Jabil (JBL) Is Up 7.1% After Analyst Upgrades Fuel Optimism for Earnings and Revenue Growth

- In the past week, Jabil’s shares moved ahead of the broader market following analyst forecasts of an earnings per share of $2.70 and revenue growth of 14.6% for the upcoming quarter.

- Analyst estimate revisions and expectations of higher profits and sales have contributed to growing optimism surrounding Jabil’s near-term business outlook.

- We’ll now assess how analyst optimism and expectations of stronger results may influence Jabil’s investment narrative moving forward.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Jabil Investment Narrative Recap

For Jabil, being a shareholder often means believing in the company's ability to capture growth from high-demand sectors such as AI infrastructure, product innovation, and global expansion, despite facing cyclical headwinds in segments like renewables and consumer electronics. The recent analyst-driven optimism, reflected in raised EPS and revenue forecasts, may support short-term momentum, but the uneven demand in regulated industries remains the main risk and hasn’t materially shifted due to this news.

Among Jabil’s recent announcements, the expanded partnership with Inno to produce battery energy storage enclosures stands out, as it could help counterbalance softness in the regulated industries segment by boosting exposure to energy transition trends. Progress in these initiatives connects directly to Jabil’s catalysts of scaling emerging tech and industrial solutions, supporting broader confidence in its business model amid sector volatility.

However, it’s important to keep in mind that, in contrast to the current analyst optimism, risks from continued weakness in the renewable and EV markets could limit...

Read the full narrative on Jabil (it's free!)

Jabil's narrative projects $34.3 billion revenue and $1.3 billion earnings by 2028. This requires 6.4% yearly revenue growth and a $723 million earnings increase from $577 million today.

Uncover how Jabil's forecasts yield a $247.38 fair value, a 17% upside to its current price.

Exploring Other Perspectives

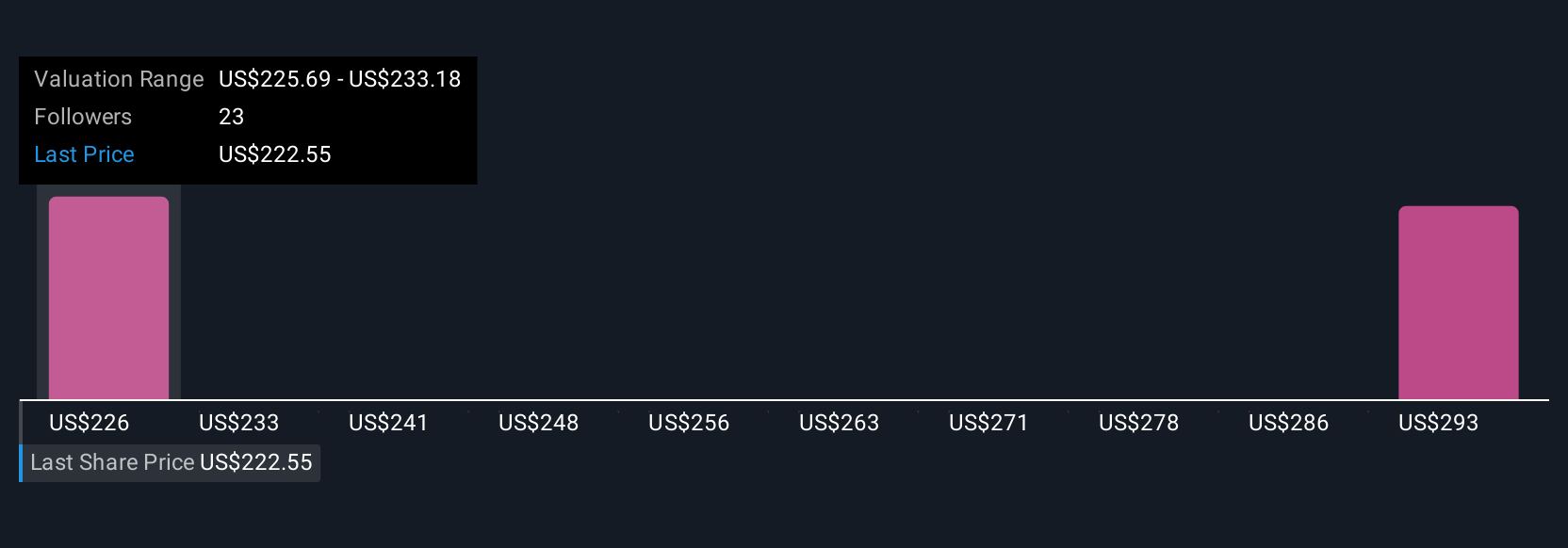

Two Simply Wall St Community members estimate Jabil’s fair value between US$247.38 and US$257.87 per share. While some expect opportunity in AI-driven growth areas, many remain wary of volatility in regulated segments, offering you several viewpoints to investigate further.

Explore 2 other fair value estimates on Jabil - why the stock might be worth as much as 22% more than the current price!

Build Your Own Jabil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jabil research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Jabil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jabil's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com