Why Is National Vision Holdings (EYE) Doubling Store Openings and Reaffirming Growth Targets for 2030?

- National Vision Holdings recently announced its investment priorities for the next five years, including a disciplined capital allocation strategy and plans to accelerate store openings from 30 per year in 2026-2027 to 60 per year between 2028-2030, while reaffirming its annual net revenue growth guidance in the high-single-digit range through fiscal 2030.

- This combination of long-term unit growth targets and multi-year financial guidance offers fresh transparency into the company's operational blueprint and management’s approach to building long-term shareholder value.

- We'll consider how National Vision Holdings' phased store expansion plan and updated growth projections could shift the company's investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

National Vision Holdings Investment Narrative Recap

To be a shareholder in National Vision Holdings, investors must believe in the company's ability to drive resilient brick-and-mortar revenue and expand its presence despite ongoing e-commerce disruption. The recent five-year investment plan, with a phased ramp-up in store openings and reaffirmed revenue guidance, provides clarity on long-term growth, but has minimal impact on the industry-wide shortage and retention of optometrists, which remains the main risk to near-term productivity and store expansion.

Among recent company announcements, the plan to accelerate unit growth from 30 to 60 net new stores per year between 2026 and 2030 is most relevant. As National Vision seeks operational scale through faster store expansion, success will likely depend on its ability to address the ongoing crunch in optometrist availability, a factor that could shape the effectiveness of its growth plans.

But as the business builds toward aggressive store growth targets, investors should also be aware that persistent optometrist shortages could...

Read the full narrative on National Vision Holdings (it's free!)

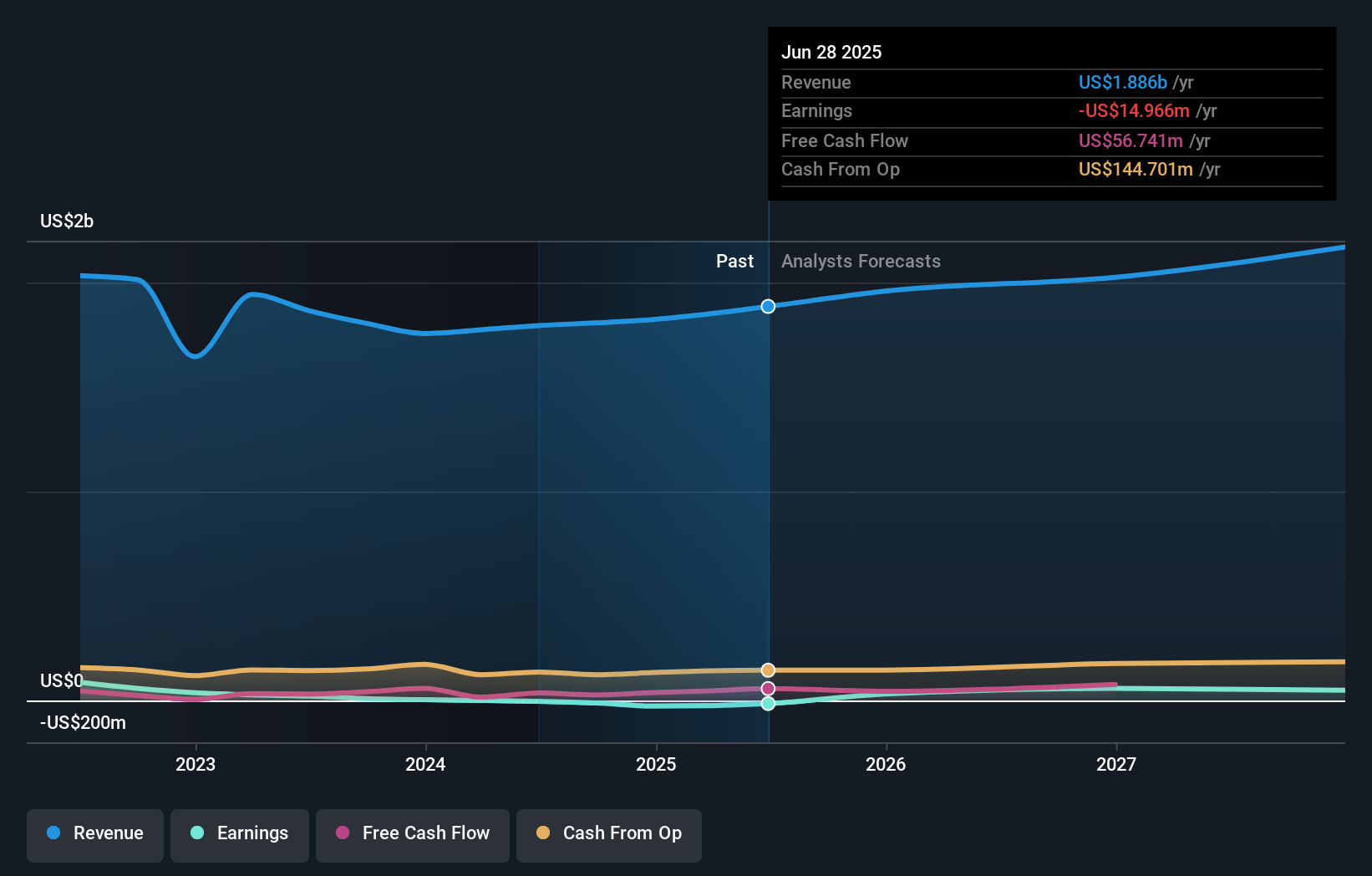

National Vision Holdings' narrative projects $2.2 billion in revenue and $89.4 million in earnings by 2028. This requires 5.4% yearly revenue growth and an earnings increase of $104.4 million from current earnings of -$15.0 million.

Uncover how National Vision Holdings' forecasts yield a $32.90 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Three retail investor estimates from the Simply Wall St Community range from US$14.02 to US$40.08, showing wide divergence in perceived fair value. Consider how the company’s ambitious store opening plans might face headwinds from workforce constraints as you explore different viewpoints on future performance.

Explore 3 other fair value estimates on National Vision Holdings - why the stock might be worth as much as 39% more than the current price!

Build Your Own National Vision Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Vision Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free National Vision Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Vision Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com