Old Dominion Freight Line (ODFL) Valuation After BMO Upgrade on Pricing Power and Cash Flow Strength

BMO Capital’s upgrade of Old Dominion Freight Line (ODFL) to Outperform, citing its pricing power and free cash flow during a freight downturn, has put the stock back on many investors’ radar.

See our latest analysis for Old Dominion Freight Line.

That backdrop helps explain why the stock has bounced recently, with a strong 7 day share price return of 13.47 percent and a 30 day share price return of 9.04 percent. However, the 1 year total shareholder return of negative 23.84 percent shows the longer term trend has been much tougher, suggesting momentum may finally be turning after a difficult stretch.

If ODFL’s renewed momentum has you rethinking the freight space, it could also be a good time to explore fast growing stocks with high insider ownership for other potentially interesting ideas.

With earnings still growing, the share price well off its highs, and the stock trading only a touch below consensus targets, the key question now is whether Old Dominion is a genuine value opportunity or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 1.2% Undervalued

With Old Dominion Freight Line closing at $153.51 versus a narrative fair value of about $155.38, the story hinges on steady growth and premium margins.

The analysts have a consensus price target of $161.048 for Old Dominion Freight Line based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $195.0, and the most bearish reporting a price target of just $129.0.

Curious why a mature freight operator still commands a premium multiple over its sector, even with only mid single digit growth baked in? The answer lies in how analysts see margins, buybacks, and future earnings power compounding together. The specific earnings ramp and profit profile behind that fair value may surprise you.

Result: Fair Value of $155.38 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent freight softness and rising overheads could squeeze margins and stall the earnings ramp that underpins today’s near-fair-value narrative.

Find out about the key risks to this Old Dominion Freight Line narrative.

Another View, Valuation Gaps

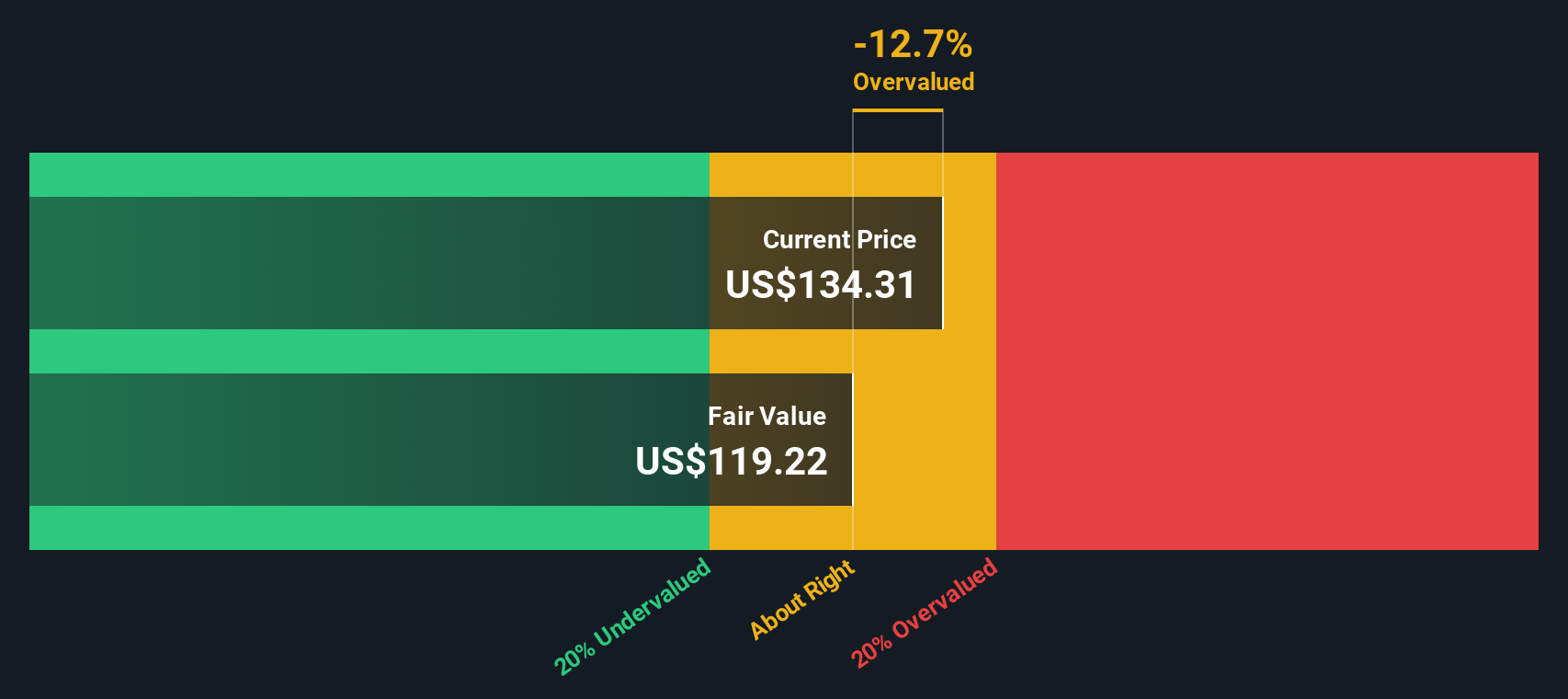

Our DCF model paints a very different picture, with ODFL trading at about $153.51 versus an estimated fair value near $114.75, implying material overvaluation instead of a small undervaluation. Is the market right to pay up for quality, or is growth optimism getting ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Old Dominion Freight Line for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Old Dominion Freight Line Narrative

If you see the story differently or prefer digging into the numbers yourself, you can shape a complete narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Old Dominion Freight Line.

Looking for your next smart opportunity?

Before freight stocks move again, consider scanning hand picked ideas on Simply Wall St’s powerful screener so tomorrow’s potential opportunities do not pass you by.

- Target potential mispriced opportunities early by reviewing these 907 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated.

- Explore the potential of transformative technology by focusing on these 26 AI penny stocks positioned to benefit from advances in automation and intelligent software.

- Strengthen your income stream by evaluating these 15 dividend stocks with yields > 3% that may offer attractive yields while maintaining solid balance sheets and consistent payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com