Centrus Energy (LEU) Is Up 7.5% After NYSE Uplisting Milestone Has The Bull Case Changed?

- Centrus Energy Corp. has already transitioned its listing from the NYSE American to the New York Stock Exchange, where its shares began trading under the symbol “LEU” on December 4, 2025.

- This uplisting marks a key milestone in the company’s effort to restore large-scale, U.S.-owned uranium enrichment capacity for both commercial and national security needs.

- Next, we’ll examine how this NYSE uplisting, and the promise of greater liquidity and visibility, shapes Centrus Energy’s investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Centrus Energy's Investment Narrative?

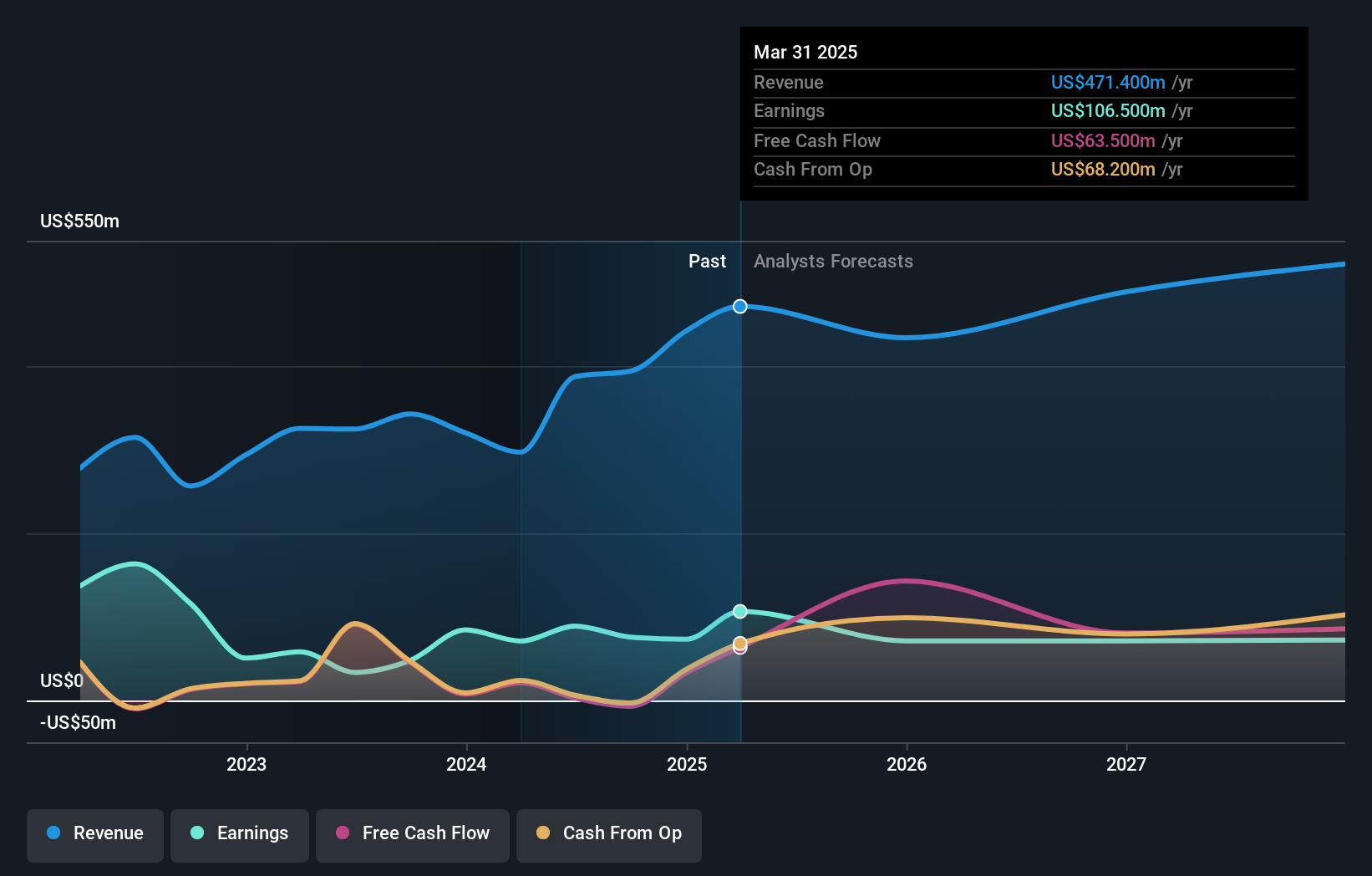

To own Centrus, you have to buy into a very specific story: that its role in rebuilding U.S.-owned uranium enrichment capacity, including HALEU, can justify a premium valuation and earnings that are currently expected to soften over the next few years. The NYSE uplisting fits that story by potentially broadening the investor base and making it easier to absorb the recently announced US$1.00 billion at-the-market equity program, which itself is a key near term catalyst and risk. Easier access to equity could support Piketon expansion and DOE backed opportunities, but it also raises dilution concerns at a time when the share price has already had a very large multi-year run and analysts see earnings declining, not compounding. For new and existing shareholders, that tension is now central to the thesis.

However, investors also need to consider how the large ATM program could reshape per share economics. Centrus Energy's shares are on the way up, but they could be overextended by 30%. Uncover the fair value now.Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly US$96 to US$310, showing how far apart views are on Centrus. When you set that against the potential dilution from the US$1.00 billion ATM and the importance of DOE decisions for Piketon, it underlines why many market participants are rethinking what should drive the company’s performance in the next few years.

Explore 9 other fair value estimates on Centrus Energy - why the stock might be worth less than half the current price!

Build Your Own Centrus Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centrus Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centrus Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centrus Energy's overall financial health at a glance.

No Opportunity In Centrus Energy?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com