Should You Reconsider AMETEK After New Acquisitions and an 11% Rally in 2025?

- Curious about whether AMETEK is truly worth its current price? You are not alone, and a surprisingly low valuation score might just catch your attention.

- AMETEK’s stock has climbed 7.4% over the past month and is up 11.0% year-to-date. This movement suggests that investors may be growing more optimistic, or perhaps simply less risk-averse about its prospects.

- The recent price moves come in the wake of news highlighting ongoing expansion efforts and strategic acquisitions. These developments may be influencing both investor sentiment and growth expectations. For example, recent announcements around product innovations and entry into new markets have kept AMETEK in the spotlight.

- Despite the momentum, AMETEK scores a 1 out of 6 on our valuation checklist, meaning it appears undervalued on just one key metric. As we review the details of each valuation approach, stay tuned for a more comprehensive way to assess AMETEK’s worth at the end of the article.

AMETEK scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AMETEK Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates all of a company’s future cash flows and then discounts them back to today’s value. These projections are used to determine what the company might be worth in the current market.

For AMETEK, the current Free Cash Flow (FCF) is $1.63 Billion. Analyst estimates expect this to grow steadily over the next decade, reaching about $2.84 Billion by 2035. In the early years, these annual projections are supported by analyst models. Projections beyond 2027 are calculated based on moderate, declining growth assumptions.

Using these inputs, the DCF model provides an intrinsic fair value of $152.22 per share for AMETEK stock. However, when compared to the current trading price, this valuation suggests the stock is about 30% overvalued. It is important for investors to note that while future growth is anticipated, the stock price appears to have outpaced conservative cash flow expectations.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AMETEK may be overvalued by 30.0%. Discover 922 undervalued stocks or create your own screener to find better value opportunities.

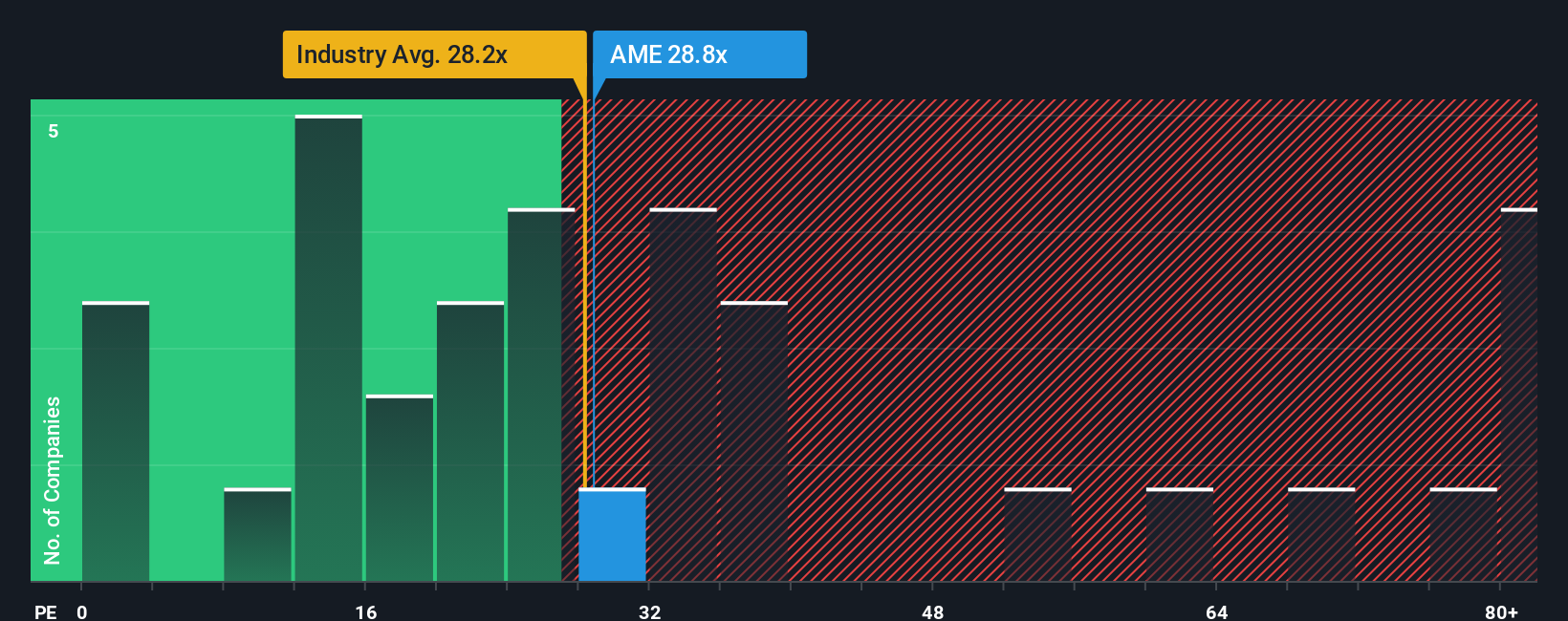

Approach 2: AMETEK Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored way to value profitable companies, as it ties a company’s market price directly to its reported earnings. This helps investors judge how much they are paying for each dollar of profit, making the PE ratio especially relevant for established firms with stable profitability, like AMETEK.

It is important to note that a company’s “normal” or “fair” PE ratio depends on factors such as expected earnings growth, risk profile, and market sentiment. Companies anticipating strong growth or offering lower risk often command higher PE multiples, while those facing uncertainty or slower growth tend to be valued lower.

Currently, AMETEK trades at a PE ratio of 31x. This compares closely with the Electrical industry average of 31x and is well below the peer group average of 44x. While these benchmarks provide some context, they do not account for unique company-specific factors.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. For AMETEK, the Fair Ratio is 25x, which reflects a combination of its earnings growth prospects, sector, profit margin, market cap, and risk factors. Unlike basic industry or peer comparisons, the Fair Ratio gives investors a more tailored measurement of what the stock is worth based on a holistic analysis of its fundamentals.

Comparing AMETEK’s current PE of 31x to its Fair Ratio of 25x suggests the stock is trading above what its fundamentals justify, even if it seems reasonable compared to peers. This indicates that AMETEK may be somewhat overvalued from the perspective of this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AMETEK Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about what you believe a company will achieve, combining your outlook on future revenues, profit margins, and what you think its fair value should be. Instead of just relying on ratios or analyst targets, Narratives help you make investment decisions by connecting the company’s business story directly to a financial forecast and resulting fair value. This approach can make the evaluation process more intuitive and personal.

On Simply Wall St’s Community page, millions of investors use Narratives to test their assumptions and share perspectives on when AMETEK might be attractive to buy or sell, based on how their Fair Value compares to the stock’s current price. Narratives are dynamic, so whenever new news or earnings results are released, your story and its fair value update automatically. This helps keep your decision-making current and relevant.

For example, some investors see AMETEK rapidly expanding in automation and sustainability, which could justify a fair value as high as $225 if profit margins expand and growth accelerates. On the other hand, those who are more cautious about continued margin risk point to a value closer to $168, citing concerns about weak end markets or digital competition. Narratives let you easily compare your viewpoint to others, ensuring your investment decisions reflect both the numbers and your perspectives about AMETEK’s future.

Do you think there's more to the story for AMETEK? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com