Undiscovered Gems in the US Market to Explore December 2025

As December 2025 unfolds, the U.S. stock market is experiencing a cautious start with major indices like the Dow Jones, Nasdaq, and S&P 500 slipping amid a risk-off sentiment that has particularly impacted big tech and crypto-tied shares. Despite this broader market hesitance, opportunities may arise in lesser-known small-cap stocks that exhibit strong fundamentals and growth potential, often overlooked during periods of heightened volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

NVE (NVEC)

Simply Wall St Value Rating: ★★★★★★

Overview: NVE Corporation specializes in developing and selling spintronic devices, a form of nanotechnology for information acquisition, storage, and transmission, with a market cap of approximately $309.29 million.

Operations: NVE Corporation's primary revenue stream comes from its electronic components and parts segment, generating approximately $24.78 million in revenue. The company has a market cap of around $309.29 million.

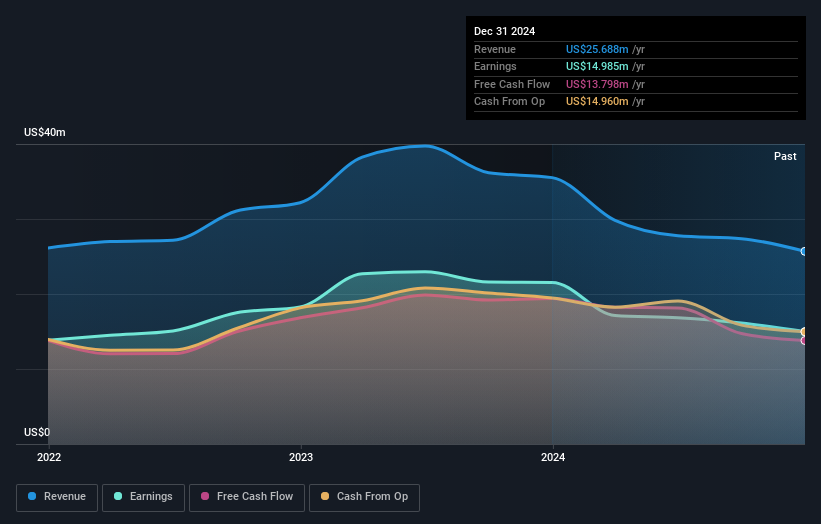

NVE Corporation, a small player in the semiconductor space, shows a mixed financial picture. With no debt for the past five years and high-quality earnings, it stands out financially. However, recent earnings reveal some challenges; revenue for Q2 2025 was US$6.35 million compared to US$6.76 million last year, while net income dropped to US$3.31 million from US$4.03 million previously. The P/E ratio of 22x suggests it's priced attractively against industry norms of 36x despite negative earnings growth of -14%. A quarterly dividend of $1 per share underscores its commitment to shareholder returns amidst these hurdles.

- Take a closer look at NVE's potential here in our health report.

Review our historical performance report to gain insights into NVE's's past performance.

NWPX Infrastructure (NWPX)

Simply Wall St Value Rating: ★★★★★☆

Overview: NWPX Infrastructure, Inc. operates in the manufacture and sale of water-related infrastructure products across North America and Canada, with a market capitalization of approximately $563.32 million.

Operations: NWPX generates revenue primarily from two segments: Water Transmission Systems, which contributes $349.39 million, and Precast Infrastructure and Engineered Systems, adding $170.60 million.

