How Strong Q3 Results and 2026 Outlook at Copa Holdings (CPA) Have Changed Its Investment Story

- Copa Holdings, S.A. announced third quarter 2025 operating results, reporting US$913.15 million in revenue and net income of US$173.35 million, with improved passenger traffic and an 88.0% load factor, as well as affirming full-year guidance and issuing preliminary 2026 outlook.

- Alongside these results, the company ratified a US$1.61 per share dividend and highlighted its confidence in future capacity expansion and cost control.

- With Copa reaffirming its 2025 guidance and reporting higher passenger and revenue figures, we'll explore how this strengthens its investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Copa Holdings Investment Narrative Recap

Copa Holdings appeals to investors who believe in the growth of intra-Latin America air travel and the company’s core Panama City hub model. The recent Q3 2025 results, with higher passenger numbers, steady profitability, and reaffirmed guidance, support confidence in near-term execution. However, this news does not materially change the biggest short-term catalyst: Copa’s ability to drive further passenger and load factor growth alongside network expansion, nor does it mitigate competition-driven risks to passenger yields and RASM over the coming quarters.

Among the latest announcements, Copa’s ratified US$1.61 per share dividend stands out, reinforcing management’s confidence in operational strength and near-term cash flow. Consistent dividend payments may appeal to income-focused shareholders, particularly as the company pursues both disciplined cost control and capacity growth. Still, investors will want to remain mindful of how these efforts intersect with the challenges of pricing pressure and capacity growth across the region ...

Read the full narrative on Copa Holdings (it's free!)

Copa Holdings' narrative projects $4.4 billion revenue and $855.0 million earnings by 2028. This requires 8.4% yearly revenue growth and a $217.5 million earnings increase from $637.5 million today.

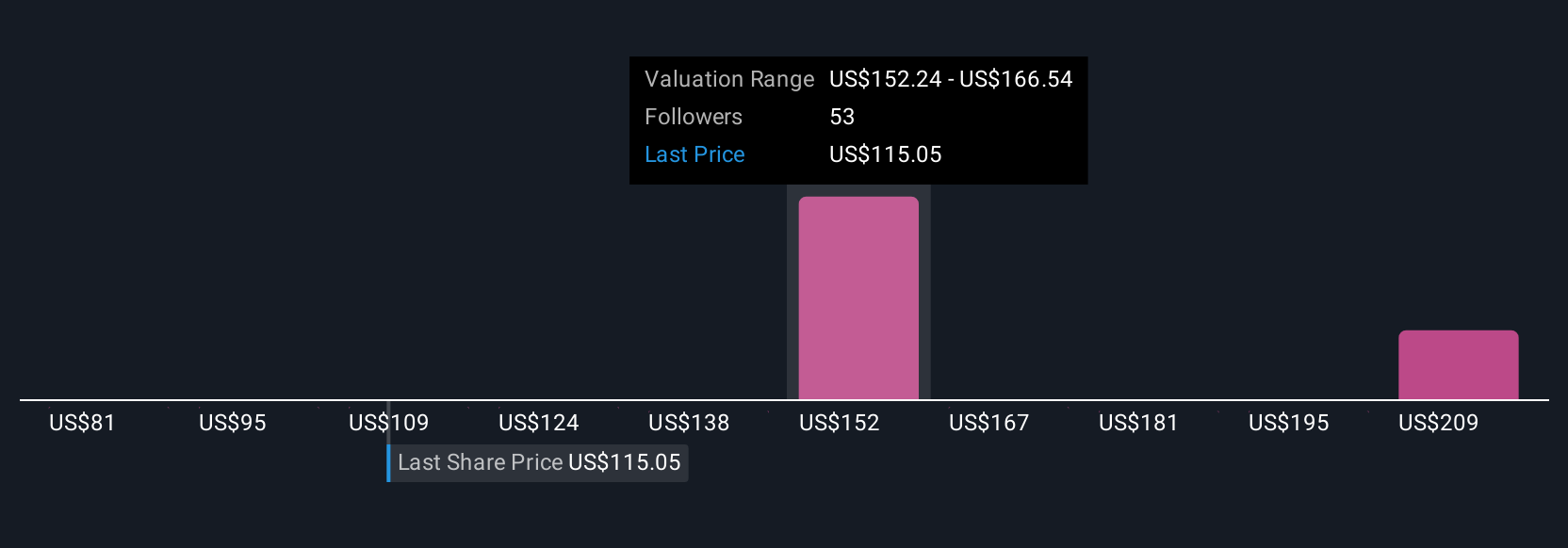

Uncover how Copa Holdings' forecasts yield a $157.13 fair value, a 32% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s nine fair value estimates for Copa Holdings range from US$32.98 to US$157.13 per share. While confidence in capacity expansion and consistent cash flows is high, competition and weaker yields remain key themes across perspectives, inviting you to compare how different views weigh these factors in the company’s prospects.

Explore 9 other fair value estimates on Copa Holdings - why the stock might be worth less than half the current price!

Build Your Own Copa Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Copa Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Copa Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Copa Holdings' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com