The Bull Case For Assurant (AIZ) Could Change Following Q3 Earnings Far Above Expectations—Learn Why

- In the third quarter of 2025, Assurant reported disciplined execution with 8.9% year-over-year topline growth and a 91% increase in adjusted EPS, surpassing analyst expectations.

- This strong quarterly result was driven by growth in premiums earned, net investment income, and fees, and has reinforced a mostly positive analyst outlook for continued earnings growth into 2025.

- We'll now explore how Assurant's significant outperformance in adjusted EPS impacts the company's longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Assurant Investment Narrative Recap

To be a shareholder in Assurant, you would need to believe in its ability to sustain premium growth and margin expansion amid evolving technology and insurance trends. The robust Q3 earnings beat reinforced the company's momentum, but did not fundamentally alter the key short-term catalyst: recurring device protection growth, nor the continuing risk of regulatory scrutiny and fee compression in lender-placed insurance, both of which remain pivotal factors for near-term performance.

Among recent announcements, Assurant’s November 2025 dividend increase stands out, aligning with the company’s stronger earnings and solid cash generation in Q3. This increases the appeal of Assurant for investors focused on reliable income streams, while linking back to the catalysts of higher recurring revenues and growing premium volumes that underpin dividend capacity.

Yet, contrasting the strong financials, investors should not overlook the heightened regulatory risks still facing the Global Housing segment if ...

Read the full narrative on Assurant (it's free!)

Assurant's outlook anticipates $14.2 billion in revenue and $1.2 billion in earnings by 2028. This scenario is based on a 4.9% annual revenue growth rate and a $483 million increase in earnings from the current $717.0 million.

Uncover how Assurant's forecasts yield a $253.67 fair value, a 11% upside to its current price.

Exploring Other Perspectives

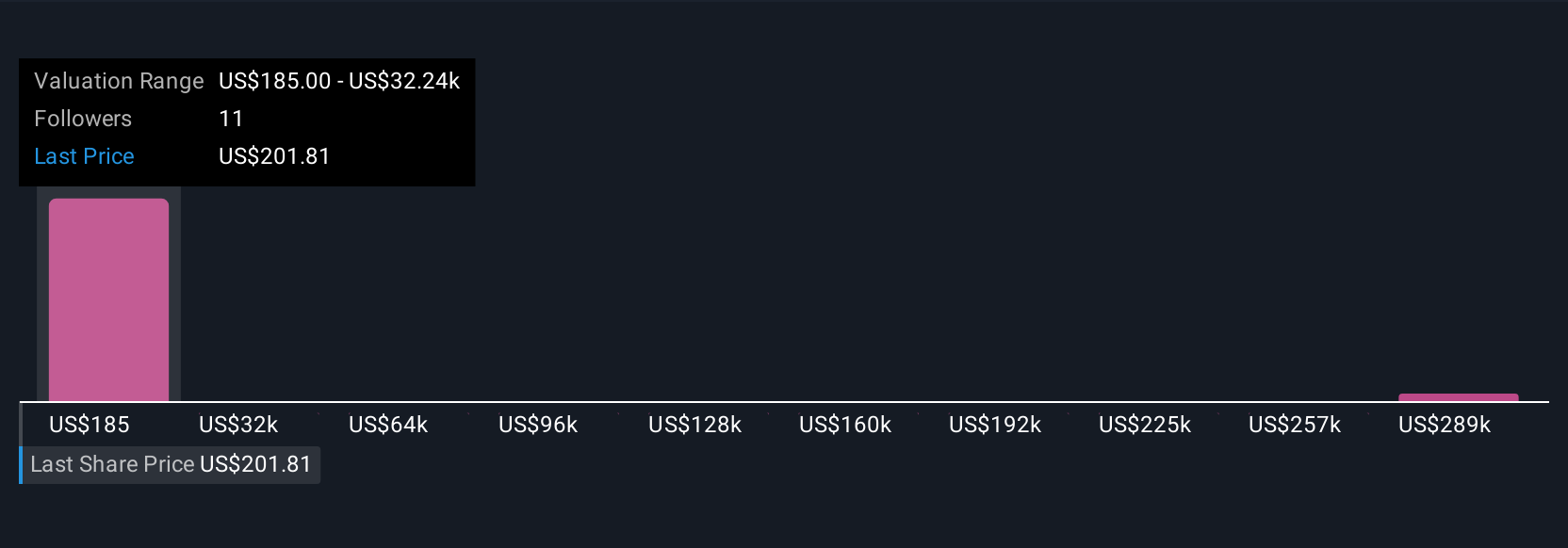

Four individual Simply Wall St Community fair value estimates for Assurant range widely from US$185 to US$320,700.23 per share. Amid this diversity, the ongoing risk of increased regulatory scrutiny in lender-placed insurance could directly affect margins, underscoring why many perspectives can shape your view of the company’s performance.

Explore 4 other fair value estimates on Assurant - why the stock might be worth 19% less than the current price!

Build Your Own Assurant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Assurant research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Assurant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Assurant's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com