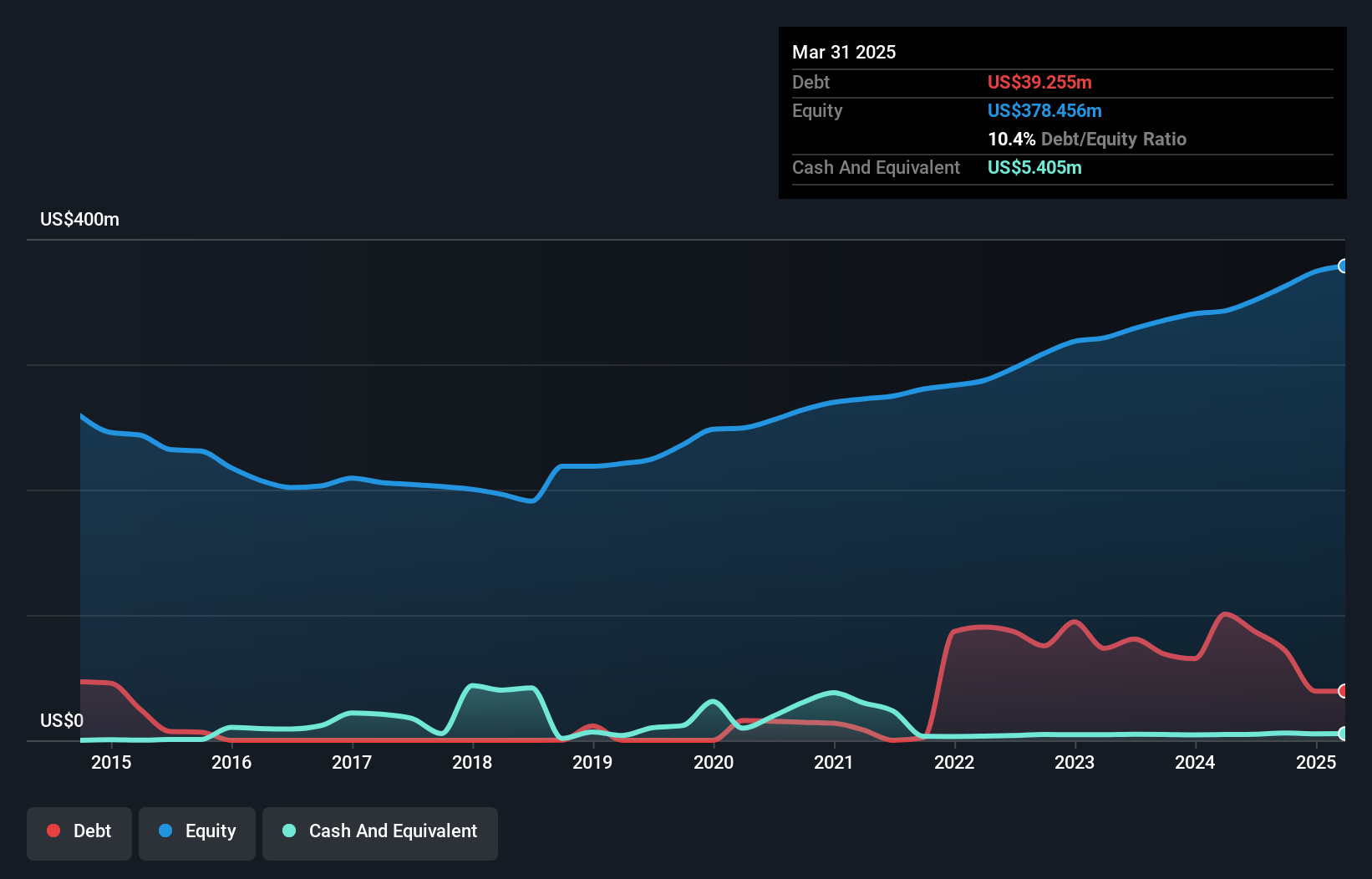

NWPX Infrastructure, a North American player in water-related infrastructure, is making waves with its disciplined acquisition strategy and robust financials. The company reported a Q3 revenue of US$151.07 million, up from US$130.2 million the previous year, alongside net income rising to US$13.51 million from US$10.25 million. With a price-to-earnings ratio of 15.4x below the market average and interest payments well-covered at 15.6 times by EBIT, it shows strong financial health. Recent buybacks totaling 577,156 shares for US$22.21 million highlight its commitment to shareholder value amidst ongoing strategic expansions in the precast space.

Core Laboratories (CLB)

Simply Wall St Value Rating: ★★★★★★

Overview: Core Laboratories Inc. offers reservoir description and production enhancement services and products to the oil and gas industry globally, with a market cap of $703.11 million.

Operations: Core Laboratories Inc. generated revenue primarily from its Reservoir Description segment, which contributed $342.38 million, and Production Enhancement segment, which added $175.49 million.

