Will Vbrick’s Video Integration Deepen ServiceNow’s AI Data Advantage And Shape Margins For NOW?

- On 2 December 2025, Vbrick announced a new integration with ServiceNow’s Now Assist, enabling enterprises to turn previously siloed video content into searchable, AI-ready data for workflow automation and support.

- This move highlights how ServiceNow is increasingly embedding external AI-ready data sources, such as enterprise video, directly into its core automation platform to deepen use cases.

- Next, we’ll examine how this deeper Vbrick–Now Assist integration might influence ServiceNow’s AI-led growth narrative and margin expectations.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ServiceNow Investment Narrative Recap

To own ServiceNow, you need to believe it can turn its AI platform, ecosystem partnerships, and workflow breadth into durable, profitable growth despite rising competition and valuation risk. The Vbrick–Now Assist integration supports that thesis by widening AI-ready data sources, but it does not fundamentally change the near term catalyst of AI monetization progress or the key risk around execution and margin pressure from intense AI investment and acquisitions.

Among recent updates, the expanded Microsoft partnership is most relevant here. Both the Vbrick integration and the Microsoft AI Foundry / Copilot Studio tie ups underline ServiceNow’s push to be the orchestration layer for third party AI and data. How well the company converts these integrations into higher priced AI SKUs and larger enterprise deals could be an important proof point for the AI led growth story that analysts are watching closely.

Yet, while the integrations look promising, investors should be aware that intense AI competition could still...

Read the full narrative on ServiceNow (it's free!)

ServiceNow's narrative projects $20.3 billion revenue and $3.3 billion earnings by 2028. This requires 18.9% yearly revenue growth and about a $1.6 billion earnings increase from $1.7 billion today.

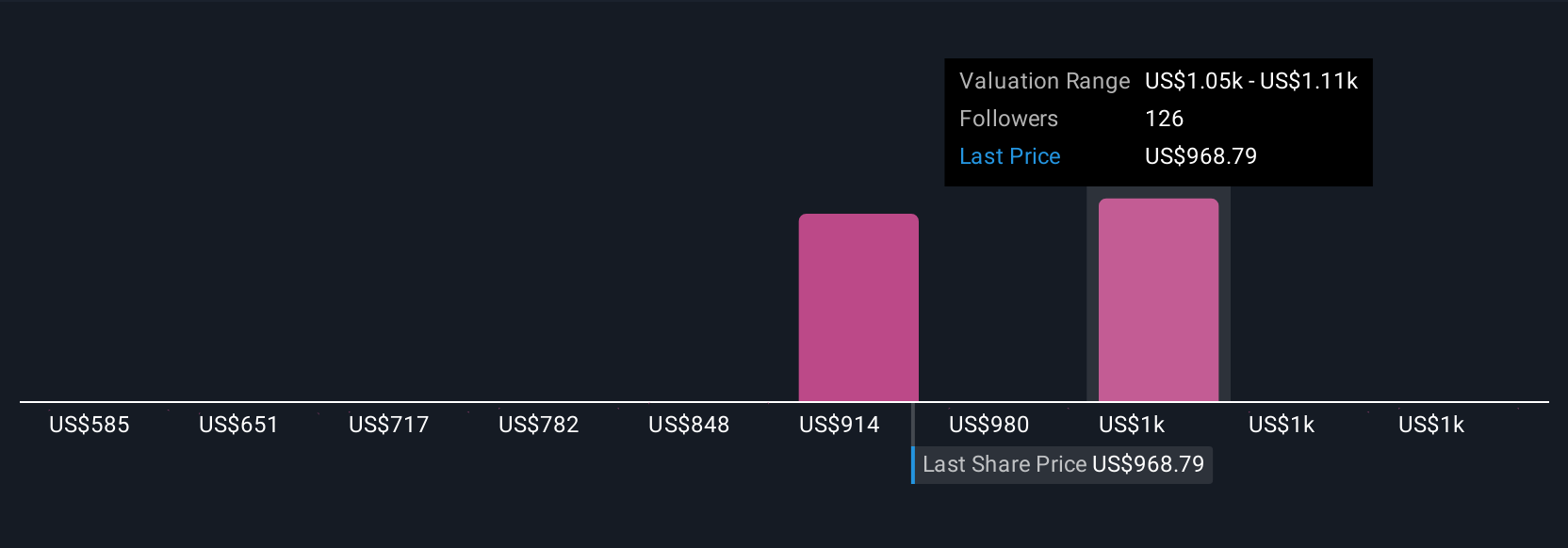

Uncover how ServiceNow's forecasts yield a $1155 fair value, a 40% upside to its current price.

Exploring Other Perspectives

More bullish analysts were assuming ServiceNow could reach about US$20.3 billion in revenue and US$4.2 billion in earnings by 2028, so compared with the baseline view, they were far more optimistic that alliances and hybrid AI pricing would pay off quickly, yet the latest Vbrick integration shows how assumptions on AI adoption and monetization can shift and you should weigh these different expectations carefully.

Explore 16 other fair value estimates on ServiceNow - why the stock might be worth as much as 51% more than the current price!

Build Your Own ServiceNow Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ServiceNow research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ServiceNow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ServiceNow's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com