Garmin’s New inReach and Black Hawk Upgrade Could Be A Game Changer For Garmin (GRMN)

- In December 2025, Garmin expanded its outdoor and aviation offerings by launching the inReach Mini 3 Plus satellite communicator at US$499.99 and announcing that its G5000H integrated flight deck will modernize 24 Brazilian Air Force UH-60L Black Hawk helicopters.

- Together, these moves highlight Garmin’s push to deepen its recurring connectivity ecosystem in Outdoor while broadening higher-value military avionics programs through commercial-off-the-shelf solutions.

- We’ll now examine how the Brazilian Black Hawk avionics upgrade could influence Garmin’s investment narrative, especially its Aviation growth outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Garmin Investment Narrative Recap

To own Garmin, I think you need to believe in its ability to compound value through premium devices tied to higher-margin software and services across Fitness, Outdoor and Aviation. The Brazilian Black Hawk upgrade and inReach Mini 3 Plus launch both support that ecosystem story, but they do not materially change the near term focus on subscription traction and the key risk of Outdoor and Marine demand softness pressuring margins.

Among recent announcements, the Brazilian Air Force’s selection of Garmin’s G5000H flight deck for 24 UH-60L Black Hawks looks most relevant here, reinforcing Aviation as a high-value growth driver at a time when Marine revenue has been under pressure and Outdoor trends remain uneven.

Yet while Aviation wins help, investors should still be aware of the risk that Outdoor demand weakens further and ...

Read the full narrative on Garmin (it's free!)

Garmin's narrative projects $8.5 billion revenue and $1.8 billion earnings by 2028. This requires 7.9% yearly revenue growth and an earnings increase of about $0.2 billion from $1.6 billion today.

Uncover how Garmin's forecasts yield a $231.14 fair value, a 14% upside to its current price.

Exploring Other Perspectives

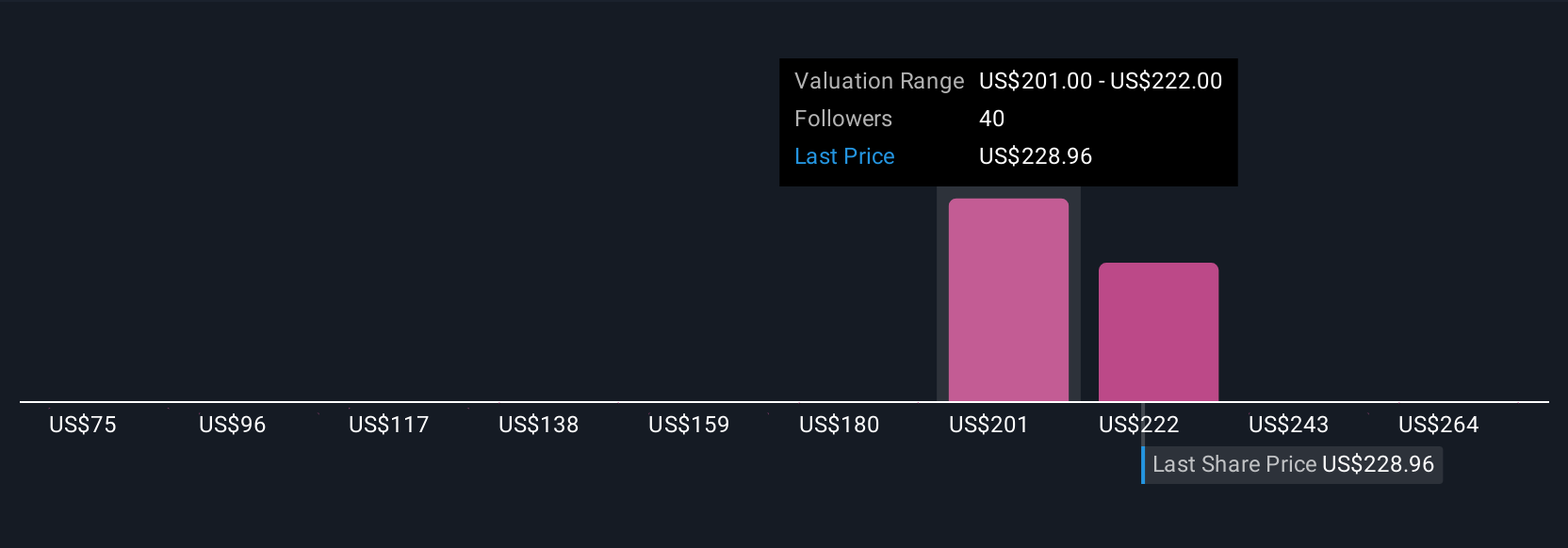

Six Simply Wall St Community fair value estimates for Garmin span a wide range, from US$119 to US$285 per share, showing how far apart views can be. Against this spread, the key concern many will weigh is whether slower Outdoor demand and rising operating expenses could constrain the earnings power needed to support the higher end of those expectations, so it can be useful to compare several of these perspectives side by side.

Explore 6 other fair value estimates on Garmin - why the stock might be worth as much as 41% more than the current price!

Build Your Own Garmin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Garmin research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Garmin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Garmin's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com