Mastercard (MA): Valuation Check After Strong Q3 2025 Results, New AI Initiatives and Easing Antitrust Overhang

Mastercard (MA) is back in focus after Q3 2025 results showed 17% year over year revenue growth and wider margins, while new AI driven products and easing antitrust overhang reshaped expectations for the stock.

See our latest analysis for Mastercard.

At around $545.52 per share, Mastercard’s recent pullback in share price contrasts with its strong execution. The 3 year total shareholder return of about 59% suggests longer term momentum is still firmly intact as investors reassess growth and regulatory risk.

If Mastercard’s AI push has you thinking bigger about the space, this is a good moment to explore high growth tech and AI stocks for other potential winners riding similar trends.

Yet with Mastercard trading at a premium multiple, but still sitting roughly 20% below average analyst targets, investors face a familiar dilemma: is this renewed weakness a fresh entry point, or is future growth already fully priced in?

Most Popular Narrative Narrative: 16.9% Undervalued

With the narrative fair value sitting well above Mastercard’s last close, the story assumes today’s price still trails the company’s future earnings power.

The company is capitalizing on the rise of e-commerce and mobile commerce, with initiatives like widespread adoption of tokenization, Click to Pay, and partnerships with digital-first players (e.g., PayPal, Uber, Mercado Libre, Alipay), driving higher transaction frequency, new customer acquisition, and increased fee-based revenue.

Curious how recurring high margin services, brisk top line expansion, and a premium future earnings multiple all combine into one punchy fair value story? The narrative shows how these levers scale together, and which assumptions have to hold for this upside case to work. Want to see the exact growth and margin path behind that conviction? Read on and unpack the full valuation blueprint.

Result: Fair Value of $656.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting regulatory scrutiny and the rapid rise of alternative payment rails could pressure Mastercard’s pricing power and chip away at long term growth expectations.

Find out about the key risks to this Mastercard narrative.

Another Lens on Valuation

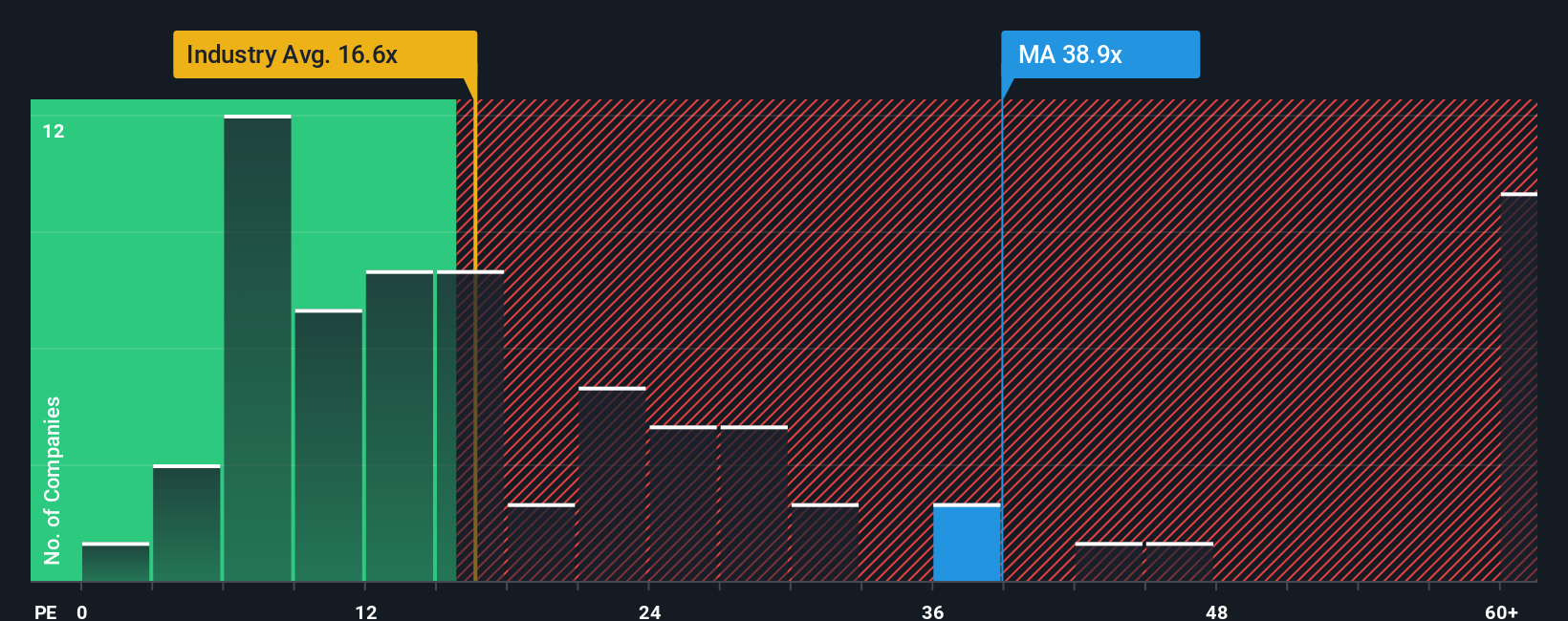

Against that upbeat narrative, Mastercard’s 34.4x earnings multiple looks demanding versus US diversified financial peers at 13.6x and a fair ratio of 19.6x. The stock screens expensive on this lens, raising a practical question: how long can growth and quality justify such a gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mastercard Narrative

If you are not convinced by this framing, or would rather stress test the numbers yourself, you can build a custom view in under three minutes: Do it your way.

A great starting point for your Mastercard research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next steps with a few targeted stock ideas from the Simply Wall St Screener so you are not leaving opportunities on the table.

- Capture potential multi-baggers early by scanning these 3573 penny stocks with strong financials that pair small market caps with surprisingly solid fundamentals.

- Position yourself for the next wave of automation by targeting these 26 AI penny stocks at the heart of real world artificial intelligence adoption.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that can help support reliable cash flow through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com