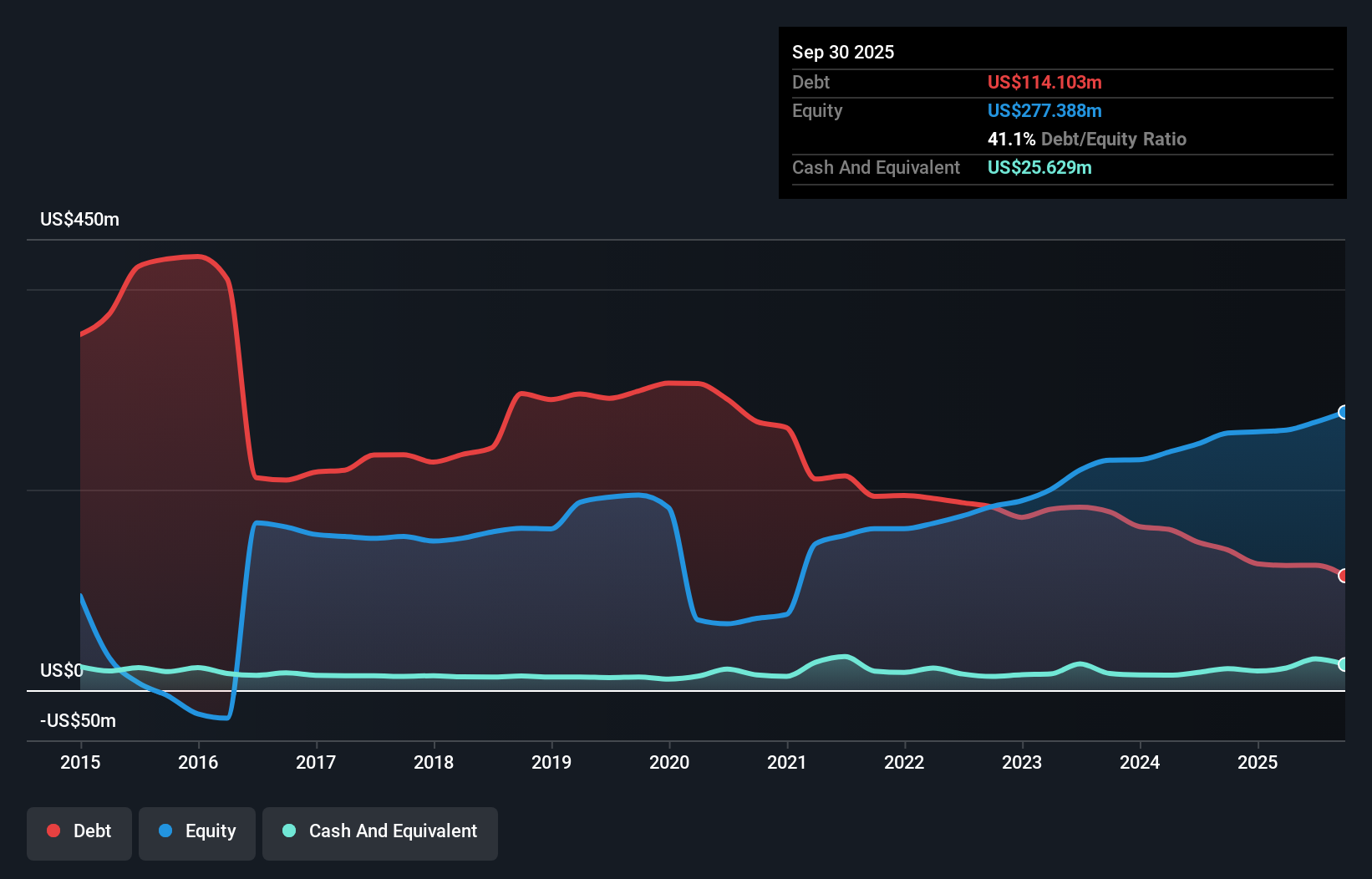

Core Labs, a smaller player in the energy sector, has shown notable resilience with a 22.6% earnings growth over the past year, outpacing its industry peers. The company reported Q3 2025 sales of US$134.52 million and net income of US$14.24 million, reflecting improved profitability from US$11.75 million last year. With a satisfactory net debt to equity ratio of 31.9%, Core Labs seems financially stable despite market volatility and one-off gains impacting results by US$9.4 million recently. Its strategic expansion into Middle East markets aims to leverage global energy demand while managing risks like geopolitical instability and regulatory pressures in renewables transition.

Key Takeaways

- Embark on your investment journey to our 294 US Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com