How Tubi’s Rapid Expansion and New Profit Focus Could Reshape Fox’s (FOXA) Risk‑Reward Profile

- Fox Corporation recently presented at the UBS Global Media and Communications Conference 2025 in New York, where Chief Financial Officer Steven Silvester Tomsic outlined the company’s latest financial and operational priorities.

- Amid this backdrop, investors are paying close attention to the rapid rise of Fox’s streaming platform Tubi, whose growing audience share is reshaping expectations for the company’s future profit mix.

- We’ll now examine how Tubi’s accelerating growth and profit expectations could influence Fox’s existing investment narrative and risk profile.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Fox Investment Narrative Recap

To own Fox today, you need to believe its core news and sports brands can keep funding a growing digital ecosystem where Tubi becomes a material profit driver. The latest conference appearance and Tubi updates reinforce that the near term catalyst remains execution on streaming monetization, while the biggest risk is that traditional TV revenues and margins soften faster than Tubi can offset them. So far, this news does not materially change that balance.

Among recent announcements, Fox’s consistent record of positive earnings surprises and the stock’s move to fresh 52 week highs stand out as most relevant. They highlight how much of the current enthusiasm already reflects expectations for Tubi to add incremental profits from 2026, raising the stakes if streaming growth or profitability timing falls short of what the market is starting to price in.

Yet investors should be aware that if linear TV headwinds intensify faster than expected, Fox’s ability to fund Tubi’s growth without pressuring margins could ...

Read the full narrative on Fox (it's free!)

Fox's narrative projects $16.4 billion revenue and $1.9 billion earnings by 2028. This implies a 0.3% yearly revenue decline and a $0.4 billion earnings decrease from $2.3 billion today.

Uncover how Fox's forecasts yield a $71.53 fair value, a 5% upside to its current price.

Exploring Other Perspectives

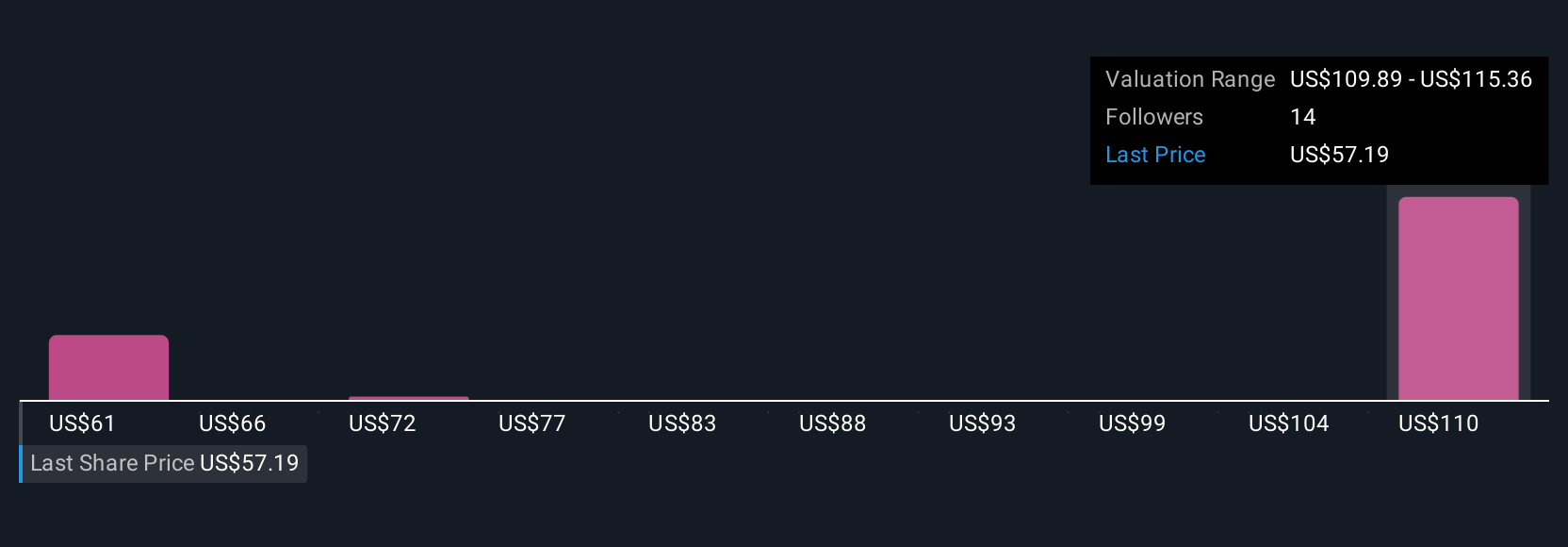

Three fair value estimates for Fox from the Simply Wall St Community cluster in a tight US$71.53 to US$73.64 range, showing closely grouped but independent views. You should weigh these against the key catalyst that Tubi’s profit contribution is expected to ramp from 2026, which could meaningfully affect how sustainable Fox’s recent share price strength proves to be over time as conditions evolve.

Explore 3 other fair value estimates on Fox - why the stock might be worth just $71.53!

Build Your Own Fox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fox's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com