There's Reason For Concern Over Knife River Corporation's (NYSE:KNF) Massive 25% Price Jump

Those holding Knife River Corporation (NYSE:KNF) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

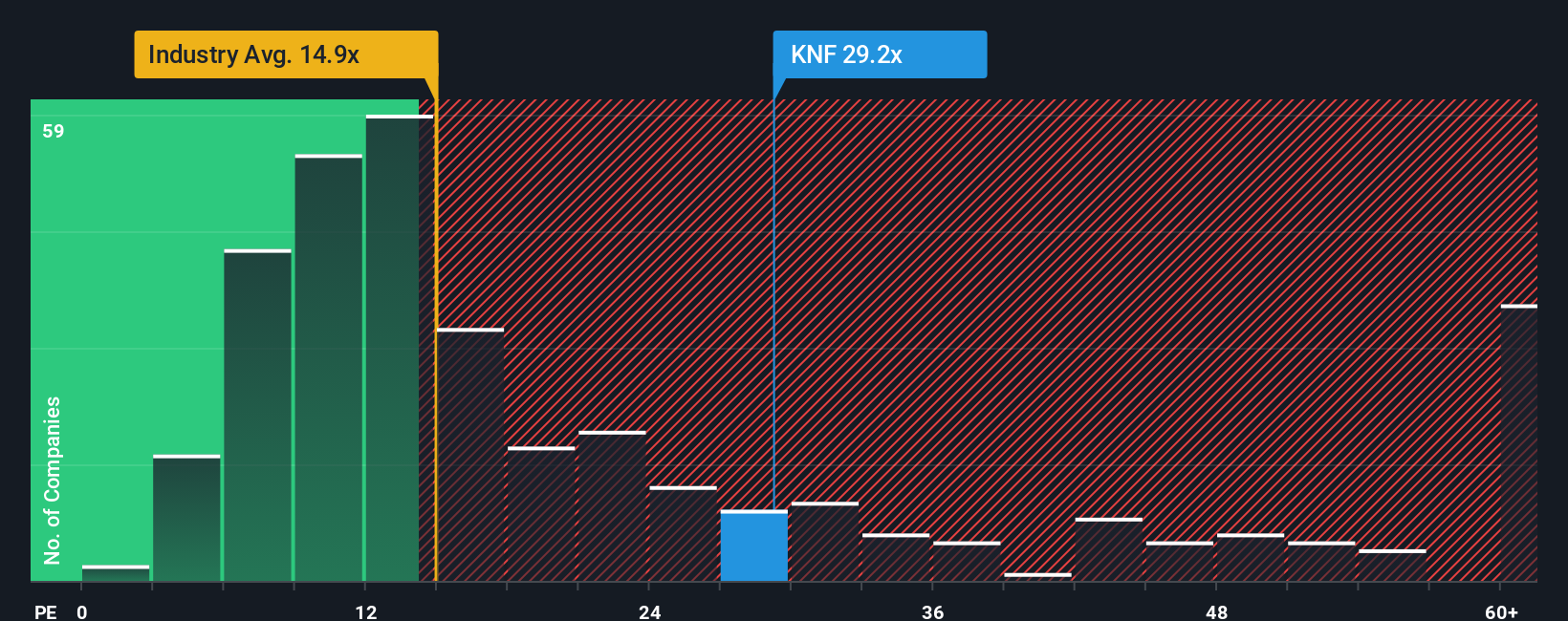

After such a large jump in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider Knife River as a stock to avoid entirely with its 29.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Knife River hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Knife River

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Knife River's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 27% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 18% over the next year. With the market predicted to deliver 16% growth , the company is positioned for a comparable earnings result.

With this information, we find it interesting that Knife River is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From Knife River's P/E?

Shares in Knife River have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Knife River's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Knife River that you need to be mindful of.

If these risks are making you reconsider your opinion on Knife River, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.