How Investors Are Reacting To Knife River (KNF) Winning A US$112 Million Texas Highway Contract

- Knife River Corporation recently announced it has been awarded a US$112 million materials and paving subcontract on the "Big 6" State Highway 6 improvement project in the Bryan/College Station area of Texas, which began this month and is scheduled to run through 2030.

- The multi-year contract not only secures demand for about 928,000 tons of hot-mix asphalt but also gives Knife River additional upside through potential supply of sand, MSE backfill and base course on an as-needed basis.

- We’ll now examine how this long-term Texas highway win, with its large asphalt volume and optional material supply, affects Knife River’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Knife River Investment Narrative Recap

To own Knife River, you need to believe that its aggregates-led materials business can convert a record public-infrastructure backlog into consistent earnings, despite recent margin pressure and weather-related volatility. The US$112 million “Big 6” win in Texas adds visibility to long-term volume but does not meaningfully change the near-term catalyst, which remains execution on pricing and cost control, nor the key risk around heavy dependence on government-funded DOT work.

The company’s recent 2025 guidance update, calling for US$3.1 billion to US$3.15 billion in revenue and US$140 million to US$160.5 million in net income, is the clearest reference point for assessing how projects like Big 6 may feed into earnings. With margins under pressure and a high proportion of public work in the backlog, investors are watching closely to see whether Knife River can translate large, multiyear highway awards into stronger profitability and improved return on equity.

But while backlog and earnings guidance may look reassuring, investors should also be aware of how exposed Knife River is if public infrastructure funding were to...

Read the full narrative on Knife River (it's free!)

Knife River's narrative projects $3.6 billion revenue and $264.4 million earnings by 2028. This requires 7.4% yearly revenue growth and about a $111 million earnings increase from $153.3 million today.

Uncover how Knife River's forecasts yield a $98.22 fair value, a 32% upside to its current price.

Exploring Other Perspectives

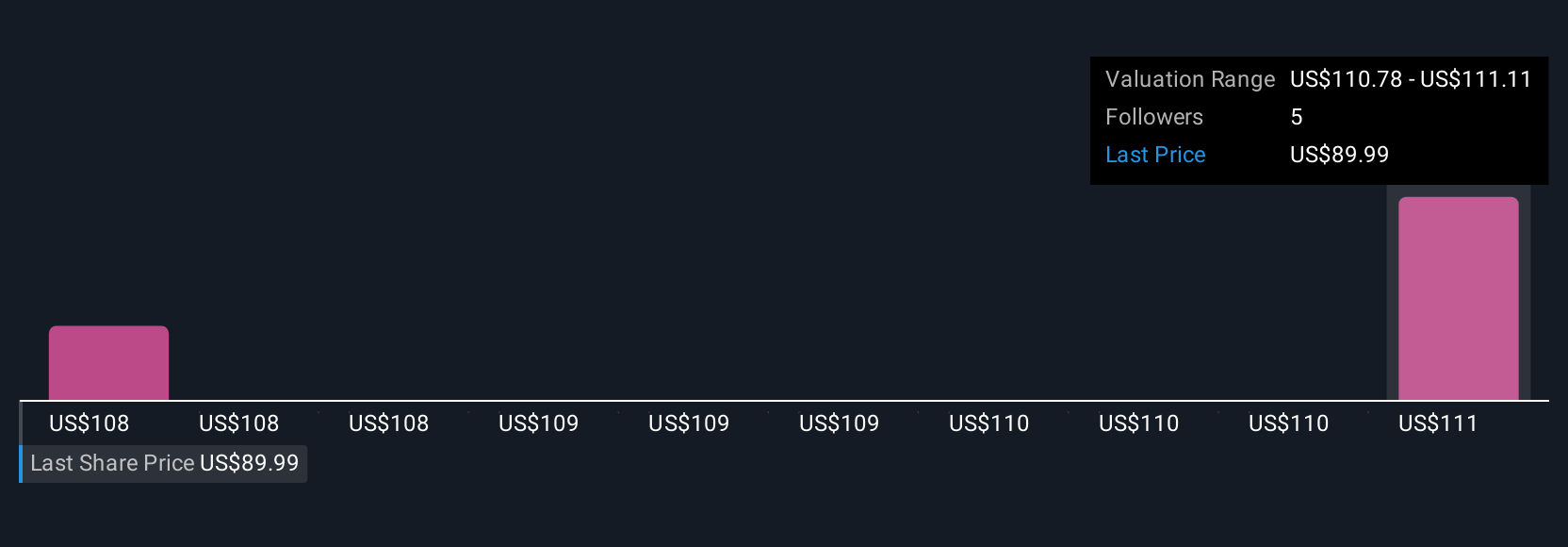

Simply Wall St Community members see Knife River’s fair value between US$27.49 and US$98.22 across 2 independent estimates, underlining how far opinions can stretch. Against that backdrop, the company’s reliance on public DOT budgets as the backbone of a US$1.3 billion backlog is a key factor that could influence how these different views play out over time, so it is worth weighing several perspectives before forming your own.

Explore 2 other fair value estimates on Knife River - why the stock might be worth as much as 32% more than the current price!

Build Your Own Knife River Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Knife River research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Knife River research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Knife River's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com