California Water Service Group (CWT): Valuation Check After Fifth Straight America’s Most Responsible Companies Recognition

California Water Service Group (CWT) just earned a spot on Newsweek and Statista's America’s Most Responsible Companies list for the fifth straight year, a steady ESG track record investors tend to notice.

See our latest analysis for California Water Service Group.

Even with this fresh ESG recognition, CWT’s recent 30 day share price return of minus 3.71 percent and one year total shareholder return of minus 5.33 percent suggest momentum has softened after a largely flat year to date.

If this kind of steady utility profile appeals, it could be worth broadening your search across regulated and essential services by exploring healthcare stocks.

With shares lagging the broader market despite resilient earnings growth and an 18 percent gap to analyst targets, is California Water Service Group quietly undervalued, or are investors already pricing in every drop of its future growth?

Most Popular Narrative: 15.3% Undervalued

With the shares last closing at $44.88 against a narrative fair value of $53, the story centers on regulated growth and margin resilience.

Analysts assume that profit margins will increase from 13.7% today to 16.9% in 3 years time.

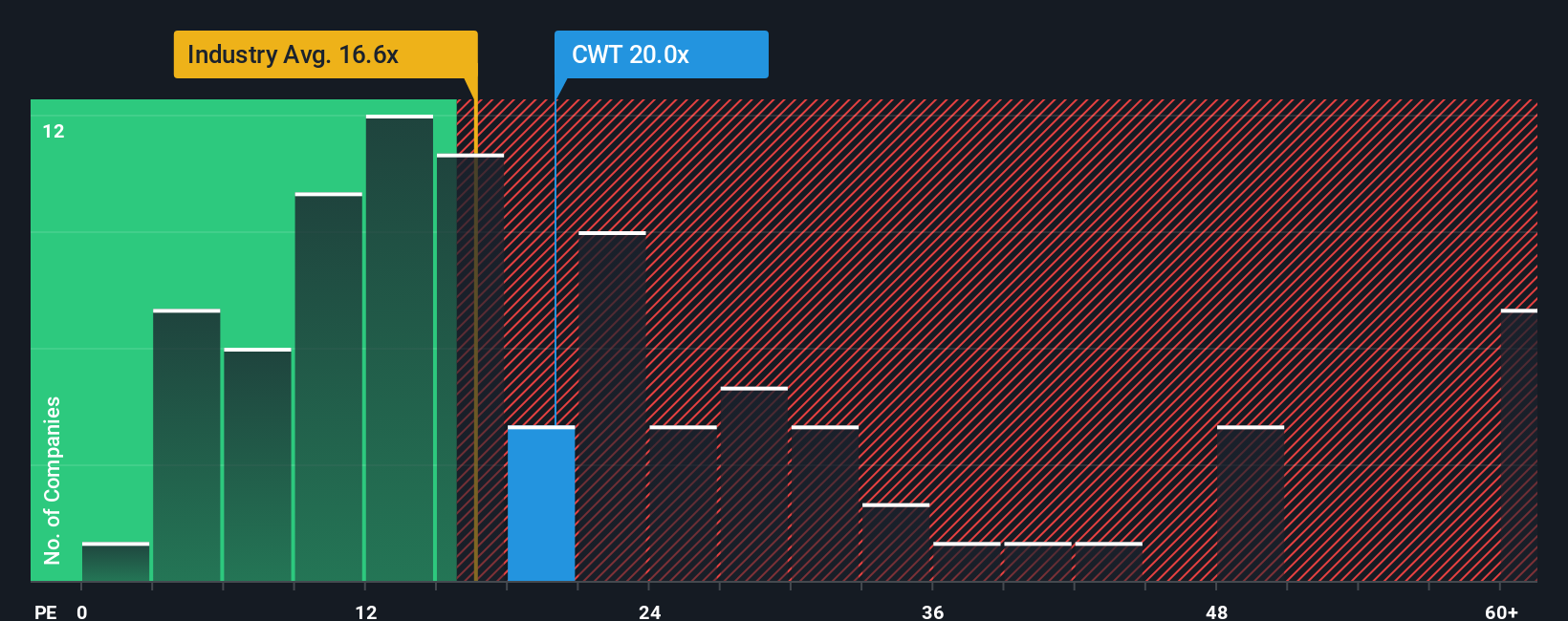

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.2x on those 2028 earnings, up from 20.3x today.

Want to see how modest revenue growth, expanding margins, and a richer earnings multiple combine to lift long term value potential? Explore the full set of projections driving that $53 fair value view and consider whether the assumptions stack up.

Result: Fair Value of $53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory delays and escalating PFAS compliance costs could compress margins and derail the steady, infrastructure-driven growth underpinning that valuation case.

Find out about the key risks to this California Water Service Group narrative.

Another View: Multiples Send A Caution Signal

While the narrative fair value suggests upside, the share price at 19.6 times earnings already matches its 19.6 times fair ratio and still sits above the global water utilities average of 16.1 times. This hints more at valuation risk than a clear bargain. Which signal do you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out California Water Service Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own California Water Service Group Narrative

If you are not fully convinced by this view, or simply want to dig into the numbers yourself, you can build a tailored storyline in just a few minutes, starting with Do it your way.

A great starting point for your California Water Service Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one utility stock when the Simply Wall St Screener can uncover more targeted opportunities aligned with your style, goals, and risk tolerance.

- Capitalize on mispriced opportunities by using these 907 undervalued stocks based on cash flows that highlight companies where cash flows suggest the market may be asleep at the wheel.

- Target powerful income streams through these 15 dividend stocks with yields > 3% that focus on companies offering yields above 3 percent with the potential to strengthen long term returns.

- Ride structural disruption by tapping into these 81 cryptocurrency and blockchain stocks positioned at the intersection of digital assets, blockchain adoption, and the next wave of financial infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com