Arista Networks (ANET) Is Up 11.3% After Beating Q3 Estimates but Guiding for Slower Growth – Has the Bull Case Changed?

- Arista Networks reported strong fiscal Q3 2025 results, with revenue increasing by 27.46% year-over-year and surpassing earnings expectations; however, management signaled modest growth for Q4 2025.

- This combination of robust performance and a more cautious growth outlook prompted mixed analyst opinions regarding the company's future trajectory and operating margins.

- We'll consider how management's more subdued outlook on near-term growth may alter the company's investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Arista Networks Investment Narrative Recap

To be a shareholder of Arista Networks, you need to believe that their core position in high-speed cloud and AI networking will create sustained demand and support long-term expansion. While the Q3 2025 results were impressive, with revenue jumping 27.46%, management’s more restrained growth outlook for Q4 could temper optimism. This shift may influence the short-term catalyst of continued AI data center buildout acceleration, while the biggest risk, customer concentration among cloud and AI titans, remains present. So far, the news does not appear to have materially altered these factors.

Piper Sandler’s recent decision to raise its price target to US$145 stands out, citing operational resilience and growing product deferred revenue. The firm highlighted traction with new products and the accumulation of a sizable customer backlog, both key indicators tied directly to the AI and cloud expansion catalysts. Analyst reactions remain divided, reflecting both confidence in near-term execution and caution over future operating margin volatility.

Yet, in contrast, investors should also be aware of how sudden changes in spending patterns among Arista’s largest customers might...

Read the full narrative on Arista Networks (it's free!)

Arista Networks' outlook anticipates revenue of $13.6 billion and earnings of $5.4 billion by 2028. This scenario assumes a 19.5% annual revenue growth rate and a $2.1 billion increase in earnings from the current level of $3.3 billion.

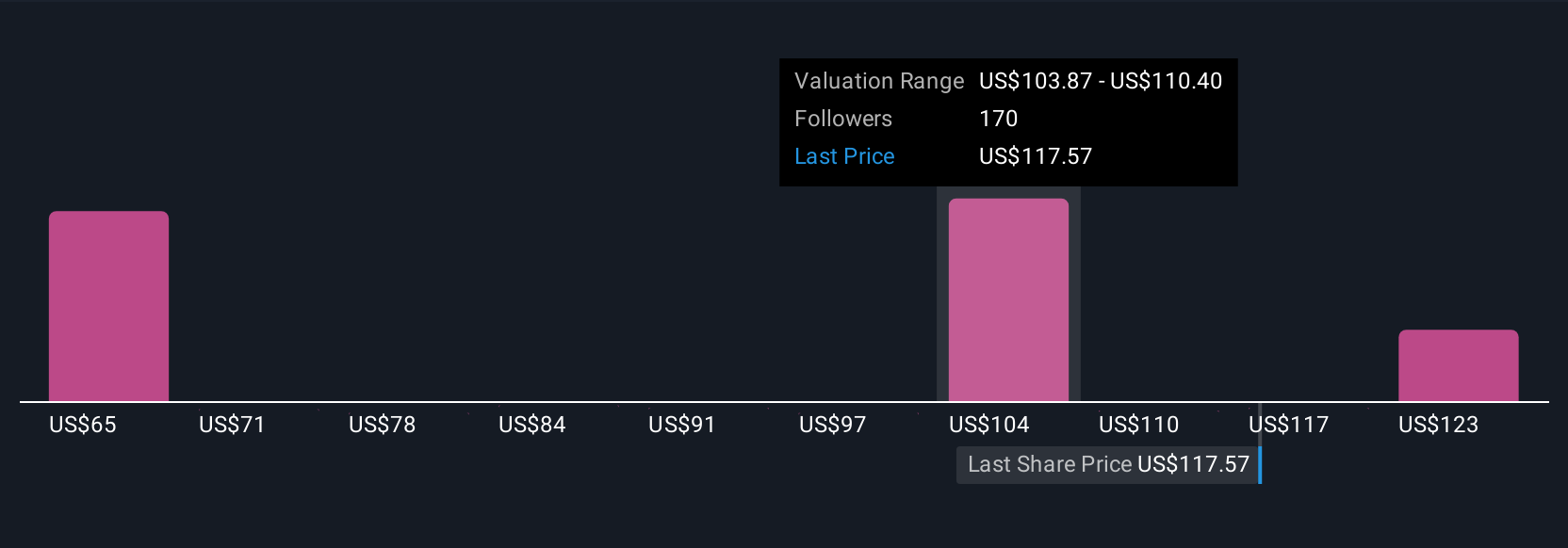

Uncover how Arista Networks' forecasts yield a $164.08 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts previously expected Arista's annual revenue to reach US$15.4 billion by 2028, but their narrative could shift if risks around customer concentration or industry changes become more prominent than anticipated. It is worth considering how dramatically opinions can differ and why reviewing several perspectives helps you weigh both upside potential and exposure to new risks.

Explore 20 other fair value estimates on Arista Networks - why the stock might be worth as much as 26% more than the current price!

Build Your Own Arista Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arista Networks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arista Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arista Networks' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com