How Investors May Respond To PACCAR (PCAR) Pivot Toward High-Margin Parts And Advanced Truck Technologies

- PACCAR recently reported that its PACCAR Parts division delivered record revenues and continued investment in distribution capacity, while the company increased spending on next-generation clean diesel, alternative powertrains, and connected vehicle services to support evolving fleet needs.

- This shift toward more stable, higher-margin parts revenue and advanced truck technologies is reshaping PACCAR’s business mix and potentially its earnings profile.

- Next, we’ll explore how PACCAR’s expanding, higher-margin Parts business could influence the company’s investment narrative and future earnings profile.

Find companies with promising cash flow potential yet trading below their fair value.

PACCAR Investment Narrative Recap

PACCAR tends to suit investors who want exposure to a global truck maker that is gradually tilting toward higher-margin, recurring parts and services revenue. The latest update on PACCAR Parts supports that thesis, but does not materially change the near term risk that weaker truck orders and freight overcapacity could pressure deliveries and earnings if demand stays soft.

Among recent announcements, PACCAR’s record PACCAR Parts revenue and continued investment in distribution capacity stands out as most relevant, because it directly supports the idea of a more stable, higher-margin earnings base. As this segment grows alongside the company’s work on cleaner powertrains and connected services, it could become an important offset if cyclical truck demand or regional macro conditions turn less supportive.

Yet even with a growing parts business, investors should still pay close attention to the risk that prolonged weakness in truck orders could...

Read the full narrative on PACCAR (it's free!)

PACCAR's narrative projects $32.1 billion revenue and $4.2 billion earnings by 2028. This requires 1.1% yearly revenue growth and a roughly $1.1 billion earnings increase from $3.1 billion today.

Uncover how PACCAR's forecasts yield a $107.28 fair value, in line with its current price.

Exploring Other Perspectives

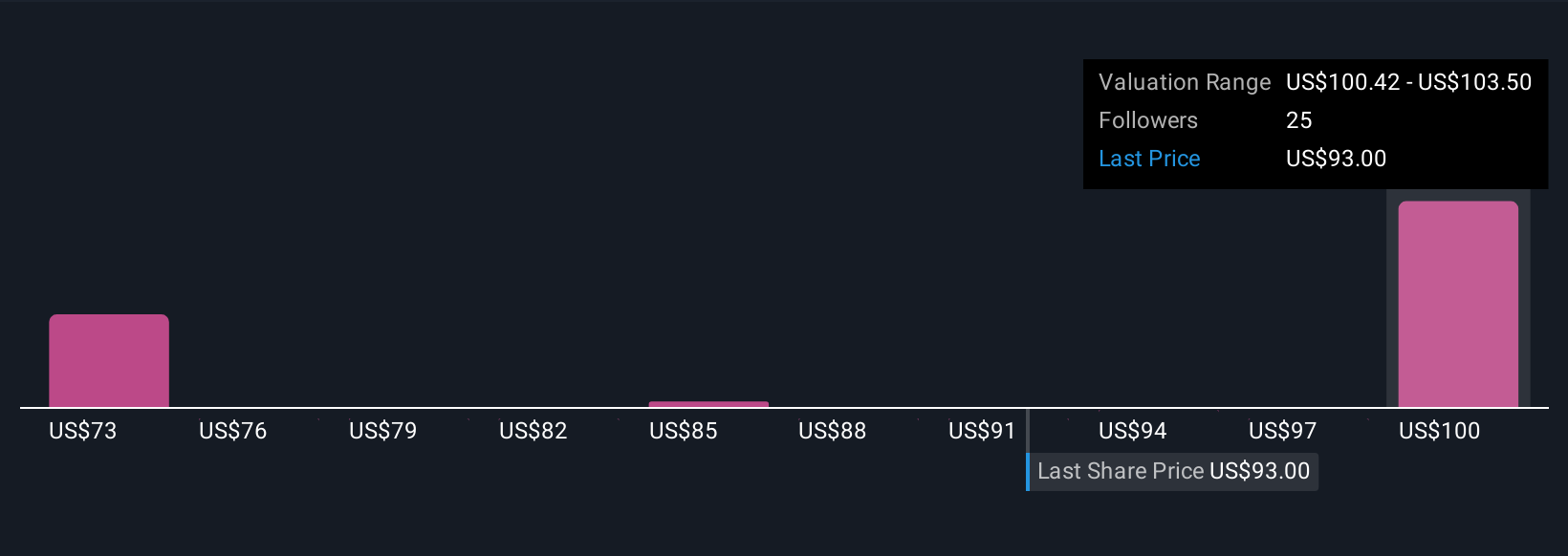

Five Simply Wall St Community fair value estimates for PACCAR range from US$86 to about US$156 per share, reflecting very different expectations. Before deciding where you stand on that spectrum, it is worth weighing how much confidence you have that higher margin parts and services can counter the risk of softer truck demand and ongoing macro uncertainty in key markets.

Explore 5 other fair value estimates on PACCAR - why the stock might be worth 21% less than the current price!

Build Your Own PACCAR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PACCAR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PACCAR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PACCAR's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com