discover’s business.

- We’ll now explore how analyst endorsement and strong quarterly results influence the long-term investment case for Capital One Financial.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Capital One Financial Investment Narrative Recap

To be a shareholder in Capital One Financial, you need to believe in the company’s ability to generate long-term value from its acquisition of Discover, execute on its proprietary payments network strategy, and capture greater share of the electronic payments market. While the latest Q3 results strongly outperformed expectations, the most important short-term catalyst, the company’s integration success with Discover, remains relatively unaffected by the positive earnings surprise. The biggest risk right now continues to be the cost and execution burden of combining the two businesses, especially as integration expenses rise.

Among recent announcements, the declaration of a quarterly dividend increase stands out, reinforcing management’s commitment to returning capital to shareholders even amid a major business transformation. This move, coupled with the upcoming dividend payable on December 1, offers a signal of confidence in underlying cash generation despite ongoing merger-related uncertainties, and may be seen as supportive to investor sentiment in the context of the current catalysts.

However, investors should also be aware that, despite strong revenues and positive analyst sentiment, significant execution risk remains if network and integration initiatives...

Read the full narrative on Capital One Financial (it's free!)

Capital One Financial's narrative projects $66.2 billion in revenue and $16.9 billion in earnings by 2028. This requires 32.7% yearly revenue growth and a $12.3 billion earnings increase from $4.6 billion today.

Uncover how Capital One Financial's forecasts yield a $260.24 fair value, a 20% upside to its current price.

Exploring Other Perspectives

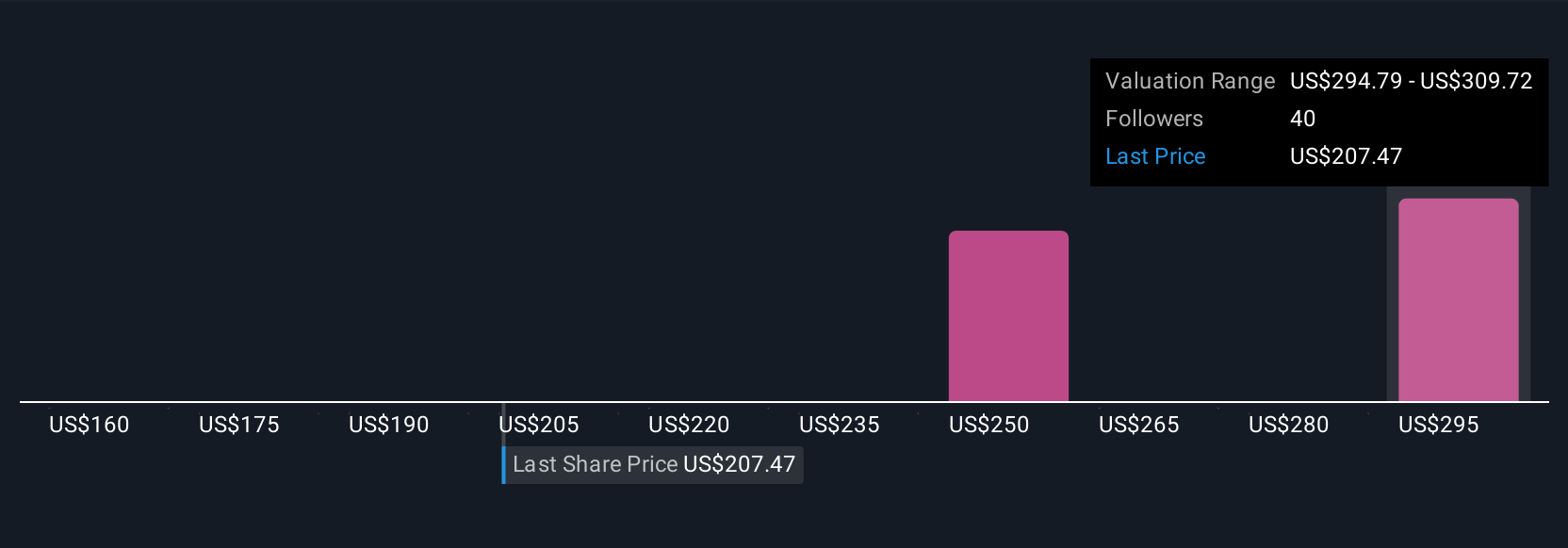

Five private investors in the Simply Wall St Community placed fair value estimates between US$160 and US$294 per share, highlighting wide variance in outlooks. As market participants assess potential integration risks and execution costs following the Discover acquisition, it pays to explore these diverse perspectives for Capital One’s future performance.

Explore 5 other fair value estimates on Capital One Financial - why the stock might be worth 26% less than the current price!

Build Your Own Capital One Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Capital One Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital One Financial's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com