Sempra (SRE): Revisiting Valuation After a Quiet Three-Month Share Price Climb

Sempra (SRE) has quietly outperformed many utilities over the past 3 years, and with the stock now up roughly 11% in the past 3 months, investors are revisiting its long term story.

See our latest analysis for Sempra.

While the 1 day and 7 day share price returns have cooled, Sempra’s roughly 11% 90 day share price return and solid three year total shareholder return suggest momentum is quietly building around its infrastructure growth story and perceived stability.

If Sempra’s steady climb has your attention, this could be a good moment to scout other regulated names and discover stable growth stocks screener (None results).

With shares trading below consensus targets despite solid long term returns and double digit profit growth, the key question now is whether Sempra is still undervalued or whether the market has already priced in its next leg of growth.

Most Popular Narrative: 9.1% Undervalued

With Sempra closing at $90.07 versus a narrative fair value near $99, the story leans toward upside, hinging on long term earnings power.

The rollout and completion of major LNG export projects (ECA Phase 1 nearing completion, Port Arthur Phase 1 advancing, and strong commercial momentum for Phase 2) positions Sempra to benefit from sustained global demand for U.S. LNG as a transition fuel, significantly increasing future cash flows and long-term revenue generation.

Want to see how steady top line expansion, rising margins, and a lower future earnings multiple still argue for upside? The full narrative unpacks those assumptions.

Result: Fair Value of $99.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could be challenged if regulatory shifts in California or Texas compress allowed returns, or if LNG demand weakens and projects underdeliver.

Find out about the key risks to this Sempra narrative.

Another View: Market Signals a Richer Price

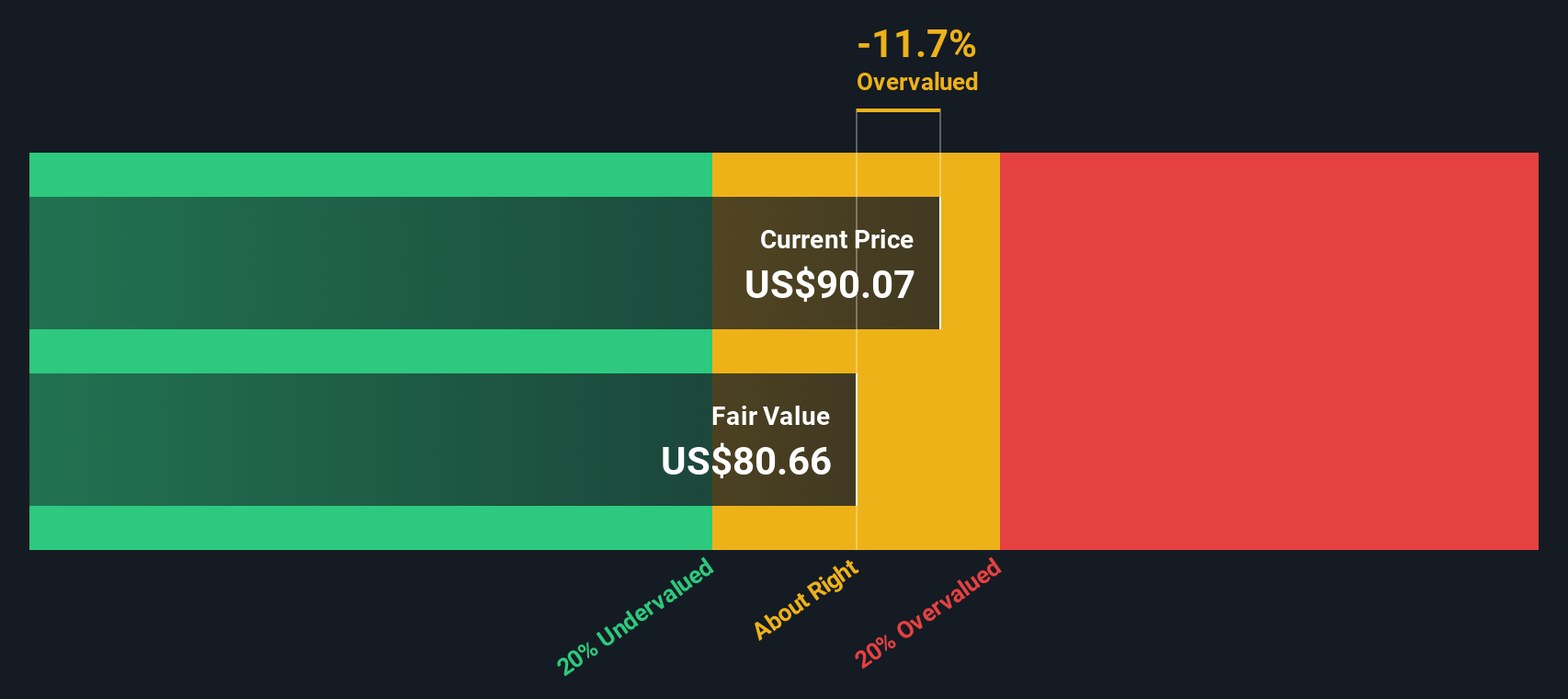

Our DCF model paints a cooler picture. On that basis, Sempra’s fair value sits closer to $80.66, making the current $90.07 share price look overvalued rather than discounted. Is the market overpaying for growth, or is the model too conservative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sempra for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sempra Narrative

If you see the numbers differently or simply want to dig into the details yourself, you can quickly build a custom view: Do it your way.

A great starting point for your Sempra research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning targeted stock lists tailored to growth, income, and innovation so potential winners do not slip past you.

- Explore early-stage potential with these 3572 penny stocks with strong financials that pair smaller market caps with robust balance sheets and notable financial strength.

- Follow the AI revolution by tracking these 26 AI penny stocks building real-world products and recurring revenue, not just buzz.

- Evaluate ways to enhance your portfolio’s income stream using these 15 dividend stocks with yields > 3% that combine attractive yields with fundamentals designed to handle volatile markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com