Texas Instruments (TXN): Valuation Check After Cautious Q4 Guidance and Heavy US Fab Investment

Texas Instruments (TXN) is back in focus after management paired strong recent revenue growth with cautious Q4 guidance, underscoring how heavy US fab spending and weak industry demand are weighing on near term margins and sentiment.

See our latest analysis for Texas Instruments.

Despite the cautious Q4 outlook and mixed commentary from high profile investors, the 1 month share price return of 13.11 percent shows momentum has picked up lately, even though the 1 year total shareholder return of minus 2.40 percent and 5 year total shareholder return of 31.01 percent point to a steadier, slower burning long term story rather than a high flying momentum trade.

If this kind of cyclical setup has you rethinking your watchlist, it could be a good moment to explore high growth tech and AI stocks that are positioned for the next leg of the semiconductor and AI cycle.

With shares trading just below analyst targets and intrinsic models flagging a premium to fair value, the real debate now is whether Texas Instruments is quietly undervalued or if the market is already pricing in that 2026 rebound.

Most Popular Narrative Narrative: 3.7% Undervalued

With Texas Instruments last closing at $182.54 versus a narrative fair value of $189.56, the story leans slightly positive on long term upside.

Strategic investment in U.S.-based 300mm wafer fabs and a diversified global manufacturing footprint uniquely position TI to benefit from evolving supply chain localization and customer preferences for geopolitically resilient suppliers. This advantage is likely to help win incremental business, strengthen preferred supplier status, and improve long-term gross margins and pricing power.

Curious how steady but unspectacular growth, expanding margins, and a richer earnings multiple can still add up to upside from here? The full narrative reveals the math behind that call.

Result: Fair Value of $189.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy fab investments and rising Chinese competition could pressure margins and demand, which could quickly challenge the case for a smooth, margin-accretive recovery.

Find out about the key risks to this Texas Instruments narrative.

Another Angle on Valuation

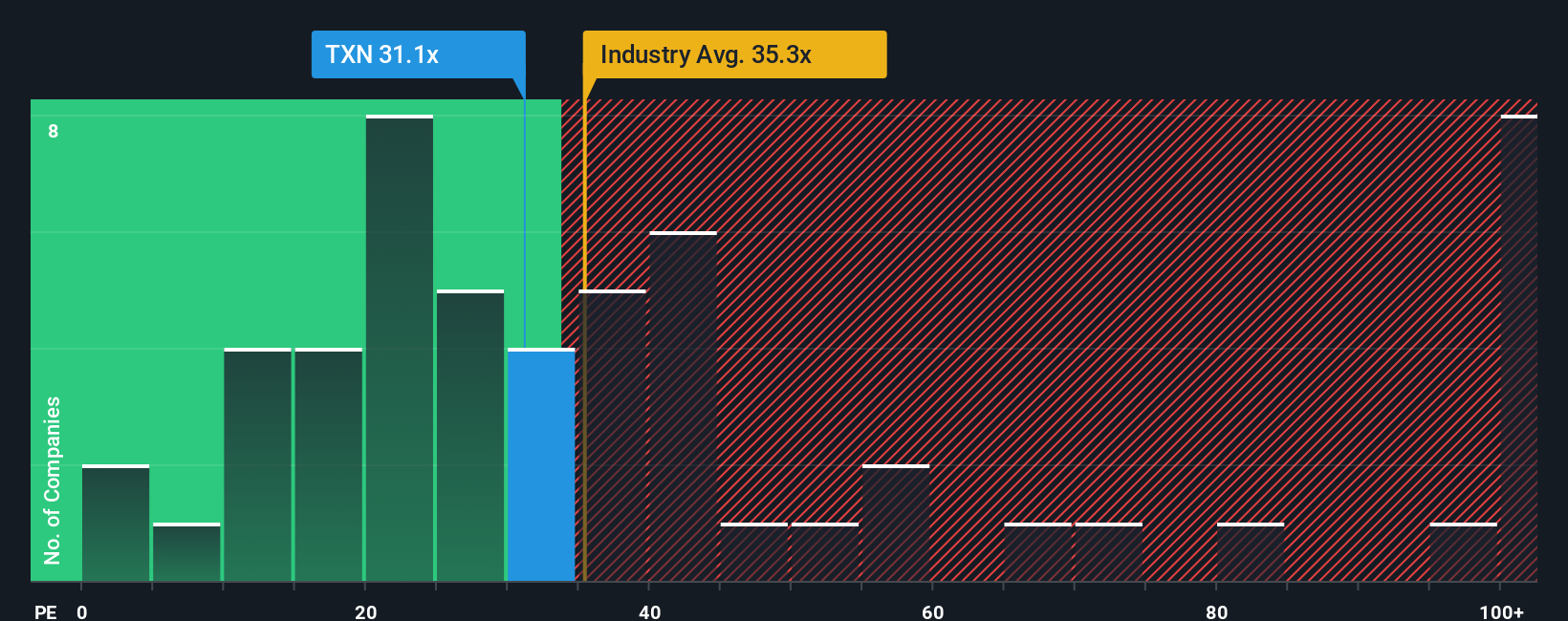

Texas Instruments trades on a 33.1x price to earnings ratio, cheaper than the US Semiconductor industry at 38x and well below peer averages near 76.6x, yet above its own fair ratio of 29x. That premium suggests less margin for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Texas Instruments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Texas Instruments Narrative

If your view differs or you would rather dig into the numbers yourself, you can build a personalized narrative in just a few minutes: Do it your way.

A great starting point for your Texas Instruments research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next steps by scanning focused stock ideas built from real fundamentals, so you are not leaving potential gains on the table.

- Explore beaten down opportunities with strong future cash flows using these 911 undervalued stocks based on cash flows that may be mispriced by the broader market.

- Seek exposure to innovation by targeting these 26 AI penny stocks that link AI themes with concrete revenue potential.

- Support your income strategy with these 15 dividend stocks with yields > 3% offering yield potential while maintaining balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com