How Strong Results and GLP-1 Demand Tailwinds May Shape West Pharma’s Investment Case (WST)

- Recently, analysts reiterated a positive outlook on West Pharmaceutical Services after the company reported strong quarterly results and raised its guidance, citing resilient demand for its high-value proprietary elastomer components and exposure to GLP-1 therapies.

- This supportive analyst commentary highlights how West’s mix of specialized injectable packaging and long-term GLP-1 demand may help offset concerns about capital allocation, insider selling during buybacks, and potential competition from oral drug alternatives.

- We’ll now examine how this renewed analyst confidence, grounded in stronger results and higher guidance, reshapes West Pharmaceutical Services’ investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

West Pharmaceutical Services Investment Narrative Recap

To own West Pharmaceutical Services, you need to believe in steady demand for its high value injectable components and durable exposure to GLP 1 therapies. The strong quarterly results and raised guidance support that thesis and point to GLP 1 related demand as the key near term catalyst, while uncertainty around capital allocation and insider selling remains the most prominent risk. This latest news reinforces the core growth drivers rather than materially changing the risk profile.

Among recent announcements, the launch of the West Synchrony PFS System, with commercial availability expected in early 2026, stands out because it aligns directly with biologics and injectable trends underpinning the GLP 1 opportunity. By broadening its portfolio for complex biologics and vaccines, West is positioning its high value products to benefit if volumes in these therapies continue to build, complementing the upgraded guidance and supporting the longer term earnings story.

Yet while the outlook appears supported by guidance, investors should still be aware of the concerns around insider selling during buybacks and how...

Read the full narrative on West Pharmaceutical Services (it's free!)

West Pharmaceutical Services’ narrative projects $3.6 billion revenue and $675.2 million earnings by 2028. This requires 6.5% yearly revenue growth and about a $187.5 million earnings increase from $487.7 million today.

Uncover how West Pharmaceutical Services' forecasts yield a $350.77 fair value, a 23% upside to its current price.

Exploring Other Perspectives

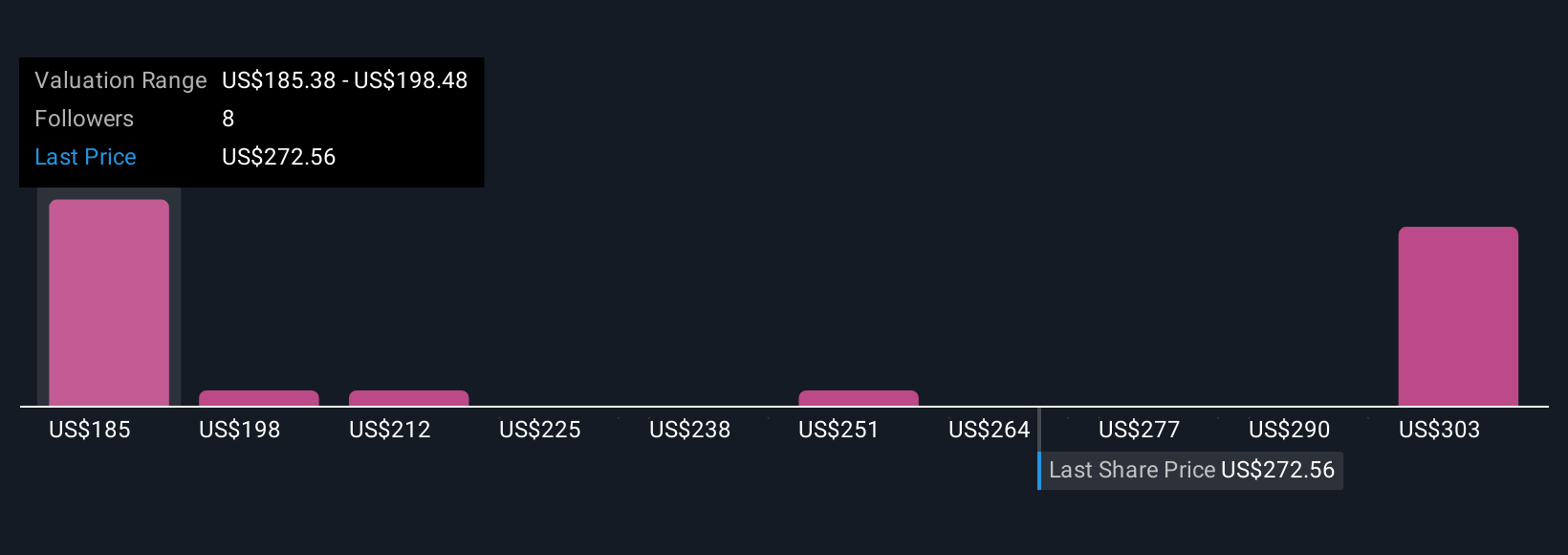

Five members of the Simply Wall St Community estimate fair value between US$161.98 and US$350.77, showing a wide range of expectations. When you set those views against West’s raised guidance and reliance on GLP 1 demand, it underlines how different assumptions about long term injectable volumes can significantly shape opinions on the company’s future performance.

Explore 5 other fair value estimates on West Pharmaceutical Services - why the stock might be worth 43% less than the current price!

Build Your Own West Pharmaceutical Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your West Pharmaceutical Services research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free West Pharmaceutical Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate West Pharmaceutical Services' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com