Green Brick Partners (GRBK): Valuation Check as Trophy Expansion and Operational Gains Drive Growth in Key Markets

Green Brick Partners (GRBK) is back in focus after fresh signs that its Trophy brand expansion across Texas, including a push into Houston, is translating into stronger growth and deeper exposure to high demand housing markets.

See our latest analysis for Green Brick Partners.

That expansion story is playing out against a mixed backdrop, with the share price now at $65.74 and an 18.69 percent year to date share price return contrasting with a slightly negative 1 year total shareholder return but a very strong 3 year total shareholder return of 176.10 percent. This suggests longer term momentum remains firmly intact even as near term sentiment cools.

If Green Brick’s housing exposure has you thinking more broadly about where growth could come from next, this might be a good moment to explore fast growing stocks with high insider ownership.

With Trophy’s expansion feeding into revenue, but net income dipping and the stock now trading slightly above analyst targets, is Green Brick Partners quietly undervalued, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 6% Overvalued

With Green Brick Partners closing at $65.74 against a most popular narrative fair value of $62, the story hinges on how earnings and margins evolve from here.

Analysts expect earnings to reach $252.1 million (and earnings per share of $5.06) by about September 2028, down from $347.1 million today. The analysts are largely in agreement about this estimate.

Curious why a shrinking profit pool could still justify a richer earnings multiple than the wider Consumer Durables space? The narrative leans hard on margin resilience, modest top line slippage, and a surprisingly confident view of how investors will be willing to price Green Brick a few years from now. Want to see exactly how those moving pieces add up to today’s fair value call?

Result: Fair Value of $62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, record closings in high growth Texas and Atlanta markets, along with industry leading gross margins, could sustain earnings far better than analysts currently expect.

Find out about the key risks to this Green Brick Partners narrative.

Another View: Multiples Paint a Different Picture

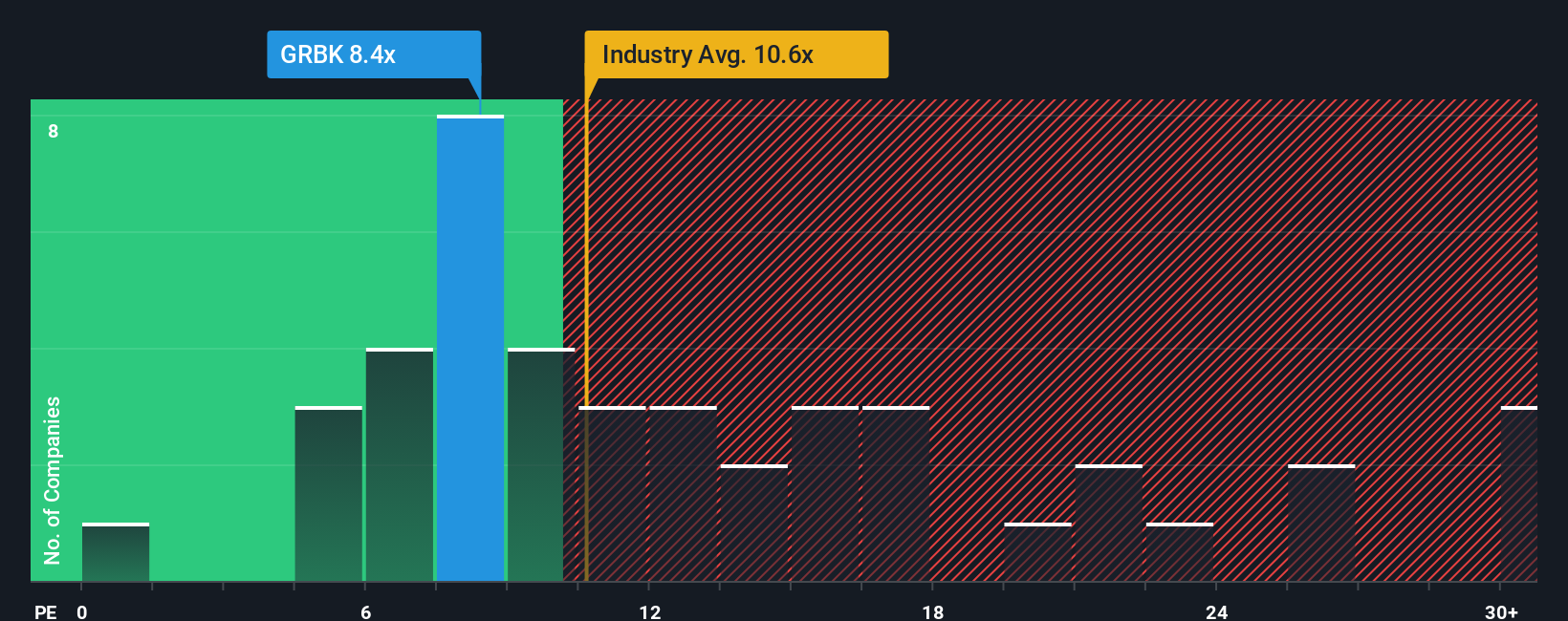

While the narrative sees Green Brick as 6 percent overvalued, its price to earnings ratio of 8.5 times looks cheap versus the US market at 18.7 times and below its 11.5 times fair ratio, yet only slightly richer than peers at 8.3 times. Is the market underestimating how long Green Brick’s strengths can last?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Green Brick Partners Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes. Do it your way.

A great starting point for your Green Brick Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the next housing cycle shifts again, lock in a broader watchlist by using targeted screeners that surface strong opportunities you might otherwise miss.

- Secure potentially mispriced opportunities by scanning these 905 undervalued stocks based on cash flows that pair solid fundamentals with attractive valuations.

- Tap into innovation at the frontier of computing by reviewing these 28 quantum computing stocks shaping the next wave of technological breakthroughs.

- Strengthen your portfolio’s income stream by focusing on these 15 dividend stocks with yields > 3% that can help support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com