Margin Compression and Softer Returns Could Be A Game Changer For C.H. Robinson Worldwide (CHRW)

- C.H. Robinson Worldwide has recently reported a 5.4% annual sales decline over the past two years and a compressed 7.4% gross margin, highlighting ongoing end-market weakness and elevated input costs.

- At the same time, waning returns on capital amid intensifying competition suggest that the company’s traditional profit engines are under strain and less effective than before.

- We’ll now examine how these margin pressures and weakening returns on capital may influence C.H. Robinson Worldwide’s existing investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

C.H. Robinson Worldwide Investment Narrative Recap

To own C.H. Robinson Worldwide today, you need to believe that its scale, technology and customer relationships can offset softer end markets and rising costs. The reported 5.4% annual sales decline and 7.4% gross margin squeeze directly pressure the near term earnings catalyst, while also sharpening the key risk that competitive intensity could further erode returns on capital.

Against this backdrop, the company’s decision on 29 October 2025 to lift its 2026 operating income target to a range of US$965 million to US$1,040 million stands out as especially relevant. That higher target, set alongside ongoing buybacks and dividend growth, sits in clear tension with the recent margin compression and will likely frame how investors judge execution on pricing, automation and cost control over the next few years.

Yet beneath the headline guidance, investors should be aware that intensifying digital freight competition could...

Read the full narrative on C.H. Robinson Worldwide (it's free!)

C.H. Robinson Worldwide's narrative projects $18.4 billion revenue and $677.2 million earnings by 2028. This requires 2.6% yearly revenue growth and about a $142.9 million earnings increase from $534.3 million today.

Uncover how C.H. Robinson Worldwide's forecasts yield a $152.20 fair value, a 5% downside to its current price.

Exploring Other Perspectives

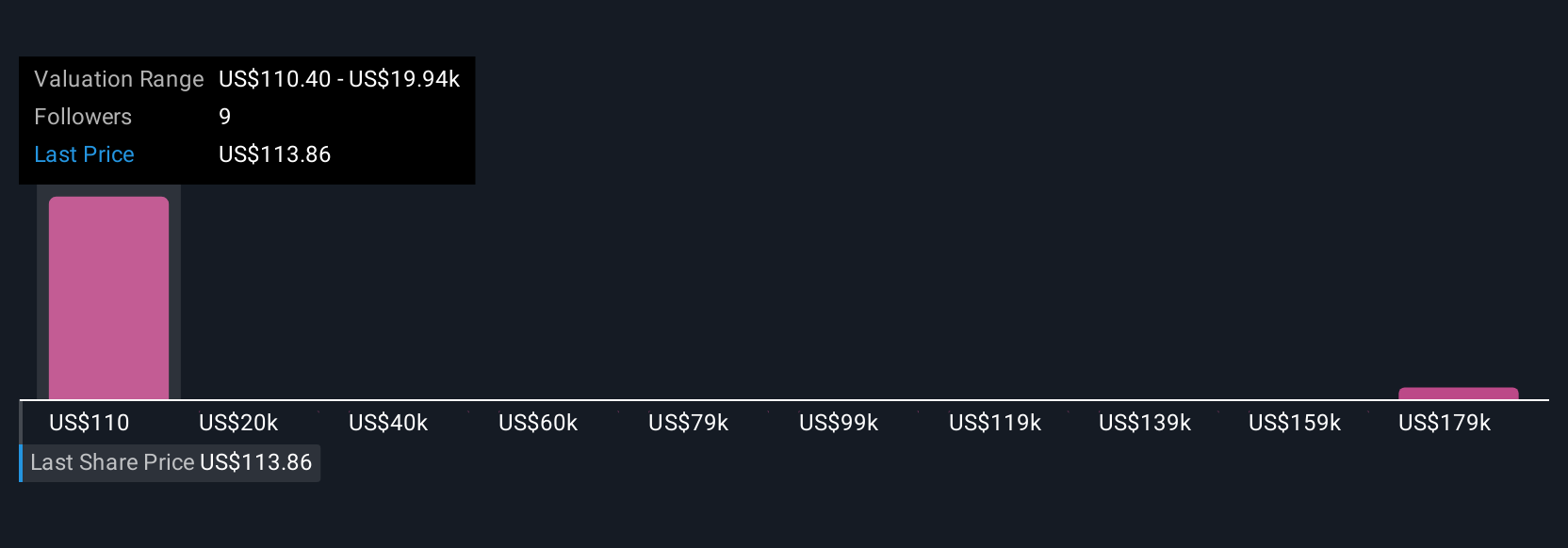

Three fair value estimates from the Simply Wall St Community span from about US$146 to over US$198,000 per share, showing just how far apart investors can be. When you set those views against current margin pressure and weaker returns on capital, it underlines why many readers may want to explore several alternative viewpoints before deciding how this business might perform.

Explore 3 other fair value estimates on C.H. Robinson Worldwide - why the stock might be a potential multi-bagger!

Build Your Own C.H. Robinson Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your C.H. Robinson Worldwide research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free C.H. Robinson Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate C.H. Robinson Worldwide's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com