Why EPAM Systems (EPAM) Is Up 9.1% After Winning AWS Global Innovation Partner of the Year

- EPAM Systems was recently named the winner of the 2025 AWS Global Innovation Partner of the Year Award, recognizing its leadership in delivering innovative consulting, professional, managed and value-added services on Amazon Web Services.

- This recognition highlights EPAM’s AI-enabled cloud offerings, including its EPAM AI/RUN™ for AWS Migration and Modernization platform, underscoring its role in complex, AI-driven transformation projects.

- Next, we’ll explore how this AWS Global Innovation Partner of the Year win could influence EPAM’s AI-led transformation investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

EPAM Systems Investment Narrative Recap

To own EPAM, you need to believe it can convert its deep engineering roots into durable, higher value AI and cloud transformation work, despite margin pressure and rising competition. The AWS Global Innovation Partner of the Year win reinforces EPAM’s relevance in AI-led migration projects, but does not, on its own, resolve the near term risk around profitability, wage inflation and integration of lower margin acquisitions.

Among recent announcements, the US$1,000,000,000 share repurchase program stands out in this context. While buybacks can support per share metrics, the more important catalyst remains EPAM’s ability to scale AI-native platforms like EPAM AI/RUN™ and move more work into higher margin, end to end transformation deals alongside partners such as AWS.

Yet behind the AWS award, investors should be aware of how generative AI and low code tools could still...

Read the full narrative on EPAM Systems (it's free!)

EPAM Systems' narrative projects $6.5 billion revenue and $582.4 million earnings by 2028. This requires 8.8% yearly revenue growth and an earnings increase of about $181 million from $401.2 million today.

Uncover how EPAM Systems' forecasts yield a $207.88 fair value, a 3% upside to its current price.

Exploring Other Perspectives

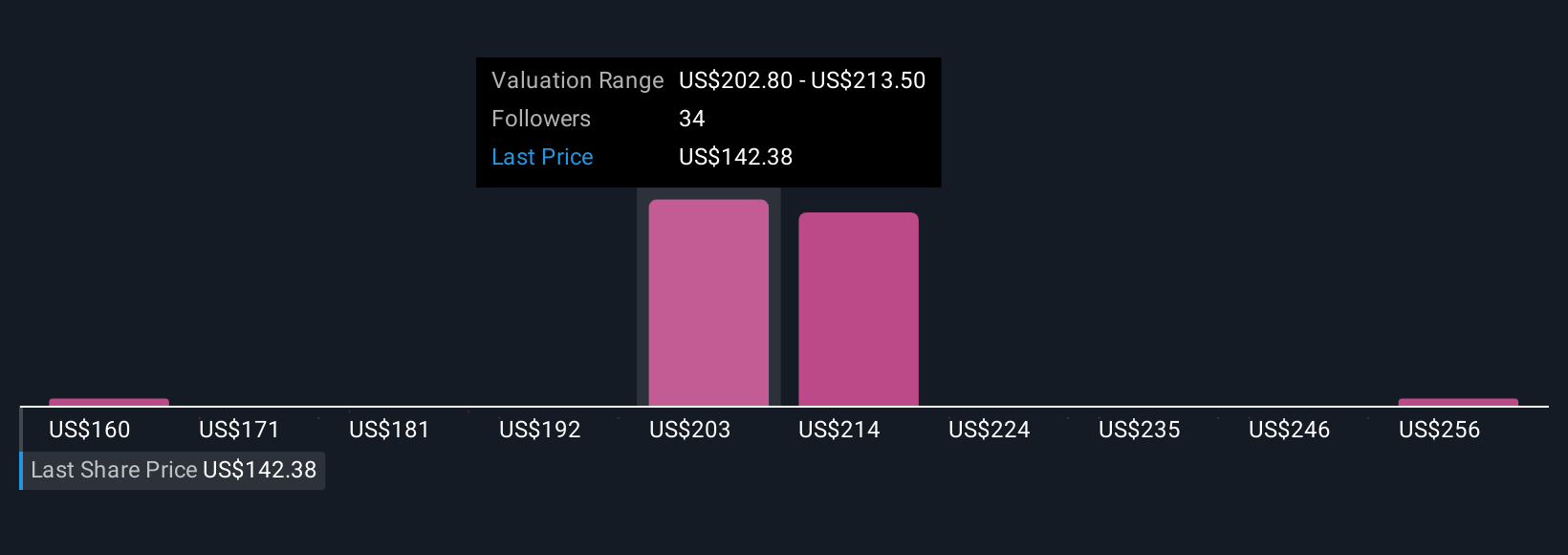

Nine members of the Simply Wall St Community currently value EPAM between US$160 and US$267 per share, reflecting a wide dispersion of expectations. Before you decide where you sit in that range, consider how EPAM’s push into AI enabled cloud projects and margin pressure from talent costs could shape its longer term performance and explore several alternative viewpoints.

Explore 9 other fair value estimates on EPAM Systems - why the stock might be worth 21% less than the current price!

Build Your Own EPAM Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EPAM Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EPAM Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EPAM Systems' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com