Is Saia’s (SAIA) November Freight Rebound Enough To Reinforce Its Margin Story?

- In early December 2025, Saia, Inc. reported operating results for October and November showing an October LTL shipment and tonnage decline followed by a November rebound, with weight per shipment moving only modestly month to month versus 2024 levels.

- This shift from volume contraction to November growth, alongside relatively stable weight per shipment, highlights how quickly freight patterns can shift for Saia’s LTL network.

- Now we’ll explore how November’s return to year-over-year tonnage growth affects Saia’s existing investment narrative around cost control and margins.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Saia Investment Narrative Recap

To own Saia, you need to believe its expanding LTL network and technology investments can translate into durable margin strength, even when freight demand moves around month to month. The October softness and November rebound are helpful datapoints for the near term, but they do not significantly change the key near term catalyst, which is whether Saia can defend margins while costs per shipment and network expenses stay elevated, or the main risk around overextension from heavy capital spending.

The most relevant recent announcement for this operating update is Saia’s October Q3 2025 earnings release, which showed modestly lower quarterly net income and compressed profit margins compared with last year. When you set that against November’s return to year over year tonnage growth, the central question becomes whether slightly improving freight trends can offset higher operating and expansion costs quickly enough to stabilize margins.

Yet even with volumes turning positive again in November, investors should be aware that Saia’s aggressive terminal expansion and capital spending could still...

Read the full narrative on Saia (it's free!)

Saia’s narrative projects $3.9 billion revenue and $456.7 million earnings by 2028. This requires 6.6% yearly revenue growth and about a $166.6 million earnings increase from $290.1 million today.

Uncover how Saia's forecasts yield a $320.45 fair value, a 3% downside to its current price.

Exploring Other Perspectives

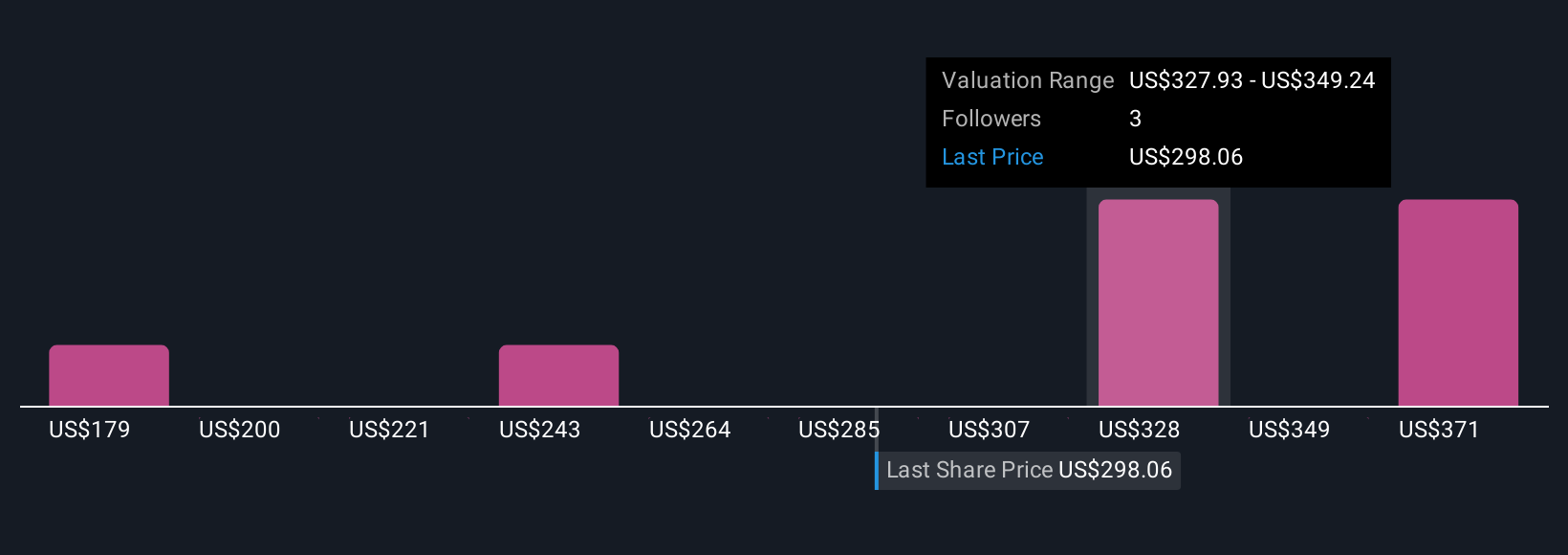

Four fair value estimates from the Simply Wall St Community span roughly US$123 to US$320 per share, underlining how differently individual investors view Saia’s earnings power. Set against recent margin pressure and higher operating costs, that spread invites you to weigh multiple viewpoints on how effectively Saia can convert its growing network into sustainable profitability.

Explore 4 other fair value estimates on Saia - why the stock might be worth less than half the current price!

Build Your Own Saia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Saia research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Saia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Saia's overall financial health at a glance.

No Opportunity In Saia?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com