OGE Energy (OGE): How Does the Follow-On Equity Offering Impact Its Valuation?

OGE Energy recently completed a follow-on equity offering, raising $172.5 million by issuing over 4 million new shares of common stock. Moves like this often attract careful investor attention, particularly regarding dilution and future growth plans.

See our latest analysis for OGE Energy.

The fresh capital raise comes as OGE Energy’s share price continues its steady climb, now at $45.78, with a 10.87% year-to-date share price return. Momentum has been building, and the stock’s 8.25% total return over the past year and 74% total return over five years point to sustained long-term value creation, even as new equity offerings reshape the landscape.

If you’re looking to uncover other compelling opportunities, this could be the ideal moment to broaden your search and discover fast growing stocks with high insider ownership

The real question now is whether OGE Energy’s fundamentals and recent growth are fully reflected at current prices, or if this pullback presents a potential entry point for investors seeking more upside.

Most Popular Narrative: 2.9% Undervalued

Conventional wisdom suggests OGE Energy’s latest close of $45.78 sits just below the narrative’s fair value estimate of $47.15. Market watchers are tuned in, with the gap reflecting how current assumptions hold up under fresh scrutiny.

The analysts have a consensus price target of $45.938 for OGE Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $52.0, and the most bearish reporting a price target of just $40.0.

Want to see what’s driving this barely-there undervaluation? The narrative is built on a surprising combination of margin expansion, measured top-line growth, and a premium future earnings multiple. Can you guess the real assumptions hidden beneath that headline number? Click through to unpack the full story and spot what just might rock the fair value target.

Result: Fair Value of $47.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty in industrial demand and the region’s economic outlook could dampen projections and lead to closer scrutiny of OGE’s long-term narrative.

Find out about the key risks to this OGE Energy narrative.

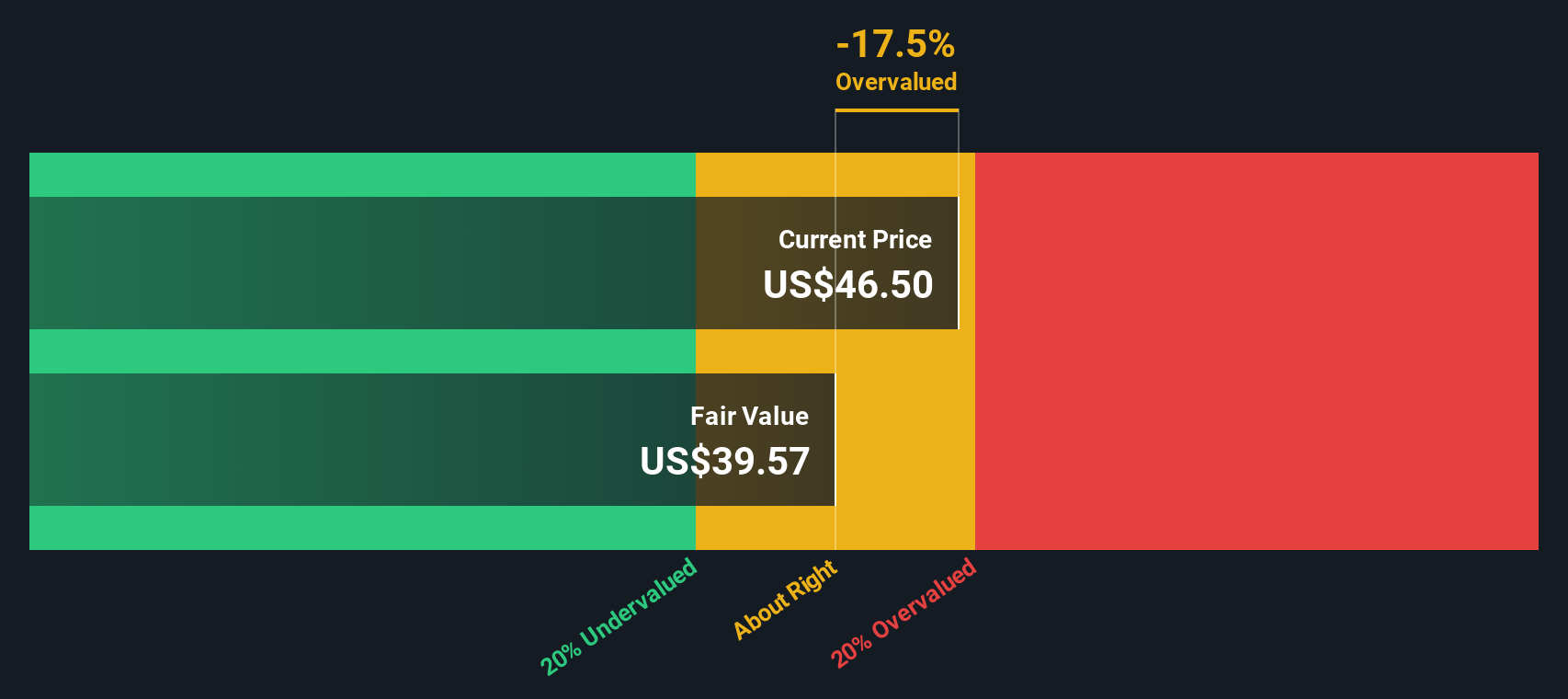

Another View: Discounted Cash Flow Analysis

Our SWS DCF model offers a different perspective, estimating OGE Energy's fair value at $37.51 per share. This is about 18% below its current price, indicating that the stock may be slightly overvalued when long-term cash flows are taken into account. Should investors emphasize future earnings, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OGE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OGE Energy Narrative

If the consensus doesn’t align with your view, or you’d like to dig deeper into the numbers, you can easily build your own perspective in just a few minutes. Do it your way

A great starting point for your OGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Broaden your horizons with high-potential stocks you might otherwise overlook. There is an opportunity waiting for you outside the familiar names. Don’t let these market movers pass you by; take control and put your watchlist to work with just a few clicks.

- Capitalize on the rise of artificial intelligence by tapping into these 25 AI penny stocks poised for significant breakthroughs.

- Secure your portfolio with steady income by evaluating these 15 dividend stocks with yields > 3% featuring reliable yields above 3%.

- Get ahead of the crowd and gain exposure to disruptive financial technology trends by tracking these 81 cryptocurrency and blockchain stocks making waves with real-world blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com