nCino (NCNO) Turns Q3 Profit, Testing Narratives Around Path to Sustainable Earnings

nCino (NCNO) has just posted its Q3 2026 numbers, reporting revenue of about $152 million and basic EPS of $0.06, with net income of roughly $6.5 million signaling a rare profitable quarter in an otherwise loss-making stretch on a trailing basis. The company has seen revenue move from roughly $132 million in Q2 2025 to about $152 million in Q3 2026, while basic EPS has swung between losses as deep as roughly -$0.16 and small profits around $0.06 over the same period. This underscores a business that is still wrestling with consistency even as it inches toward breakeven margins.

See our full analysis for nCino.With the latest earnings on the table, the next step is to see how these shifting margins and bumpy profitability track against the dominant narratives investors have been using to frame nCino’s story.

See what the community is saying about nCino

Losses Narrow on a Trailing Basis

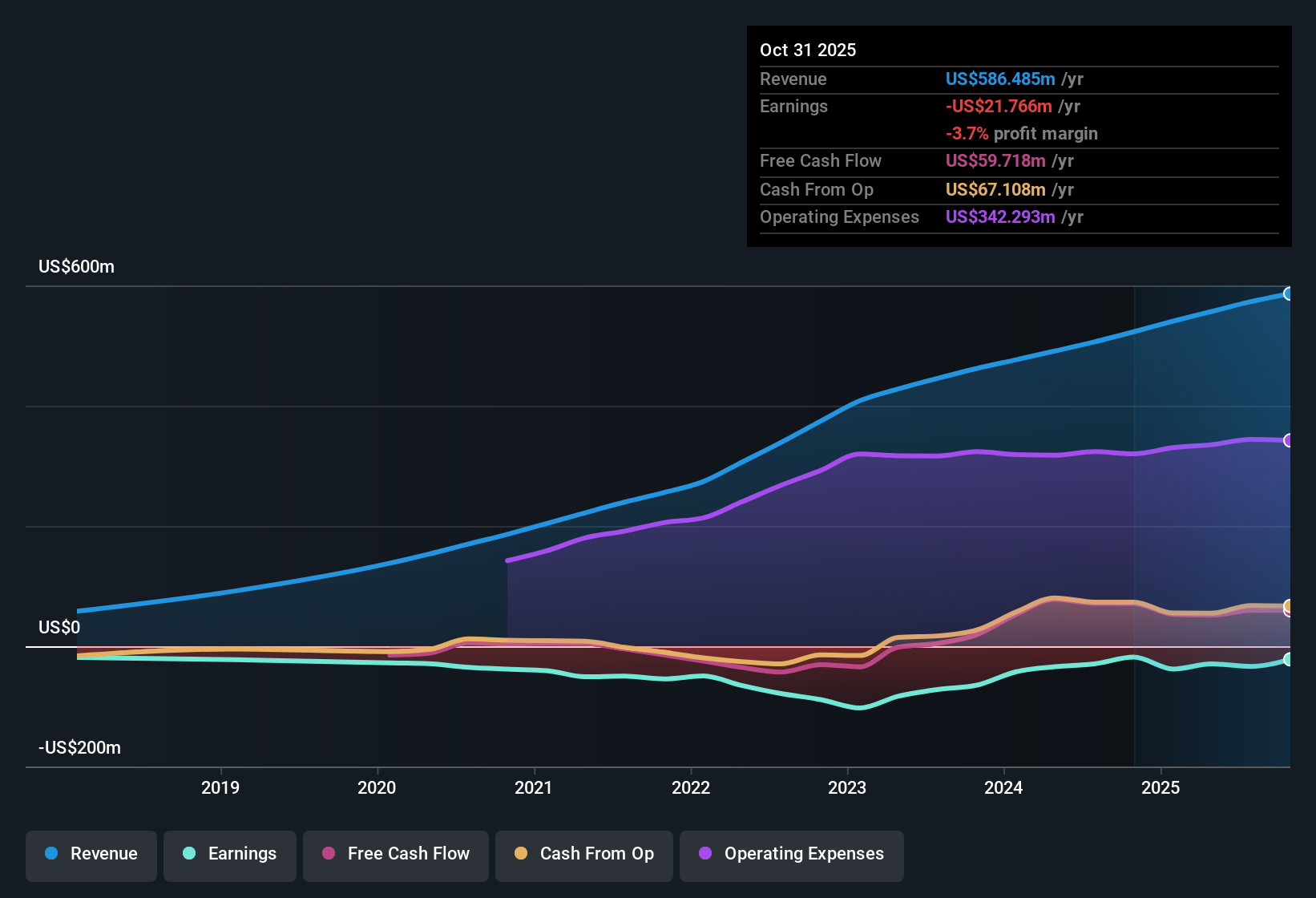

- Over the last twelve months, nCino generated about $586 million in revenue but still posted roughly $22 million in net losses, compared with around $541 million in revenue and $38 million in net losses four quarters ago, showing losses shrinking as sales rise.

- Consensus narrative highlights that banks are adopting nCino’s AI driven automation and broader platform, and the recent pattern of higher trailing revenue alongside smaller losses

- Supports the bullish view that expanding use cases like onboarding and analytics can keep lifting revenue while nudging margins higher.

- Also shows that even with ongoing investment, the business has been moving from roughly $38 million of trailing losses to about $22 million, which bulls see as part of the path toward profitability.

Valuation Points to Upside Potential

- At a share price of $24.35, nCino trades on a price to sales of 4.8 times, slightly below both the US Software industry at 4.9 times and peers at 5.0 times, while also sitting under the DCF fair value estimate of about $29.38.

- Consensus narrative suggests strong demand for nCino’s cloud native platform and AI tools, and today’s discount to both peers and DCF fair value

- Heavily supports the bullish case that if revenue continues to grow and margins improve, the current 4.8 times sales multiple could move closer to or above peer levels.

- Also aligns with forecasts that earnings could move from a loss today to about $56 million by 2028, which bulls argue would justify a higher share price than $24.35.

Growth Outlook Versus Market Benchmarks

- Analysts expect nCino’s revenue to grow about 8.3 percent per year and earnings to increase roughly 131 percent per year, with profit margins projected to improve from around minus 5.9 percent to about 7.7 percent within three years.

- While the consensus narrative talks up strong structural demand and international expansion, the fact that forecast revenue growth of 8.3 percent trails the broader US market at 10.6 percent

- Challenges the most optimistic bullish angles that treat nCino purely as a high growth story, because the top line is expected to grow a bit slower than the overall market.

- At the same time, the projected margin lift and earnings swing toward roughly $56 million by 2028 are what bulls point to when arguing that slower revenue growth can still deliver meaningful value creation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for nCino on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Turn that view into your own narrative in just a few minutes and share your angle with the community, Do it your way.

A great starting point for your nCino research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

nCino’s slower expected revenue growth versus the broader market and its still modest, hard won profitability leave plenty of uncertainty around long term compounding.

If you want more predictable progress, use our stable growth stocks screener (2079 results) to quickly focus on businesses already delivering steadier revenue and earnings momentum without the same execution risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com