Mission’s New AWS Cloud Bundles and Agentic AI Specialization Might Change The Case For Investing In CDW (CDW)

- Recently, Mission, a CDW company, announced six integrated multi-product cloud solutions in AWS Marketplace that combine governance, security, operations, and managed services to streamline how enterprises manage their AWS environments.

- Mission also achieved the AWS Agentic AI Specialization, highlighting CDW’s push into autonomous AI systems that can run complex business processes with minimal human intervention.

- Now we’ll examine how Mission’s new AWS Marketplace solutions and Agentic AI Specialization could influence CDW’s investment narrative around cloud and AI.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

CDW Investment Narrative Recap

To own CDW, you generally need to believe its pivot toward higher value software, cloud, and managed services can offset slower hardware growth, margin pressure, and macro or funding headwinds. Mission’s new AWS solutions and Agentic AI Specialization support the near term cloud and AI services catalyst, but do not directly resolve the key risk that margins could stay under pressure if large, lower margin enterprise deals and hardware mix continue to weigh on profitability.

Among recent developments, Mission’s launch of six integrated multi product cloud solutions in AWS Marketplace looks most closely tied to the cloud and AI catalyst. By combining governance, observability, security, and FinOps across partners like CrowdStrike, New Relic, and Nutanix, CDW is leaning further into higher value managed services that can deepen customer relationships and potentially help counter competitive pressures in more transactional hardware categories.

Yet against this push into cloud and AI, investors should be aware that competitive pressure in lower margin hardware and large enterprise deals could...

Read the full narrative on CDW (it's free!)

CDW's narrative projects $24.3 billion revenue and $1.3 billion earnings by 2028. This requires 3.5% yearly revenue growth and an earnings increase of about $0.2 billion from $1.1 billion today.

Uncover how CDW's forecasts yield a $182.00 fair value, a 26% upside to its current price.

Exploring Other Perspectives

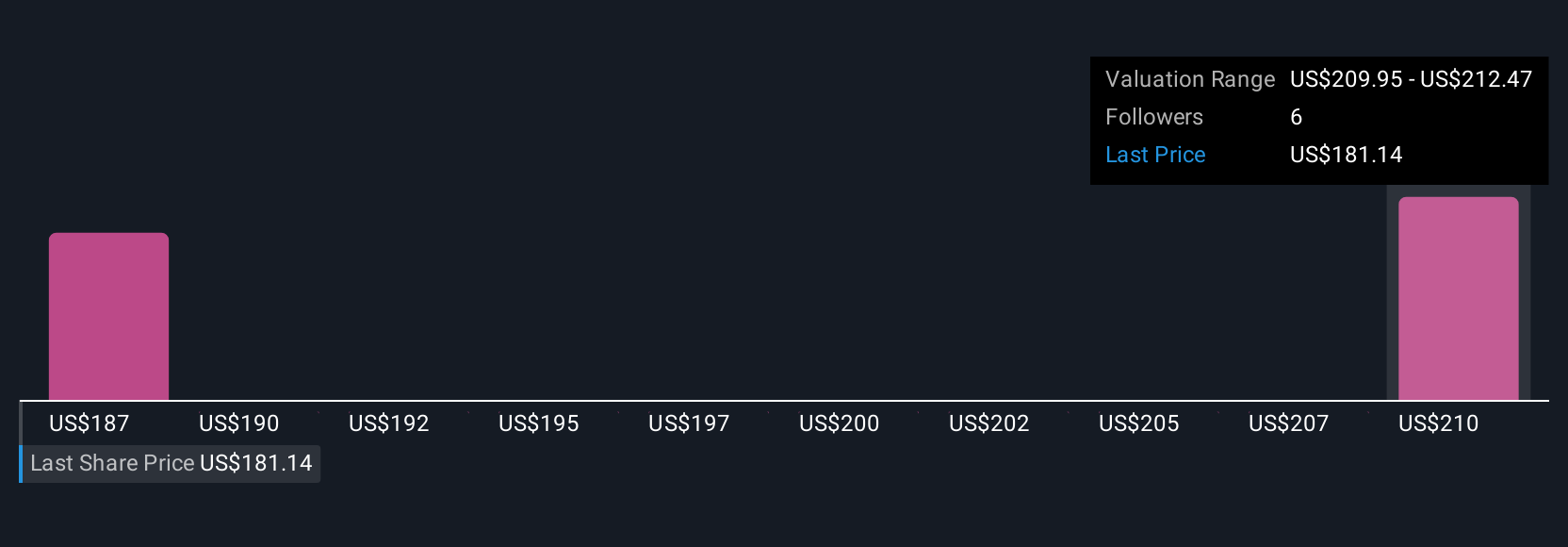

Three Simply Wall St Community fair value estimates for CDW range from US$161.29 to US$234.14, underlining how far views can diverge. Against that backdrop, CDW’s push into AI driven cloud and security services may matter more for long term earnings resilience than for near term revenue growth comparisons to the wider US market, so it is worth weighing several perspectives before forming a view.

Explore 3 other fair value estimates on CDW - why the stock might be worth as much as 62% more than the current price!

Build Your Own CDW Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CDW research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CDW research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CDW's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com